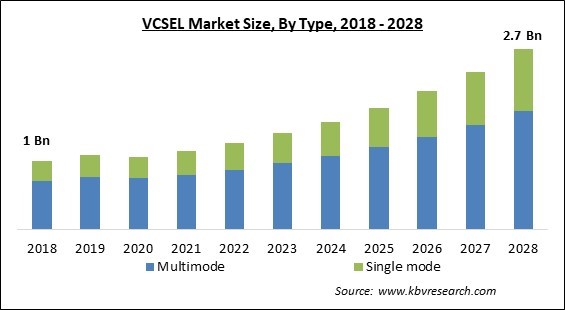

The Global VCSEL Market size is expected to reach $2.7 billion by 2028, rising at a market growth of 13.1% CAGR during the forecast period.

The vertical-cavity surface-emitting laser or VCSEL is a type of semiconductor laser diode with laser beam emission perpendicular to the top surface, as opposed to conventional edge-emitting semiconductor lasers (also in-plane lasers) that emit from surfaces formed by cleaving the individual chip from a wafer. VCSELs are utilized in various laser goods, such as computer mice, fiber optic communications, laser printers, Face ID, and smart glasses.

Excitation of higher-order transverse modes cannot be avoided for larger mode areas due to the relatively short resonator length of only a few microns and the difficulties of pumping a larger active region uniformly with a ring electrode. However, the short resonator also facilitates single-frequency functioning in conjunction with wavelength tunability. VCSELs may also be modulated at high frequencies, making them valuable for applications such as optical fiber communications.

In addition to the outstanding beam quality of low-power VCSELs, the reduced beam divergence compared to edge-emitting laser diodes and the symmetric beam profile are vital features. This makes it straightforward to collate the output beam with a primary lens that does not need a high numerical aperture.

As a result of the GaAs/AlGaAs material system, the most prevalent emission wavelengths of VCSELs are in the range of 750–980 nm (typically 850 nm). Using dilute nitrides (GaInNAs quantum wells on GaAs) and devices based on indium phosphide, greater wavelengths of, e.g., 1.3 m, 1.55 m, or even beyond 2 m (as necessary for, for example, gas sensing) can be achieved (InAlGaAsP on InP).

The COVID-19 pandemic pushed businesses and institutions to implement remote working. Consequently, most businesses from diverse industries, such as healthcare and education, began offering their services electronically. As corporations adopted remote working methods and individuals turned to online ways of leisure, there was an increase in the need for cloud computing services. This change resulted in significant growth in the quantity of electronic data generated by diverse sources and increased application of VCSEL which aided the market to recover.

VCSELs play a vital role in smartphone 3D sensing applications. VCSEL laser components support 3D camera sensing with a flood illuminator, dot projector, and proximity sensor. Object-scanning and rendering 3D cameras are now a typical feature of premium smartphones. When connected with the appropriate software, the cameras enable the user to detect light levels, motions, and textures more accurately than ever before. VCSELs provide several benefits, including low cost, optical efficiency, wavelength stability, low power consumption, and high modulation rates.

Globally, the increase in internet traffic and digital data production has boosted the need for data centers. Numerous data center optical links are based on VCSELs and multimode fiber. The links are employed as optical transceivers because of their high-speed data transfer, high reliability, and low energy consumption and because they enable the application of data analytics to enhance decision-making abilities. For intra-data center communication, VCSEL-based optical transceivers enhance the overlapping of carriers and visual modes.

VCSELs have disadvantages in comparison to edge emitters. The manufacturing tolerances for VCSEL growth are significantly more stringent than those for edge-emitting lasers, as the layer thickness must be controlled to within 1%. Due to the high transverse dimensions of the optical cavity, VCSELs have a great inclination to operate on many transverse modes, which may be the most significant disadvantage. This results in emission spectra with numerous emission wavelengths, which restricts the most significant attainable distance due to chromatic dispersion effects.

Based on type, the VCSEL market is segmented into single mode and multimode. The multi-mode segment dominated the VCSEL market with maximum revenue share in 2021. This is because these vertical-cavity surface-emitting lasers can achieve large power densities with a quick rise time. Consequently, their use is expanding in time-of-flight (TOF), industrial, lighting, LiDAR, and other high-power applications. Multimode VCSELs are infrared light sources for mobile consumer applications, and their compact dimensions make them ideal for use in highly integrated sensors.

On the basis of material, the VCSEL market is divided into gallium arsenide (GaAs), indium phosphide (InP) and others. The gallium arsenide (GaAs) segment held the highest revenue share in the VCSEL market in 2021. This is due to the ability of Gallium Arsenide-based VCSELs to meet the demand for high resolution and high speed in multimedia applications. VCSELs based on GaAs manufacture optical high-definition multimedia interface cables for various consumer electronics applications. In addition, other advantages of GaAs-based VCSELs, includes a low current threshold, decreased power consumption, and a small divergence angle, have accelerated their global acceptance.

By wavelength, the VCSEL market is classified into red, near infrared (NIR) and shortwave infrared (SWIR). The red segment garnered a prominent revenue share in the VCSEL market in 2021. This is because of the benefits of red VCSELs which enables technical advancements that standard LEDs or semiconductor lasers cannot attain efficiently. As the development of red VCSEL technology continues to bring down the price of these laser sources, a growing number of individuals will find their properties favorable for various applications.

