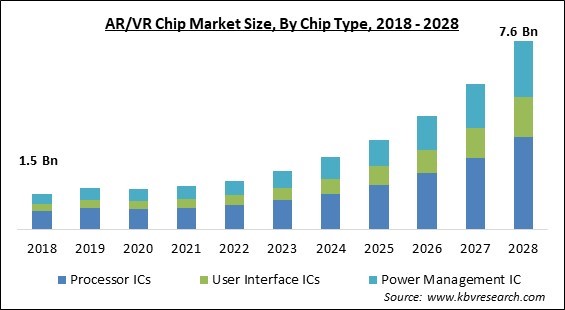

The Global AR/VR Chip Market size is expected to reach $7.6 billion by 2028, rising at a market growth of 25.4% CAGR during the forecast period.

In augmented reality (AR), real-world items are improved with computer-generated perceptual data, sometimes spanning many human senses, including visual, aural, haptic, sensorimotor, and olfactory. Augmented reality is a type of interactive simulation of the actual world. AR is a system that combines the real and virtual worlds, allows for real-time interaction, and accurately registers 3D models of actual and virtual items.

The sensory information that is superimposed may be harmful or beneficial, adding to or subtracting from the natural environment. This experience is so completely integrated with the real world that it appears to be a realistic component of the setting. In contrast to virtual reality, which substitutes the user's real-world surroundings with a simulated one, augmented reality modifies one's continuous perspective of a real environment.

Mixed reality and computer-mediated reality are words that are related to augmented reality and are mostly interchangeable. A simulated experience known as virtual reality (VR) can be quite similar to or very dissimilar from the actual world. Virtual reality has applications in business, education (such as healthcare or military training), and entertainment especially video games such as virtual meetings.

Augmented reality and mixed reality, sometimes known as extended reality or XR, are further different forms of VR-style technology. Present-day standard virtual reality systems either employ virtual reality headsets or multi-projected environments to deliver convincing sights, audio, and other sensations that simulate a user's physical presence in a virtual world.

A user can see around the virtual world, move within it, and interact with virtual features or objects while utilizing virtual reality technology. The impression can also be produced by specially built rooms with numerous large screens, although it is most frequently produced by VR headsets that have a head-mounted display with a small screen in front of the eyes. Virtual reality normally includes audio and visual feedback, but haptic technology may also enable additional types of sensory and force feedback.

After COVID-19 spread, semiconductor businesses moved swiftly to secure supply chains, safeguard staff, and take care of other pressing issues. Even if the situation is critical and numerous governments still demand physical separation restrictions, semiconductor firms are prepared for the time when the pandemic ends and a new normal sets in. Numerous essential elements of the industry have changed as a result of COVID-19, including client behavior, business revenue, and numerous areas of corporate operations. Therefore, some businesses might not be able to endure the crisis.

Due to the pandemic, online purchasing has suddenly become more popular. Virtual try-on for jewelry and cosmetics enabled shoppers to determine whether the items were a good fit for them in place of many websites' disabled return policies during the pandemic. The convenience will increase demand in this sector, which will in turn help to fuel the growth of the augmented reality market. The shopping applications Loreal and Lenskart, which let users virtually try on cosmetics and judge how a pair of glasses might appear on them, respectively, are two well-known examples of augmented reality in the e-commerce industry.

There is a tone of chances in enterprise applications. A key factor in the enterprise industry's growth in the AR market will be significant expenditures made by businesses in smart manufacturing. Companies with operations scattered across the nation can implement AR and hire a few engineers to manage a large setup. By using AR technology to remotely manage equipment and other installations, organizations could be run more successfully through remote collaboration. Enterprise AR has further major uses concerning the educational usage for engineers and other staff members in businesses.

Gamers are becoming more concerned about AR-related health risks as new gaming hardware and software become available. AR games are very involved and keep players hooked for extended periods, which can lead to problems including anxiety, eye strain, obesity, and loss of attention. Due to the immersive nature of AR technology, prolonged use of the AR headset may cause anxiety or stress. Users of AR gadgets are also exposed to dangerous electromagnetic frequency radiation, which can lead to disease in addition to stress.

Based on the Chip Type, the AR/VR Chip Market is segmented into Processor ICs, User Interface ICs, and Power Management IC. The Processor ICs segment acquired the highest revenue share in the AR/VR chip market in 2021. Logic circuitry on an integrated circuit that analyzes data and instructions in a computer is referred to as a processor in general. The processor receives data and instructions, processes the data following the instructions, and calculates an output that is either utilized to manage the computer or device or finish a particular task.

On the basis of Device Type, the AR/VR Chip Market is divided into Head Mounted Display, Gesture Tracking devices, Projector & Display Wall, Head Up Display, and Handheld Device. The head up display segment witnessed a promising revenue share in the AR/VR chip market in 2021. A head-up display, commonly referred to as a heads-up display or HUD, is any transparent display that shows data without needing viewers to change their natural viewing angles.

