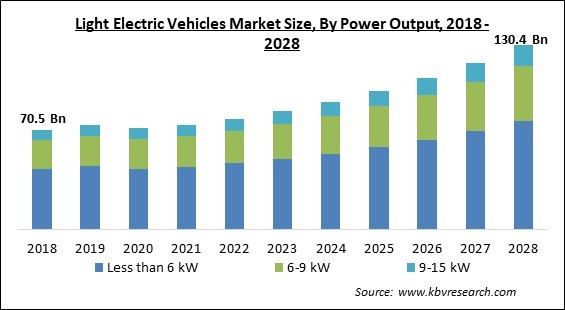

The Global Light Electric Vehicles Market size is expected to reach $130.4 billion by 2028, rising at a market growth of 8.9% CAGR during the forecast period.

Light electric vehicles (LEV) consisting of two- and three-wheeled electric cars are the largest segment of electric vehicles in terms of stock. These vehicles will be at the center of electrification initiatives in China, India, and other Asian nations, where their conventional counterparts are favored for last-mile connection and are seen as a cost-effective means of personal transportation.

Due to the usage of lead-acid batteries, these cars were historically charged slowly. The adoption of new chemistry makes faster charging possible, but thermal control remains the greatest obstacle. On the other side, battery changing is an option that can help reduce the battery charging time.

A vehicle driven by one or more electric engines is an electric vehicle (EV). It can be fueled externally by a collector system or autonomously by a battery. EVs include road and rail vehicles, surface and underwater watercraft, electric airplanes, and electric spacecraft, among others.

EVs initially appeared in the late 19th century, when electricity was one of the preferred ways for motor vehicle propulsion, offering a level of comfort and ease of operation that gasoline cars of the period could not match. Approximately 100 years ago, internal combustion engines dominated the propulsion of automobiles and trucks, but electric power remained prevalent in trains and smaller vehicles of all sizes.

Several COVID-induced market shifts may have a negative influence on the EV transition. Falling global crude oil prices have been one of the first casualties of the economic downturn. Low oil prices at the pump undermine the economic viability of EV adoption relative to combustion vehicles, particularly in nations with limited EV fiscal incentives. If oil prices worldwide remain at current levels, the considerably higher total cost of ownership for EVs may impede the changeover. Supply chain disruptions pose a further significant threat to EV adoption. China is the major provider of EV manufacturing ecosystem components. In such a scenario, the transition trajectory will differ from country to country, depending on each nation's capacity to create an indigenous supply chain within a specified timeframe.

In recent years, the demand for fuels such as gasoline and diesel has expanded dramatically due to the rising need for vehicles. The most recent increase in fuel prices is due to the price increase of crude oil, which is used to produce gasoline and diesel. At the outset of the COVID-19 pandemic, crude oil was less expensive due to the temporary closure of a large number of businesses and a fall in energy demand. As life resumed its usual path, the energy demand soared. However, expenses have climbed dramatically as a result of suppliers' challenges in meeting consumers' rising demands.

Electric vehicles have several advantages, such as lower operating costs than conventional gasoline engines, the execution of strict government regulations to reduce environmental pollution, and a reduction in tailpipe emissions, all of which have a significant positive effect on their global demand. To capitalize on the market opportunity, key market players for electric car power inverters are implementing a variety of strategic initiatives, including product development and product launch. For example, ABB Ltd. released an all-in-one electric vehicle charger with the fastest charging speed on the market.

Due to range restrictions, the expansion of the Light electric vehicle market has been restricted. LEVs lack fuel tanks for energy storage and easy refueling, unlike ICE vehicles. A fully charged battery has a restricted range, which is often less than that of its internal combustion engine counterpart. Currently, the majority of electric two-wheelers, such as e-scooters, e-motorcycles, and e-bikes, have a range of 100–120 miles and a charge time of 6-8 hours. As a result, consumers who travel more than 100 miles per day are hesitant to invest in LEVs.

Based on the Vehicle category, the Light Electric Vehicles Market is segmented into 2-wheelers, 3-wheelers, and 4-wheelers. The 2-wheelers segment acquired the highest revenue share in the light electric vehicles market in 2021. Two-wheeled vehicles obtain their electricity from a battery and an alternator. The purpose of the battery is to store charge; it also maintains a specified voltage level and keeps the electrical system operational when the engine is turned off.

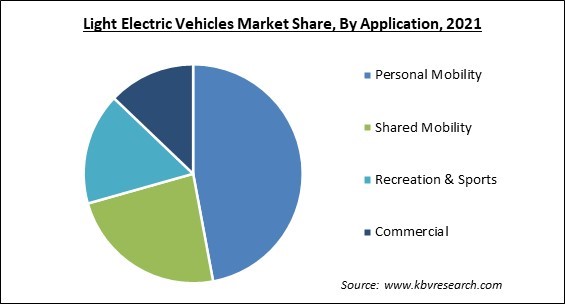

On the basis of Application, the Light Electric Vehicles Market is divided into Personal Mobility, Shared Mobility, Recreation & Sports, and Commercial. The shared mobility segment recorded a substantial revenue share in the light electric vehicles market in 2021. With increasing environmental concerns, traffic congestion, and a preference for autonomous driving, the market for shared mobility is anticipated to grow steadily. Shared mobility refers to the collective use of a vehicle for transportation by commuters who do not own it.

