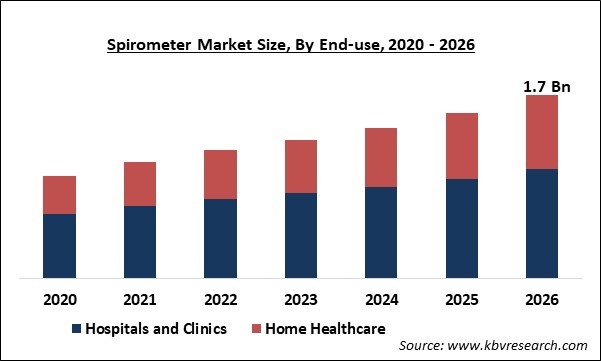

The Global Spirometer Market size is expected to reach $1.7 billion by 2026, rising at a market growth of 10.2% CAGR during the forecast period. A spirometer refers to a medical device, used for estimating the accurate lungs’ functioning. The inhaled and exhaled volume of air from the lungs is calculated after the maximum inhalation by the patient. Spirometer assists in the diagnosis of various respiratory diseases, such as bronchitis and chronic lung diseases like emphysema, asthma, and other breathing diseases for monitoring in an occupational environment. Commonly, a spirometer is used to examine the function of the lungs before surgery in order to predict the type of respiratory diseases.

The rate of chronic respiratory diseases has been increasing among adults and children across the world. The regulations regarding the diagnosis and treatment of asthma in children and the Global Initiative on Asthma (GINA) guidelines suggests the utilization of spirometry regularly for asthma. GINA launched a 2020 update for Global Strategy for Asthma Management and Prevention that includes information regarding asthma after evaluating the scientific literature and has citations from the scientific literature.

Some of the factors such as surge in the rate of chronic respiratory diseases, advancements in technology, and rising inclinations for home-based healthcare are boosting the market growth. Organizations are developing advanced spirometers with enhanced features and design. The purpose behind is to streamline complicated procedure included in pulmonary function testing for patients and professionals. The primary aim is to develop spirometers that have a superior yield and enhanced patient comfort without complications. To prevent any kind of bacterial infection, organizations are implementing innovative packaging methods. Such developments in technology make testing methods simpler and convenient for patients.

Based on End-use, the market is segmented into Hospitals & Clinics and Home Healthcare. The hospitals and clinics segment garnered the largest market share in 2019. This is because spirometry is widely performed in hospitals and clinics for the diagnosis and monitoring of chronic respiratory diseases. However, the home healthcare segment in Spirometer market is anticipated to register the highest growth rate over the forecast period.

Based on Product Type, the market is segmented into Table Top, Desktop and Hand Held. The spirometer market was dominated by the tabletop segment and held the biggest market share in 2019. The growth of the market is defined by wide use in the diagnosis of obstructive airway disorders including asthma and other pulmonary diseases.

Based on Technology, the market is segmented into Flow Measurement, Volume Measurement and Peak Flow Measurement. The peak flow measurement segment is anticipated to register the highest growth over the forecast period. Peak flow measurement devices are capable of providing alerts before an asthma attack by showing the contraction of lung airways. Therefore, medical care can be offered on time for patients with asthma.

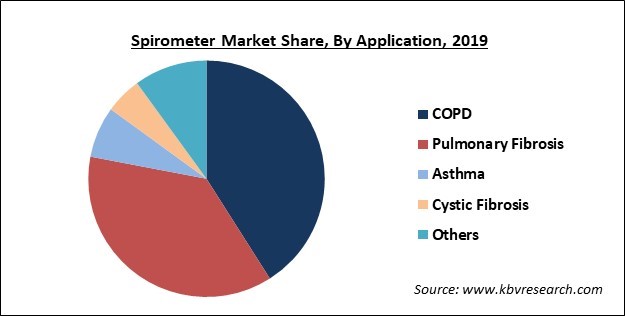

Based on Application, the market is segmented into COPD, Pulmonary Fibrosis, Asthma, Cystic Fibrosis and Others. The spirometer market was dominated by the COPD segment in 2019. This is owing to the high number of individuals who have mild to severe COPD. However, the asthma segment is anticipated to register the highest development over the forecast period.

| Report Attribute | Details |

|---|---|

| Market size value in 2019 | USD 788.9 Million |

| Market size forecast in 2026 | USD 1.7 Billion |

| Base Year | 2019 |

| Historical Period | 2016 to 2018 |

| Forecast Period | 2020 to 2026 |

| Revenue Growth Rate | CAGR of 10.2% from 2020 to 2026 |

| Number of Pages | 234 |

| Number of Tables | 450 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | End Use, Application, Product Type, Technology, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Free Valuable Insights: Global Spirometer Market to reach a market size of $1.7 Billion by 2026

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America was the leading segment of the Global Spirometers market in 2019. This is owing to the high rate of Chronic Obstructive Pulmonary Diseases (COPD) in the U.S. The Asia Pacific is anticipated to register the highest growth rate over the forecast period, owing to the increasing initiatives with respect to primary care for timely diagnosis and management of chronic lung diseases like COPD and asthma.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Hill-Rom Holdings, Inc., Smiths Group PLC (Smiths Medical, Inc.), Koninklijke Philips N.V., Medline Industries, Inc., Schiller AG, Vyaire Medical, Inc., SDI Diagnostics, Inc., Nihon Kohden Corporation, Koko LLC and Fukuda Sangyo Co., Ltd.

By End Use

By Application

By Product Type

By Technology

By Geography

Companies Profiled

The global spirometer market size is expected to reach $1.7 billion by 2026.

The major factors that are anticipated to drive the spirometer industry include technological developments in the spirometry field.

Hill-Rom Holdings, Inc., Smiths Group PLC (Smiths Medical, Inc.), Koninklijke Philips N.V., Medline Industries, Inc., Schiller AG, Vyaire Medical, Inc., SDI Diagnostics, Inc., Nihon Kohden Corporation, Koko LLC and Fukuda Sangyo Co., Ltd.

The spirometer market was dominated by the flow measurement technology segment in 2019.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.