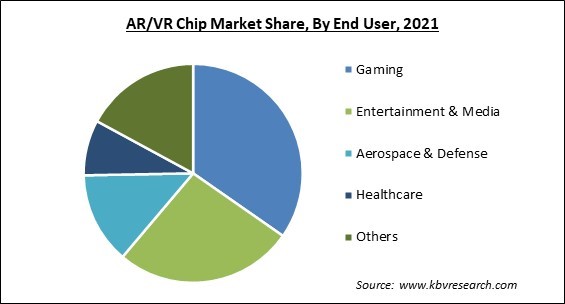

By End-user, the AR/VR Chip Market is classified into Gaming, Entertainment & Media, Aerospace & Defense, Healthcare, and Others. The entertainment & media segment registered a significant revenue share in the AR/VR chip market in 2021. AR has been successfully applied in PR and marketing campaigns for motion pictures, broadcasts, and other media promotional campaigns for entertainment purposes. Typically, these have involved printed graphics or actual object recognition, in which computer or smartphone software recognizes a special sign.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.7 Billion |

| Market size forecast in 2028 | USD 7.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 25.4% from 2022 to 2028 |

| Number of Pages | 253 |

| Number of Tables | 394 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Device Type, Chip Type, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the AR/VR Chip Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region acquired the largest revenue share in the AR/VR chip market in 2021. It is because countries focus on training, medical support, and online learning for consumers using virtual reality technology, that the Asia Pacific region was quite significant. However, nations like India are still on the cusp of beginning to adopt new technologies and incorporate them into various industries, which also suggests that the region would experience a faster development rate in the virtual reality market over the projection period.

Free Valuable Insights: Global AR/VR Chip Market size to reach USD 7.6 Billion by 2028

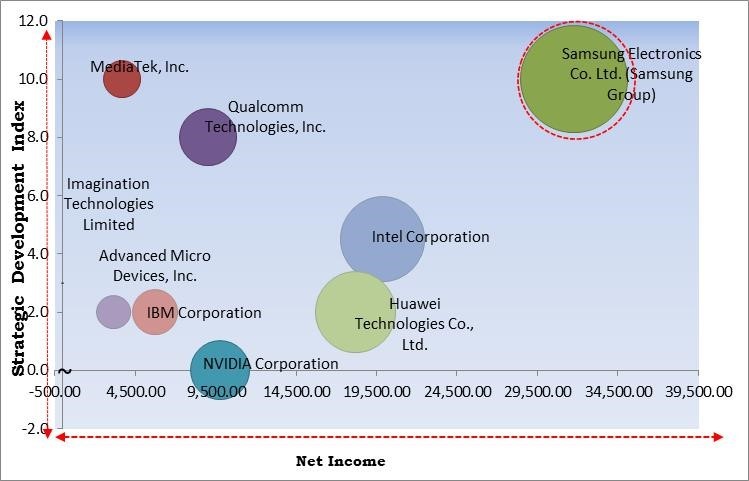

The major strategies followed by the market participants are Product Launches and Partnerships. Based on the Analysis presented in the Cardinal matrix; Samsung Electronics Co. Ltd. are the forerunners in the AR/VR Chip Market. Companies such as Intel Corporation, Huawei Technologies Co., Ltd. and NVIDIA Corporation are some of the key innovators in AR/VR Chip Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, NVIDIA Corporation, Intel Corporation, Samsung Electronics Co., Ltd. (Samsung Group), QUALCOMM Incorporated (Qualcomm Technologies, Inc.), Spectra7 Microsystems Inc., MediaTek, Inc., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Advanced Micro Devices, Inc., and Imagination Technologies Limited.

By Device Type

By End User

By Chip Type

By Geography

The global AR/VR Chip Market size is expected to reach $7.6 billion by 2028.

Increasing Demand For AR In E-Commerce And Retail are driving the market in coming years, however, Health Problems Linked To Prolonged AR Use restraints the growth of the market.

IBM Corporation, NVIDIA Corporation, Intel Corporation, Samsung Electronics Co., Ltd. (Samsung Group), QUALCOMM Incorporated (Qualcomm Technologies, Inc.), Spectra7 Microsystems Inc., MediaTek, Inc., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Advanced Micro Devices, Inc., and Imagination Technologies Limited.

The expected CAGR of the AR/VR Chip Market is 25.4% from 2022 to 2028.

The Gaming segment acquired maximum revenue share in the Global AR/VR Chip Market by End User in 2021 thereby, achieving a market value of $2.4 billion by 2028.

The Asia Pacific market dominated the Global AR/VR Chip Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $2.9 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.