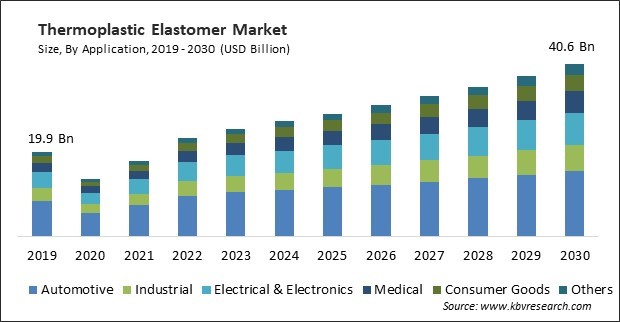

The Global Thermoplastic Elastomer Market size is expected to reach $40.6 billion by 2030, rising at a market growth of 6.9% CAGR during the forecast period. In the year 2022, the market attained a volume of 6,869.9 Kilo Tonnes, experiencing a growth of 5.4% (2019-2022).

Using TPEs in automotive components improves fuel economy, a critical factor in meeting stringent emission standards. Thus, the automotive segment acquired $9,595.0 million revenue in 2022. Lightweight materials, including TPEs, play a role in enhancing the overall energy efficiency of vehicles. TPEs provide design flexibility, allowing for the creation of complex shapes and intricate designs. This versatility is particularly advantageous in the automotive industry, where components often have specific design requirements for functionality and aesthetics. These factors will help in the expansion of the segment. Some of the factors impacting the market are versatility and range of applications, lightweighting trends in the automotive industry, and chemical resistance variation of thermoplastic elastomer.

One distinguishing characteristic of TPEs is their remarkable adaptability to various applications, which positions them favorably among manufacturers in various sectors, including automotive, consumer goods, medical devices, construction, and others. The consumer goods industry benefits from the versatility of TPEs in producing a wide range of products. TPEs are commonly used to manufacture household items, electronics, toys, and other consumer goods. Their adaptability allows for the creation of soft-touch surfaces, ergonomic designs, and aesthetically pleasing products. Whether it's the grip on a tool, the handle of a kitchen appliance, or the casing of an electronic device, TPEs provide the desired combination of tactile feel and functionality. Additionally, the automotive sector's emphasis on lightweighting is primarily driven by the need to enhance fuel efficiency and reduce emissions. Lighter vehicles require less energy, improving fuel economy and lowering greenhouse gas emissions. As governments worldwide implement stringent emission standards, automakers need to explore lightweight materials to meet regulatory requirements. Manufacturers can create complex shapes and incorporate intricate design elements without compromising material performance. This flexibility supports innovative and appealing automotive designs. Owing to these aspects, there will be increased growth in the market.

However, the variability in chemical resistance among different TPE formulations requires careful consideration during material selection. If a TPE formulation does not provide the required resistance to the chemicals present in a given application, alternative materials may be chosen, limiting the market share of TPEs in such environments. This can increase maintenance costs and potential safety issues in critical applications. Established materials, such as certain rubber or engineering plastics, may be preferred over TPEs in applications where chemical resistance is a primary consideration. These aspects will lead to reduced demand in the market.

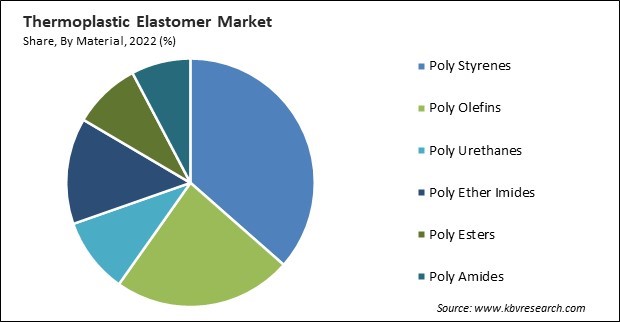

Based on material, the market is divided into polystyrenes, poly olefins, poly ether imides, poly urethanes, poly esters, and poly amides. In 2022, the poly olefins segment witnessed a substantial revenue share in the market. Polyolefin TPEs, including TPOs and TPVs, offer a versatile range of properties that make them suitable for diverse applications. They exhibit a balanced combination of flexibility, toughness, and chemical resistance. This versatility allows manufacturers to tailor polyolefin-based TPE formulations to meet specific performance requirements in various industries. These factors will pose lucrative growth prospects for the segment.

Based on application, the market is segmented into automotive, electrical & electronics, industrial, medical, consumer goods, and others. In 2022, the electrical and electronics segment garnered a significant revenue share in the market. TPEs exhibit excellent electrical insulating properties, making them suitable for electrical components and devices. They provide a reliable barrier against electrical currents, preventing short circuits and ensuring the safety and efficiency of electronic systems. TPEs' flexibility and flex-fatigue resistance are advantageous in applications with frequent bending or movement. This is particularly beneficial in manufacturing cables and connectors, contributing to the durability and reliability of electronic devices. Therefore, the segment will grow rapidly in the coming years.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 23.2 Billion |

| Market size forecast in 2030 | USD 40.6 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 6.9% from 2023 to 2030 |

| Number of Pages | 351 |

| Number of Table | 630 |

| Quantitative Data | Volume in Kilo Tonnes, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Material, Application, Region |

| Country scope |

|

| Companies Included | Arkema S.A., BASF SE, China Petrochemical Corporation (Sinopec Group), Evonik Industries AG (RAG-Stiftung), Huntsman Corporation, The Dow Chemical Company, Covestro AG, Mitsubishi Chemical Holdings Corporation, DuPont de Nemours, Inc., and Asahi Kasei Corporation |

| Growth Drivers |

|

| Restraints |

|

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific segment acquired the highest revenue share in the market. The rapid industrialization in APAC countries has led to increased demand for TPEs across diverse sectors. Industries such as automotive, construction, and consumer goods that extensively use TPEs have grown substantially in the region. The automotive industry is a major consumer of TPEs, and the growing automotive sector in Asia Pacific has significantly contributed to the increased demand for TPEs. TPEs find applications in interior components, exterior parts, and under-the-hood applications in vehicles. These factors will boost the demand in the segment.

Free Valuable Insights: The Global Thermoplastic Elastomer Market size to reach USD 40.6 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Arkema S.A., BASF SE, China Petrochemical Corporation (Sinopec Group), Evonik Industries AG (RAG-Stiftung), Huntsman Corporation, The Dow Chemical Company, Covestro AG, Mitsubishi Chemical Holdings Corporation, DuPont de Nemours, Inc., and Asahi Kasei Corporation

By Material (Volume, Kilo Tonnes, USD billion, 2019-2030)

By Application (Volume, Kilo Tonnes, USD billion, 2019-2030)

By Geography (Volume, Kilo Tonnes, USD billion, 2019-2030)

This Market size is expected to reach $40.6 billion by 2030.

Versatility and range of applications are driving the Market in coming years, however, Chemical resistance variation of thermoplastic elastomer restraints the growth of the Market.

Arkema S.A., BASF SE, China Petrochemical Corporation (Sinopec Group), Evonik Industries AG (RAG-Stiftung), Huntsman Corporation, The Dow Chemical Company, Covestro AG, Mitsubishi Chemical Holdings Corporation, DuPont de Nemours, Inc., and Asahi Kasei Corporation

In the year 2022, the market attained a volume of 6,869.9 Kilo Tonnes, experiencing a growth of 5.4% (2019-2022).

The Polystyrenes segment is leading the Market by Material in 2022; thereby, achieving a market value of $14 billion by 2030.

The Asia Pacific region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $16 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.