Based on the data rate, the VCSEL market is bifurcated into Up to 10 Gbps, 10.1 to 25 Gbps and Above 25 Gbps. The up to 10Gbps segment recorded a substantial revenue share in the VCSEL market in 2021. This is because a high-performance VCSEL is engineered to meet performance standards for 10Gbps data transfer over multimode optical fiber. Its variety of applications includes ethernet, fibre channel, and atm protocols. The optical assembly is designed to link 50m or 62.5m multimode fiber and enable compatibility with higher bandwidth fiber per various launch conditioning standards. These features of the up to 10Gbps are expected to surge the segment's growth.

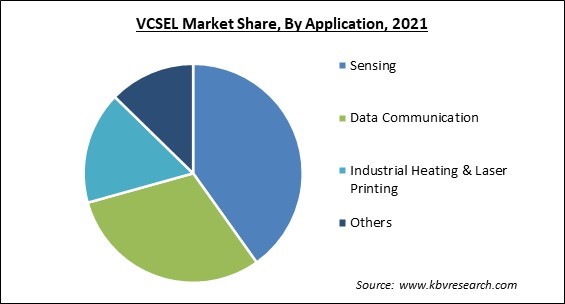

On the basis of application, the VCSEL market is segmented into sensing, data communication, industrial heating & laser printing and others. The sensing segment led the VCSEL market by generating the maximum revenue share in 2021. This is due to the rising demand for object detection and face recognition, as well as developments in logistics, home & building automation, and Industry 4.0 technologies, are responsible for the segment's rapid growth rate. In surveillance, smartphone, automotive, manufacturing, and consumer electronics applications, VCSEL-based sensors improve speed and precision.

By industry, the VCSEL market is classified into consumer electronics, automotive, data center, commercial & industrial, healthcare and military. In 2021, the data center segment acquired a substantial revenue share in the VCSEL market in 2021. The effectiveness of VCSELs for data centers has been improved by changes and advancements in the VCSEL architecture, which have also improved the integration of VCSELs in a wide range of cutting-edge commercial and industrial applications. For applications like infrared illumination, laser printing, sensing, and industrial heating, VCSELs are employed in a variety of industries.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.2 Billion |

| Market size forecast in 2028 | USD 2.7 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 13.1% from 2022 to 2028 |

| Number of Pages | 364 |

| Number of Table | 643 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Wavelength, Application, Data Rate, Type, Material, Industry, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the VCSEL market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2021, the APAC region led the VCSEL market with the maximum revenue share. The greatest consumer electronics and automotive markets, the proliferation of data centers, and significant industrial growth all contribute to the rapid expansion of VCSEL adoption in the Asia-Pacific region. The major markets for electronics in the world are Asian nations such as China, South Korea, and others which account for the majority of production investments. Also, the smartphones are the primary application for VCSELs.

Free Valuable Insights: Global VCSEL Market size to reach USD 2.7 Billion by 2028

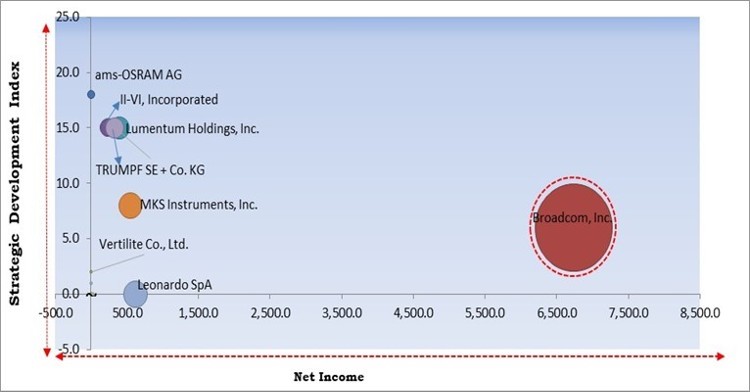

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Broadcom, Inc. is the forerunner in the VCSEL Market. Companies such as II-VI, Incorporated, Lumentum Holdings, Inc., and TRUMPF SE + Co. KG are some of the key innovators in VCSEL Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include II-VI, Incorporated, Lumentum Holdings, Inc., ams-OSRAM AG, Broadcom, Inc., Leonardo SpA, MKS Instruments, Inc., TRUMPF GmbH + Co. KG, Santec Corporation, Vertilite Co., Ltd., and TT electronics PLC.

By Type

By Wavelength

By Application

By Data Rate

By Material

By Geography

The global VCSEL Market size is expected to reach $2.7 billion by 2028.

The rising usage of 3D sensing application in smartphones are driving the market in coming years, however, Drawbacks compared to edge-emitters restraints the growth of the market.

II-VI, Incorporated, Lumentum Holdings, Inc., ams-OSRAM AG, Broadcom, Inc., Leonardo SpA, MKS Instruments, Inc., TRUMPF GmbH + Co. KG, Santec Corporation, Vertilite Co., Ltd., and TT electronics PLC.

The Near Infrared (NIR) segment acquired maximum revenue share in the Global VCSEL Market by Wavelength in 2021 thereby, achieving a market value of $1.4 billion by 2028.

The 10.1 to 25 Gbps segment is leading the Global VCSEL Market by Data Rate in 2021 thereby, achieving a market value of $1.3 billion by 2028.

The Asia Pacific market dominated the Global VCSEL Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $993.3 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.