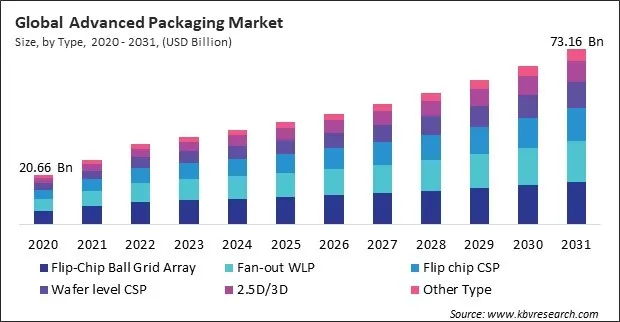

“Global Advanced Packaging Market to reach a market value of USD 73.16 Billion by 2031 growing at a CAGR of 9.2%”

The Global Advanced Packaging Market size is expected to reach $73.16 billion by 2031, rising at a market growth of 9.2% CAGR during the forecast period.

Wafer level chip scale package (WLCSP) is unique because it involves packaging the semiconductor die at the wafer level, eliminating the need for a separate substrate. This reduces package size and height while maintaining excellent electrical and thermal performance. WLCSP is highly suitable for miniaturized devices such as sensors, MEMS, and compact consumer electronics like earbuds and fitness trackers. Hence, the wafer level CSP segment acquired 14% revenue share in the market in 2023. Its simplicity in manufacturing and the ability to produce ultra-thin, lightweight packages have made it a preferred choice for applications requiring high reliability and compact form factors. As IoT and wearable technologies expand, the demand for WLCSP will increase.

The semiconductor industry also relies on advanced packaging to support ongoing miniaturization trends. As transistor sizes continue to shrink, conventional packaging methods are insufficient to maintain connectivity and reliability. Innovative approaches, such as heterogeneous integration, which combines different types of chips into a single package, have become vital for achieving the high-density, high-performance designs required by modern devices. Additionally, the interplay between IoT and 5G further amplifies the need for innovative packaging solutions. IoT devices generate enormous volumes of data, while 5G networks facilitate their transmission with unprecedented speed and reliability. This synergy necessitates packaging technologies that provide enhanced thermal performance, signal integrity, and energy efficiency, enabling the seamless functioning of interconnected ecosystems. Therefore, the demand for advanced packaging will grow as the semiconductor industry expands and evolves.

However, the complexity of these manufacturing processes can present significant challenges to the industry. Longer production cycles are common, as advanced packaging requires multiple steps, including wafer-level packaging, die stacking, and advanced interconnect technologies. Each step must meet exacting standards, increasing the risk of defects during production. Even minor inaccuracies can lead to substantial losses, as flawed components may undermine the operational integrity of high-value electronic devices. These challenges may impede adoption, particularly for organizations that lack the requisite resources or expertise to navigate such complex processes. Moreover, the time and costs associated with troubleshooting and ensuring quality control further contribute to the overall burden. Thus, such issues may hamper the expansion of the market.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

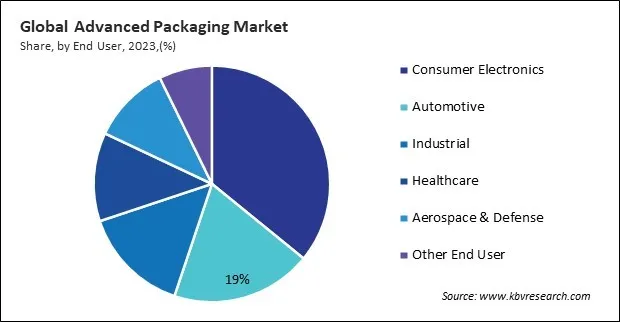

On the basis of end user, the market is divided into consumer electronics, automotive, industrial, healthcare, aerospace & defense, and others. The consumer electronics segment recorded 36% revenue share in the market in 2023. The ever-growing demand for compact, high-performance devices such as smartphones, tablets, laptops, and wearable technology drives this dominance. The proliferation of IoT-enabled devices and the transition to 5G technology further accelerate the demand for advanced semiconductor solutions. In addition, consumer expectations for slimmer, lightweight devices with enhanced processing power and battery life fuel innovation in this segment. As consumer electronics evolve rapidly, the demand for advanced packaging solutions will remain robust.

Based on type, the market is classified into flip chip CSP, flip-chip ball grid array, wafer level CSP, 2.5D/3D, fan-out WLP, and others. The flip chip CSP segment procured 18% revenue share in the market in 2023. Flip chip chip scale package (CSP) integrates the chip and substrates in a small form factor, offering improved electrical performance compared to traditional wire-bonded packages. This technology is extensively employed in consumer electronics, particularly in smartphones, wearable devices, and Internet of Things (IoT) devices, where considerations of spatial limitations and cost-effectiveness are paramount.

Free Valuable Insights: Global Advanced Packaging Market size to reach USD 73.16 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured 46% revenue share in the market in 2023. This leadership is primarily attributed to the region's robust semiconductor manufacturing ecosystem, driven by countries like China, Taiwan, South Korea, and Japan. These nations are home to some of the largest semiconductor foundries and packaging companies, such as TSMC, Samsung, and ASE Technology, which significantly contribute to market growth. The region's adoption of cutting-edge packaging technologies has been spurred by the rising demand for consumer electronics, including laptops, cell phones, and wearable technology.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 36.75 Billion |

| Market size forecast in 2031 | USD 73.16 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 9.2% from 2024 to 2031 |

| Number of Pages | 240 |

| Tables | 320 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Market Share Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, End User, Region |

| Country scope |

|

| Companies Included | Qualcomm Incorporated (Qualcomm Technologies, Inc.), Intel Corporation, IBM Corporation, Texas Instruments, Inc., Analog Devices, Inc., Microchip Technology Incorporated, Infineon Technologies AG, Samsung Electronics Co., Ltd. (Samsung Group), Renesas Electronics Corporation, VMware, Inc. (Broadcom Inc.) |

By Type

By End User

By Geography

This Market size is expected to reach $73.16 billion by 2031.

Growth of the Semiconductor Industry are driving the Market in coming years, however, Substantially High Initial Costs restraints the growth of the Market.

Qualcomm Incorporated (Qualcomm Technologies, Inc.), Intel Corporation, IBM Corporation, Texas Instruments, Inc., Analog Devices, Inc., Microchip Technology Incorporated, Infineon Technologies AG, Samsung Electronics Co., Ltd. (Samsung Group), Renesas Electronics Corporation, VMware, Inc. (Broadcom Inc.)

The expected CAGR of this Market is 9.2% from 2023 to 2031.

The Flip-Chip Ball Grid Array segment is leading the Market by Type in 2023; thereby, achieving a market value of $18.05 billion by 2031.

The Asia Pacific market dominated the Market by Region in 2023; thereby, achieving a market value of $34.37 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges