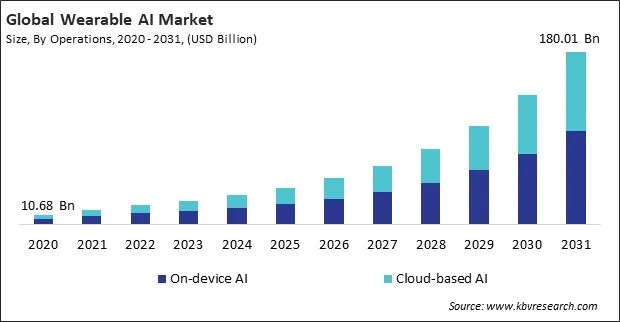

“Global Wearable AI Market to reach a market value of USD 180.01 Billion by 2031 growing at a CAGR of 28.5%”

The Global Wearable AI Market size is expected to reach $180.01 billion by 2031, rising at a market growth of 28.5% CAGR during the forecast period.

The North America segment acquired 34% revenue share in the market in 2023. This market in North America is the most advanced in the world, and it is fueled by a highly tech-savvy population, a strong presence of key market participants, and advanced technological infrastructure. The rising adoption of wearable devices in healthcare, fitness, and productivity applications, along with substantial investments in AI research and development, has fueled growth in the region.

The rapid advancements in artificial intelligence (AI) and machine learning (ML) have revolutionized the wearable technology industry. With the continuous development of sophisticated algorithms and enhanced processing capabilities, wearable devices can now perform real-time data analysis and facilitate instantaneous decision-making. Hence, these advancements will aid in the expansion of the market.

Additionally, The growing awareness and emphasis on personal health and wellness have fueled the demand for wearable devices that enable users to monitor and manage their physical well-being effectively. Consumers are progressively utilizing health and fitness wearables to monitor daily activity metrics, sleep patterns, blood oxygen levels, and heart rate. Thus, by offering personalized insights and early health warnings, these devices cater to the needs of a health-conscious population, driving their widespread adoption and solidifying their role in the modern wellness landscape.

However, these devices are designed to collect, process, and transmit sensitive personal information, which makes them highly susceptible to data vulnerabilities. This information often includes health metrics, such as heart rate, sleep patterns, and activity levels, as well as location data and behavioral insights. The risk of data breaches and misuse, which can result in identity theft, financial fraud, or unauthorized surveillance, is posed by the collection and storage of such intimate details. Hence, these factors may hamper the growth of the market.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

On the basis of operations, the market is bifurcated into on-device AI and cloud-based AI. The cloud-based AI segment recorded 43% revenue share in the market in 2023. Cloud-based AI leverages the power of remote servers to perform complex computations, enabling wearables to provide in-depth analytics, seamless updates, and integration with broader smart ecosystems. This approach is advantageous for large-scale data analysis applications like predictive health insights and machine learning model updates.

Based on type, the market is classified into smartwatches, smart eyewear, smart earwear, and others. The smart eyewear segment procured 24% revenue share in the market in 2023. Smart eyewear, such as augmented reality (AR) glasses and AI-enabled vision tools, has seen growing demand in gaming, healthcare, and professional training. These devices are increasingly used for immersive experiences, hands-free interaction, and enhanced productivity.

By component, the market is divided into sensors, connectivity IC, and processor. The connectivity IC segment witnessed 31% revenue share in the market in 2023. The growth of the segment is fueled by the rising adoption of wireless communication technologies such as Wi-Fi, Bluetooth, Zigbee, and 5G. The increasing proliferation of smart home devices, industrial IoT solutions, and automotive connectivity applications has led to a surge in demand for high-speed, low-latency, and power-efficient connectivity ICs.

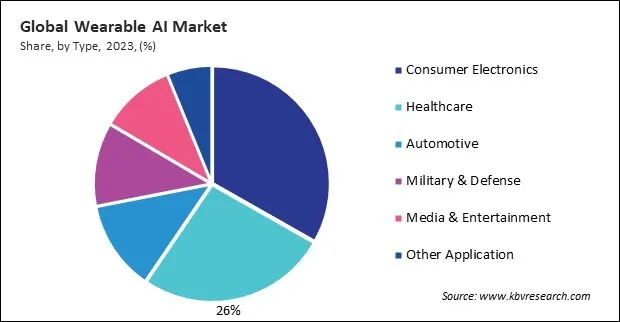

By application, the market is divided into consumer electronics, healthcare, automotive, military & defense, media & entertainment, and others. The healthcare segment garnered 26% revenue share in the market in 2023. The increasing prevalence of chronic diseases necessitating continuous monitoring and the increasing emphasis on proactive health management are the primary factors propelling this segment. These devices provide real-time tracking of vital signs, early detection of anomalies, and remote patient management, making them highly valuable in modern healthcare.

Free Valuable Insights: Global Wearable AI Market size to reach USD 180.01 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment recorded 31% revenue share in the market in 2023. The European market is driven by increasing consumer awareness of health and fitness technologies and the rising adoption of wearables in industrial and automotive applications. Government initiatives supporting digital health solutions and sustainable technologies further boost the market.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 25.46 Billion |

| Market size forecast in 2031 | USD 180.01 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 28.5% from 2024 to 2031 |

| Number of Pages | 302 |

| Number of Tables | 470 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Operations, Type, Component, Application, Region |

| Country scope |

|

| Companies Included | Apple, Inc., Sony Corporation, Samsung Electronics Co., Ltd. (Samsung Group), Microsoft Corporation, Garmin Ltd., Fitbit, Inc. (Google LLC), Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Amazon Web Services, Inc. (Amazon.com, Inc.), IBM Corporation, and Oracle Corporation |

By Operations

By Type

By Component

By Application

By Geography

This Market size is expected to reach $180.01 billion by 2031.

Advancements In AI And Machine Learning Technologies are driving the Market in coming years, however, Substantial Privacy And Security Concerns restraints the growth of the Market.

Apple, Inc., Sony Corporation, Samsung Electronics Co., Ltd. (Samsung Group), Microsoft Corporation, Garmin Ltd., Fitbit, Inc. (Google LLC), Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Amazon Web Services, Inc. (Amazon.com, Inc.), IBM Corporation, and Oracle Corporation

The expected CAGR of this Market is 28.5% from 2023 to 2031.

The Sensors segment led the maximum revenue in the Market by Component in 2023, thereby, achieving a market value of $92.3 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $59 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges