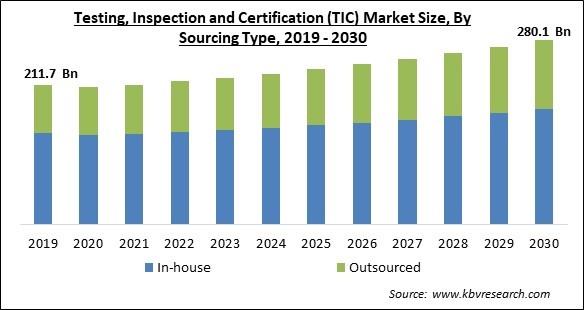

The Global Testing, Inspection and Certification (TIC) Market size is expected to reach $280.1 billion by 2030, rising at a market growth of 3.3% CAGR during the forecast period.

To make mobility safer, more secure, as well as more physically effective, TIC supports automotive suppliers in the ongoing improvement of current technology as well as new developments. Therefore, Automotive sector captured $14,063.4 million revenue in the market in 2022. Increased use of TIC results from the rising number of car component failure situations. Customers get dissatisfied due to component failures, which incur significant costs for the business. Establishing in-house TIC infrastructure or collaborating with regional TIC service providers is projected to need significant investment from automakers to produce goods that adhere to regional regulatory standards.

The major strategies followed by the market participants are Partnerships as the key developmental strategy in order to keep pace with the changing demands of end users. For instance, In November, 2022 Applus+ joined hands with Sentin GmbH to profitably combine artificial intelligence into the daily work of the testing, inspection, and certification industry. Furthermore, both companies agreed on joint development work in the area of image recognition and evaluation. Additionally, In May, 2023, SGS SA came into partnership with Eezytrace to support food operators enhance food safety management across the world. Furthermore, the alliance with Eezytrace sets the new benchmark for excellence and efficiency in the food service and retail industry.

Based on the Analysis presented in the KBV Cardinal matrix; Eurofins Scientific SE, SGS S.A. and Bureau Veritas S.A. are the forerunners in the Market. In January, 2022, Bureau Veritas partnered with NAPA, the provider of maritime software, services, and data analysis. This partnership allows highly effective and widespread usage of 3D models in the class approval process. Additionally, both companies would seek to enhance the complete efficiency and accuracy of future vessel development and solve the present challenges related to 2D drawings. Companies such as DEKRA SE, DNV AS and Intertek Group PLC are some of the key innovators in the Market.

In order to guarantee that products are secure and of the highest caliber, government authorities in several nations have made testing and certification of inspections necessary. For consumer items to adhere to regulatory requirements, they must pass safety and quality inspections performed by an independent lab. Globally, producers must abide by laws and regulations that are getting stricter to safeguard people's and the environment's safety. The classification, labeling, and packaging/globally harmonized system (CLS/GHS), REACH, CE, and RE Marking, EU Children Safety, and Toy Safety Act, among other safety regulations, are just a few of the regulations that manufacturers in European nations must abide by. Therefore, the increasing provisions of such acts to conform to standards will propel the market's growth in the coming years.

In recent years, technology has changed in every field at a rapid pace. The healthcare sector has seen significant technical advancements. It will be feasible to detect and treat medical conditions in people well before they show any symptoms because of the capacity to collect data from wearable technology, such as smartwatches. One can predict that treatments will take a tailored approach. Precision medicine, which enables doctors to precisely prescribe medications and administer treatments to patients, is another name for this. The development of genetics and AI has made it possible to better understand how people respond to various drugs and therapies. As a result, the demand for testing, inspection, and certification services by manufacturing companies to guarantee the successful delivery of their goods has increased, accelerating the market's development.

Companies incur additional costs (hiring local staff to address tax-related issues) due to different tax rates caused by regulatory standards across different geographic regions. Companies that do testing, inspection, and certification must adhere to local laws as well as the rules and standards of the nations in which they do business; this may reduce the effectiveness of their operations. Obstacles to items being accepted worldwide are likely to be caused by unique local legislation and standards. As a result, conflicts arise between regional and global norms, which slows market expansion. To address how pollutants like nitrogen oxide, non-methane organic oxides, and carbon monoxide affect air quality, the US and the EU have established several anti-pollution policies. Hence, the differences in regional, national, and local standards obstruct proper compliance with regulations, hampering the market's growth.

