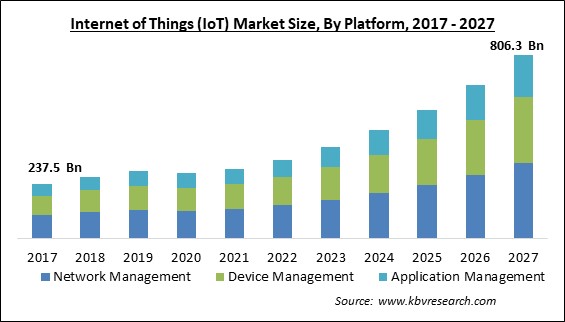

The Global Internet of Things (IoT) Market size is expected to reach $806.3 billion by 2027, rising at a market growth of 17.6% CAGR during the forecast period.

The IoT technology includes web-connected smart devices that receive, analyze and process the data gathered from their surroundings with the help of embedded systems consisting of sensors, processors, and communication hardware. Organizations over a vast range of businesses are moderately shifting to IoT technology to boost organizational performance and understand consumers in a better way to deliver better customer services, improve decision making, and fuel the value of their business.

The up-gradation of wireless networking technologies, the growth of advanced data analytics, decrease in the cost of connected devices, and an enhancement in cloud platform adoption, are augmenting the growth of the market. When it comes to connecting several smart devices to ease operations and sharing of data between themselves, the internet of things always does favor. Many smart devices, like smartphones, sensors, and wearable, take relevant data from the devices that are further used to accelerate the experience of the customer. The fueling requirement for data analysis and analytics integration is anticipated to increase the usage of the Internet of Things market over the forecast period.

Industry 4.0 and IoT are in the middle of new technologies approaches for developing, producing & managing the whole logistics chain, in other words, known as smart factory automation. Significant shifts in manufacturing because of industry 4.0 and rising acceptance of IoT that demands enterprises to follow unique, vigilant, and smarter methods to boost production with technologies that support and fuel human labor with robotics and turn down industrial accidents due to any process failure.

The outbreak of the COVID-19 pandemic affected various sectors of the business environment. This is allocated to a rapid rise in the demand for cloud-based IoT solutions that maintained to be a pillar of businesses to survive during the pandemic. The IoT solution performed an important role in maintaining the whole business processes efficiently operating and under control during the COVID-19 pandemic. Internet of Things kept good connectivity between connected devices during the lockdown. This was attained through various features of internet of things solutions like digital data exchange, remote access, real-time data analytics, and real-time work floor control.

Exposure to various data analytics and data processing tools like as large data analytics, data science, Hadoop are propelling the deployment of IoT technology among enterprises across different business verticals. Data Analytics is a method utilized to analyze large & small data sets with different data properties to draw precious results and actionable insights. These results normally take the shape of developments, patterns, and figures that permit market enterprises to interact in advance with data to execute successful decision-making processes. Big data includes a tremendous volume of heterogeneous data in structured, semi-structured, and unstructured forms.

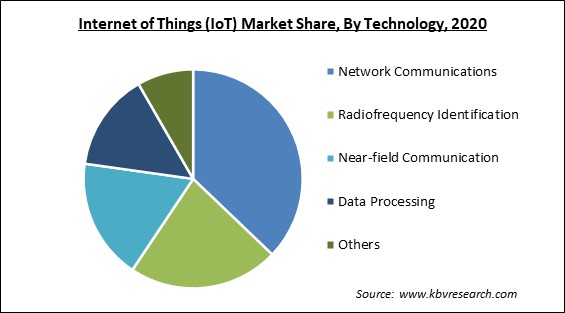

Sensors are the most pivotal components in IoT devices. They help in creating information about a physical event or state. Sensors can compute from their situations, consisting of orientation, motion, light, sound, humidity, and temperature to biometrics, such as blood pressure and heart rate. These sensors will drive the feasibility of the IoT across industry verticals for numerous application areas. In addition, continued innovation in sensor technologies is anticipated to further stretch IoT capabilities. The sharp fall in the prices of these sensors has resulted in a significant rise in the adoption rate of IoT technology & solutions across organizations. The cost of certain low-frequency passive categories of Radio Frequency Identification (RFID) tags and radically reduced in the past few years.

IoT technology has a wide vast range of applications, from gathering biometric data through communication networks and cloud technologies. These devices include unique IP addresses by which they can speak and exchange data inside and with other machines. But, with enhancing deployment, data security and privacy are also enlarging for connected devices, smart devices, mobile devices, and platforms. All these devices and networks might include sensitive and personal information which the intruders can use. With rising dependency on connected devices, data exploitation might take a hike, showing design flows and vulnerability of connected devices. Multiple solutions are being brought by many data protection providers and enterprises.

Based on Component, the market is segmented into Solution and Services. In 2020, the services segment procured a significant revenue share in the Internet of Things market. The services segment of the IoT industry promises good coordination between software provider companies, and managed services. The assumption of this software fastens up the customer satisfaction of various industrial verticals like energy & utilities, IT & telecommunication, and healthcare, which accelerate the numbers of the existing customer by optimizing their requirements and minimizes the cost of operation. This further accelerates the adoption of services that are needed to manage the software properly.

