The Global Vodka Market size is expected to reach $35.4 billion by 2029, rising at a market growth of 5.3% CAGR during the forecast period.

The non- flavored Vodka is leading the market as Vodkas that don't have flavor are put through a number of distillation stages to improve their appearance and functionality overall and set them apart from other types of alcohol. Thus, rising standard of living and disposable income are the factors driving the market. Hence, non-flavored Vodka is expected to generate approximately 2/3rd share of the market by 2029.

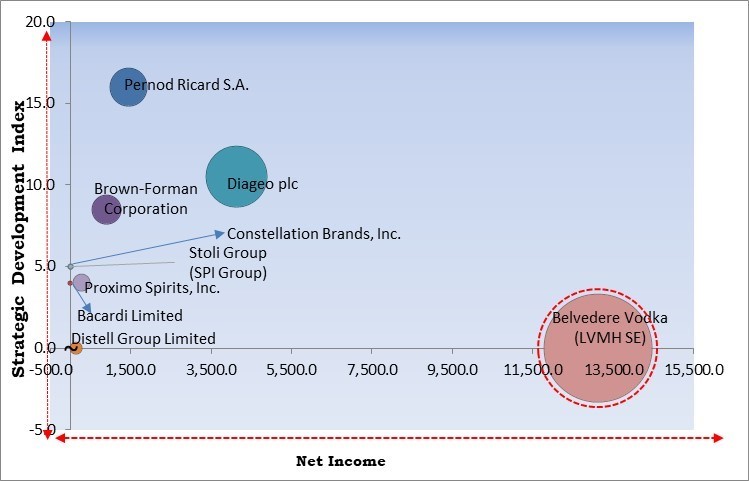

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In January, 2023, Brown–Forman acquired Diplomático Rum Brand to meet the linking of global spirits consumers. Additionally, In March 2023, Pernod Ricard joined hands with Kraft Heinz for launching Absolut vodka-based pasta sauce. The vodka in the pasta sauce is claimed to enhance the texture and flavor. In October 2022, Proximo Spirits partnered with Blue Ridge Spirits & Wine Marketing. The partnership involves Blue Ridge acting as a marketing, and distribution management partner for select Proximo's brands, thereby advancing the growth of Proximo's brands across the whole United States.

Based on the Analysis presented in the Cardinal matrix; Belvedere Vodka (LVMH SE) is the forerunner in the Market. Companies such as Diageo plc, Pernod Ricard S.A., and Brown-Forman Corporation are some of the key innovators in Market. In March, 2023, Pernod Ricard joined hands with Kraft Heinz, a US-based food and beverage manufacturer. The collaboration involves launching Absolut vodka-based pasta sauce. The vodka in the pasta sauce is claimed to enhance the texture and flavor.

The rise of vodka over online distribution channels is further aided by consumers' preference for e-commerce. Vodka may expand rapidly from a tiny basis through direct-to-consumer (DTC) along with additional e-commerce channels. To lawfully sell to consumers directly, participants in direct-to-consumer strategies have used various business models. For starters, distilleries now provide direct-to-consumer sales both offline and online. In addition, due to the "cocktail culture" craze, third-party cocktail clubs are becoming increasingly popular. Therefore, the adoption of such marketing models will probably help in the expansion of the market.

Today's consumers are more discriminating in their tastes than five years ago. They constantly seek out new and expensive alcoholic beverages to sample, and these beverages frequently combine high-quality components with distinctive botanical infusions to create a delectable flavor. Additionally, premium vodkas undergo several phases of distillation to enhance their overall appeal and functioning, setting them distinct from more common types. As a result of consumers' rising interest in leading sustainable and healthy lifestyles, the premium vodka range has better possibilities.

Consumption of alcohol and alcoholic beverages in excess can result in a range of adverse health effects, including but not limited to depression, cognitive impairments, strokes, and failure of the lungs. The WHO estimates that 3 million deaths worldwide each year, or 5.3% of all deaths, are due to hazardous alcohol use. Over 200 illnesses and injuries are influenced by alcohol misuse. When the worldwide burden of disease and injury is calculated in terms of disability-adjusted life years (DALYs), alcohol use is responsible for 5.1% of that total. Early death and disability are results of overconsumption of alcohol. Therefore, all these elements present significant factors that may obstruct the growth of the market throughout the forecast period.

Based on type, the market is characterized into flavored and non-flavored. The non-flavored segment garnered the highest revenue share in the market in 2022. To create a flavorful beverage, they can frequently be blended with a combination of unique botanical infusions and premium components. Aside from that, the rise in health consciousness promotes the consumption of alcohol that uses natural ingredients, is lower in calories, and doesn't include sugar.

On the basis of distribution channel, the market is classified into off-trade and on-trade. The off-trade segment recorded a significant revenue share in the market in 2022. All retail establishments, such as wine and spirit shops, hypermarkets, supermarkets, small markets, and liquor specialty stores, are included in the off-trade section. Because they provide a wide range of coupons and discounts, consumers favor these stores. These stores provide simple access to several alcohol variations in addition to providing discounts and promotional deals. Most businesses partner with renowned supermarkets like Target, Tesco, Walmart, etc., to introduce their products and widen customer outreach in an effort to reach the greatest number of consumers.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 25 Billion |

| Market size forecast in 2029 | USD 35.4 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 5.3% from 2023 to 2029 |

| Number of Pages | 145 |

| Number of Table | 244 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Distribution Channel, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Egypt, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment witnessed the maximum revenue share in the market in 2022. Changes in consumer behavior brought on by the pandemic continue to have an impact on the consumption of and demand for vodka in North America. These tendencies will continue to have an impact on the alcoholic beverage industry in the long run, especially the craft spirits industry, even after the COVID-19 lockdowns and limitations are lifted. Due to growing customer demand for high-end, original drinks with distinctive flavors, vodka is growing.

Free Valuable Insights: Global Vodka Market size to reach USD 35.4 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Brown-Forman Corporation, Diageo plc, Pernod Ricard S.A., Bacardi Limited, Constellation Brands, Inc., Distell Group Limited, Proximo Spirits, Inc. (BECLE, S.A.B. DE C.V.), Belvedere Vodka (LVMH SE), Stoli Group (SPI Group) and Iceberg Vodka Corporation.

By Type

By Distribution Channel

By Geography

The Market size is projected to reach USD 35.4 billion by 2029.

The growing popularity of premium vodka are driving the Market in coming years, however, High intake poses health risks and strict government regulations restraints the growth of the Market.

Brown-Forman Corporation, Diageo plc, Pernod Ricard S.A., Bacardi Limited, Constellation Brands, Inc., Distell Group Limited, Proximo Spirits, Inc. (BECLE, S.A.B. DE C.V.), Belvedere Vodka (LVMH SE), Stoli Group (SPI Group) and Iceberg Vodka Corporation.

The expected CAGR of this Market is 5.3% from 2023 to 2029.

The On-Trade segment is leading the Market by Distribution Channel in 2022 thereby, achieving a market value of $23.7 billion by 2029.

The North America market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $12.4 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.