By power output, the Light Electric Vehicles Market is classified into Less than 6 kW, 6-9 kW, and 9-15 kW. The less than 6 kW segment garnered the highest revenue share in the light electric vehicles market in 2021. For personal commuting and shared mobility applications, the increased demand for LEVs with modest seating capacity is projected to increase sales of electric scooters and electric cycles with low power (less than 6 kW). Due to their huge demand, Chinese manufacturers ship these low-power LEVs to North America and Europe at comparatively reduced prices.

On the basis of Vehicle type, the Light Electric Vehicles Market is segmented into e-scooter, e-ATV/UTV, Neighborhood Electric Vehicle, e-bike & Motorcycle, e-lawn Mower, Autonomous Forklifts, Delivery Robots & Electric Industrial Vehicle, and Others. The e-bike & motorbike segment recorded a significant revenue share in the light electric vehicles market in 2021. An electric bicycle (e-bike, eBike, etc.) is a pedal-assist bicycle with an integrated electric motor. There are numerous types of e-bikes on the market, but they mainly fall into two categories: pedelecs and e-bikes with throttles and moped-like functions.

Based on the component Type, the Light Electric Vehicles Market is bifurcated into the Battery Pack, Electric Motor, Motor Controller & Power Controller, Inverters, e-brake Booster & Power Electronics. The electric motor segment witnessed a substantial revenue share in the light electric vehicles market in 2021. Electric Propulsion (EP) is a type of space propulsion that employs electrical power to accelerate a propellant through a variety of electrical and/or magnetic mechanisms. Compared to typical chemical thrusters, the performance of EP thrusters is enhanced by the use of electrical power.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 74 Billion |

| Market size forecast in 2028 | USD 130.4 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 8.9% from 2022 to 2028 |

| Number of Pages | 370 |

| Number of Tables | 601 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Vehicle Category, Vehicle Type, Component Type, Application, Power Output, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Norway, Netherlands, China, Japan, India, South Korea, Singapore, Taiwan, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the Light Electric Vehicles Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment garnered the largest revenue share in the light electric vehicles market in 2021. APAC is considered to have the largest market for light electric vehicles due to the region's rapid urbanization and the consequent need for environmentally friendly and cost-effective transportation solutions. Government initiatives and subsidies also promote regional market expansion as a means of mitigating the rising pollution levels of industrial economies, particularly China and India.

Free Valuable Insights: Global Light Electric Vehicles Market size to reach USD 130.4 Billion by 2028

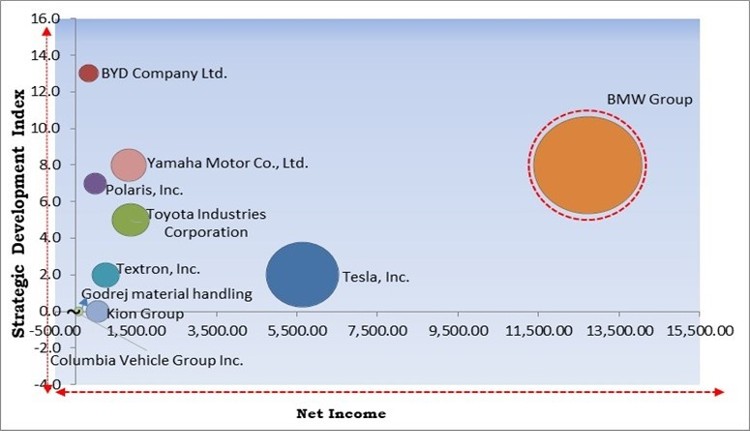

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; BMW Group is the major forerunner in the Light Electric Vehicles Market. Companies such as Tesla, Inc., Toyota Industries Corporation and Yamaha Motor Co., Ltd. are some of the key innovators in Light Electric Vehicles Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Tesla, Inc., BMW Group, Columbia Vehicle Group Inc. (Nordic Group of Companies, Ltd.), Godrej Group (Godrej Material Handling), Kion Group, Yamaha Motor Co., Ltd., Textron, Inc., Polaris, Inc., BYD Company Ltd., and Toyota Industries Corporation.

By Vehicle Category

By Vehicle Type

By Component Type

By Application

By Power Output

By Geography

The global Light Electric Vehicles Market size is expected to reach $130.4 billion by 2028.

Constantly Rising Gasoline And Diesel Prices are driving the market in coming years, however, Levs have a shorter range and higher initial cost of ownership than ice vehicles restraints the growth of the market.

Tesla, Inc., BMW Group, Columbia Vehicle Group Inc. (Nordic Group of Companies, Ltd.), Godrej Group (Godrej Material Handling), Kion Group, Yamaha Motor Co., Ltd., Textron, Inc., Polaris, Inc., BYD Company Ltd., and Toyota Industries Corporation.

The e-scooter segment acquired maximum revenue share in the Global Light Electric Vehicles Market by Vehicle Type in 2021 thereby, achieving a market value of $46.7 billion by 2028.

The Personal Mobility segment is leading the Global Light Electric Vehicles Market by Application in 2021 thereby, achieving a market value of $59.8 billion by 2028.

The Asia Pacific market dominated the Global Light Electric Vehicles Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $58.7 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.