Based on Technology, the market is segmented into Network Communications, Radiofrequency Identification, Near-field Communication, Data Processing, and Others. The Radiofrequency Identification procured a substantial market share in the Internet of Things Market in 2020. Before executing data processing, it is important to have a take on what is a good balance between the number of updates and the consumption of resources. The good balance relies on the IoT use case. In some use cases, it is important to know instantly how the collected data hampers the output. This requires real-time data processing which can be very resource-consuming.

Based on Platform, the market is segmented into Network Management, Device Management, and Application Management. The Network management segment acquired the highest revenue share in the Internet of Things market in 2020. This platform permits enterprises to operate IoT devices, apply security patches, and deliver device-centric reports utilizing administrative tools. Authentication, provisioning, setting, monitoring, routing, and device software maintenance are all possible with IoT network management, which is opening news growth prospects for the segment growth.

Based on Deployment Mode, the market is segmented into On-premise and Cloud. The On-premise segment garnered the maximum revenue share in the Internet of Things market in 2020. This is owing to the number of advantages offered by on-premise deployments such as a high level of data security and safety. In addition, there are many companies that are adopting on-premise IoT solutions in order to protect their data from breaches.

Based on Organization Size, the market is segmented into Large Enterprises, and Small & Medium Enterprises (SMEs). The Small & Medium enterprise (SME) garnered a significant revenue share in the Internet of Things market in 2020. This is owing to the fact that SMEs are moving their businesses to a digital platform, and are utilizing IoT solutions, which is helping them to become more productive, smarter, and efficient.

Based on Vertical, the market is segmented into Manufacturing, Retail, E-commerce, & Consumer Electronics, Telecom & IT, Transportation & Logistics, and Healthcare & Life Sciences. Manufacturing segment acquired the highest revenue share in the Internet of Things market in 2020. It is due to the rising adoption of latest solutions and devices by the manufacturers and the increasing prevalence of smart factory concept across the world.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 286.1 Billion |

| Market size forecast in 2027 | USD 806.3 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 17.6% from 2021 to 2027 |

| Number of Pages | 402 |

| Number of Tables | 653 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Technology, Deployment Mode, Platform, Organization Size, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America emerged as the leading region with the maximum revenue share in the Internet of Things market in 2020. It is due to the quick adoption of digitalization, the significant rise in the demand for the smart connected device, and the rising technological advancements. In addition, the rising spending in the research and development activities by the companies as well as governments, would further accelerate the growth of the regional market.

Free Valuable Insights: Global Internet of Things (IoT) Market size to reach USD 806.3 Billion by 2027

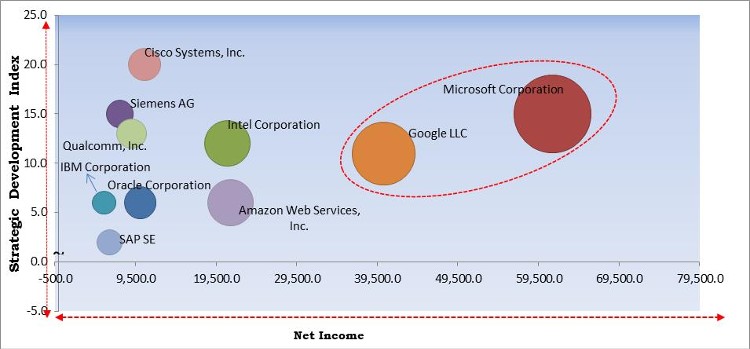

The major strategies followed by the market participants are Partnership. Based on the Analysis presented in the Cardinal matrix; Google LLC and Microsoft Corporation are the forerunners in the Internet of Things (IoT) Market. Companies such as Amazon Web Services, Inc., Intel Corporation, Cisco Systems, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Siemens AG, IBM Corporation, Oracle Corporation, Microsoft Corporation, SAP SE, Google LLC, Amazon Web Services, Inc. (Amazon.com, Inc.), Cisco Systems, Inc., Intel Corporation, and Qualcomm, Inc.

By Component

By Technology

By Deployment Mode

By Organization Size

By Vertical

By Geography

The global Internet of Things (IoT) market size is expected to reach $806.3 billion by 2027.

Rising prevalence of advanced data analytics and data processing solutions are driving the market in coming years, however, availability of Low-cost, low-power sensor technology have limited the growth of the market.

Siemens AG, IBM Corporation, Oracle Corporation, Microsoft Corporation, SAP SE, Google LLC, Amazon Web Services, Inc. (Amazon.com, Inc.), Cisco Systems, Inc., Intel Corporation, and Qualcomm, Inc.

The expected CAGR of the Internet of Things (IoT) market is 17.6% from 2021 to 2027.

The Solution segment acquired the maximum revenue share in the Global Internet of Things (IoT) Market by Component in 2020; thereby, achieving a market value of $569.5 billion by 2027.

The North America market dominated the Global Internet of Things (IoT) Market by Region in 2020, and would continue to be a dominant market till 2027; thereby, achieving a market value of $290.1 billion by 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.