Based on service type, the market is characterized into testing, inspection, and certification. The certification segment procured a considerable growth rate in the market in 2022. To display conformity marking on their products or to give certificates confirming compliance with requirements, firms are granted product licenses or certificates by a certification authority. Consumers are assured that the products are of high caliber by compliance with the standards. A product's compliance with rules and/or standards has been verified through testing and certification. Only those businesses get the certification with a quality control system that is effective enough to preserve the conformance of their products to the standards. In the food and IT & telecommunications certification services, players can find profitable opportunities.

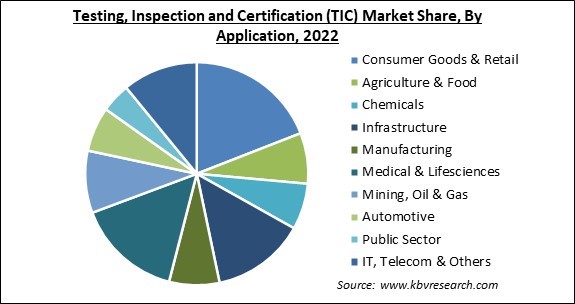

By application, the market is divided into consumer goods & retail, medical & life sciences, agriculture & food, chemicals, infrastructure, manufacturing, mining, oil, & gas, public sector, automotive, IT & telecom, and others. The consumer goods and retail segment witnessed the maximum revenue share in the market in 2022. The use of cutting-edge technologies like machine learning (ML), artificial intelligence (AI), and the Internet of Things (IoT) is responsible for this segment's expansion. Consumer purchases of computers, laptops, cell phones, and other devices have increased due to the growing trend of working from home or remotely. As a result, there is a high demand for testing, inspection, and certification services to ensure that consumer-purchased gadgets adhere to strict safety and inspection standards.

On the basis of sourcing type, the market is classified into in-house and outsourced. The outsourced segment recorded a significant revenue share in the market in 2022. Companies can be cost-effective and concentrate on short-term commitments through the outsourcing segment. The efficiency of the system is increased by helping businesses implement TIC practices utilizing several engagement models, such as the hourly model, the material and time model, and the dedicated team model. In addition, growing urbanization and globalization have complicated the supply chains for TIC services, which has, in turn, led to the commercialization of laboratories, raised the bar for efficiency, and ultimately increased demand for outsourced services.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 217 Billion |

| Market size forecast in 2030 | USD 280.1 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 3.3% from 2023 to 2030 |

| Number of Pages | 298 |

| Number of Table | 414 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Sourcing Type, Service Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment recorded the largest revenue share in the market in 2022. The market for testing, inspection, and certification is expanding in the Asia Pacific region due to several factors, including raised research & development in connected and autonomous cars (new as well as improved technologies) and improved lifestyles. Furthermore, the significant reliance of many developed nations on Asian manufacturers of medical devices, pharmaceuticals, personal protective equipment (PPE), and other essential equipment also drives the demand for TIC services.

Free Valuable Insights: Global Testing, Inspection and Certification (TIC) Market size to reach USD 280.1 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include SGS S.A., Bureau Veritas S.A., Intertek Group PLC, Eurofins Scientific SE, TÜV Rheinland AG, Applus+ Group, TÜV Nord Group, DEKRA SE, TUV SUD and DNV AS.

By Application

By Sourcing Type

By Service Type

By Geography

This Market size is expected to reach $280.1 billion by 2030.

Strict laws and regulations and increasing demand for product standardizations are driving the Market in coming years, however, Geographical diversity contributing to the high price of TIC services restraints the growth of the Market.

SGS S.A., Bureau Veritas S.A., Intertek Group PLC, Eurofins Scientific SE, TÜV Rheinland AG, Applus+ Group, TÜV Nord Group, DEKRA SE, TUV SUD and DNV AS.

The Agriculture & Food segment has shown the high growth rate of 5.2% during (2023 - 2030).

The In-house segment is leading the Market by Sourcing Type in 2022, thereby achieving a market value of $175.5 billion by 2030.

The Asia Pacific region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $105.2 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.