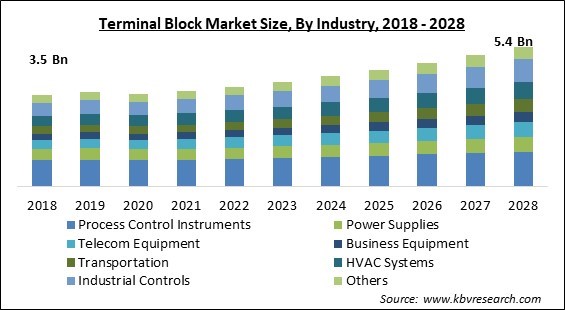

The Global Terminal Block Market size is expected to reach $5.4 billion by 2028, rising at a market growth of 5.7% CAGR during the forecast period.

A terminal block is known as a modular block with an insulated frame, which is used to connect two or more wires together. It is also known as a connecting terminal or terminal connector. It is made up of a conducting strip and a clamping element. A terminal block's insulating body contains a current carrying component that is called a metal strip or terminal bar. Additionally, it offers a basis for the clamping element.

The body has a mounting configuration that makes it simple to mount or demount the block from a PCB or a mounting rail. Most terminal blocks are typically installed on DIN rail and are modular. As a result, the number of terminals to address the requirements can be increased. Terminal blocks keep wires neatly organized and connections much more secure. Although they may analyze signals and provide outputs, electronic circuits nearly always require connections to other parts, power sources, inputs, or outputs.

Connectors, which come in a wide variety of types, forms, sizes, and ratings, are used to make these connections. Understanding diverse connector types are crucial since selecting the incorrect connector for any design can result in a variety of problems, such as excessive product sizes or components that catch fire. Although there are several connector types available, like pin headers, sockets, DIN, and DB, terminal blocks are increasingly becoming popular because they are used in nearly every industry, from household wiring to industrial rack systems connecting to diverse I/O.

In car control panels and below vehicle dashboards, terminal blocks are frequently employed. Compared to other connector types, they often withstand larger power levels. A terminal block can be considered as a hub where ground and power are kept together. In electric vehicles, this kind of connector is not frequently utilized. Busbars, on the other hand, are used to transport high current loads, like those that might be present in applications involving EV battery packs.

During the pandemic, all the operations, such as industrial automation, were suspended. It caused a hindrance in the growth of the terminal block market. With the lifting of the lockdown restrictions in 2021, manufacturing companies reopened, which led to the restart of production facilities. As a result of COVID-19 compelling their clients to stay within their budgets or postpone IT/IoT spending, several IoT providers have witnessed a decline in sales. Moreover, the outbreak also had a catastrophic effect on a number of businesses, including telecommunications, IT, and the automotive sector. Due to the suspension of operations in these sectors, the business environment in the first half of 2020 was adversely affected. Although, the COVID-19 outbreak accelerated the transition to a work-from-home model, increasing demand for consumer electronics goods and electronic devices that require PCBs.

The process of turning uninhabited or sparsely populated terrain into densely populated cities is known as urbanization. Urban areas can expand due to migration into urban regions or growth in the human population. Nowadays, a significant proportion of the world's population dwells in cities, many of which are growing in population density. One of the major factors that are propelling this shift is the increasing number of facilities that are being offered within urban areas along with the expanded digital divide all over the world.

Climate change worries, rising energy costs, and carbon emissions all continue to drive up the use of HVAC systems in commercial buildings. The growing demand for these solutions that save energy is expected to benefit the terminal block market as well. Commercial building users are being encouraged to install and upgrade HVAC systems through rebates for energy-efficient systems, including air conditioning and HVAC. The technology used in the sector has witnessed significant development recently, partly as a result of consumers' demands to have complex microcontrollers integrated into their systems and an increase in demand for environmentally friendly refrigerants.

In recent years, improvements in connection technologies have been observed. All varieties of terminal blocks previously used screw-type technology. Users have to take the time to ensure a strong connection in this form of connection. Screw terminals were difficult to install and carried the danger of causing wires to become loose over time. Many terminal blocks can be found in a single assembly, and most terminal blocks have approximately 8 to 10 poles on average. During installation or maintenance, it takes a lot of time for a user to unscrew and screw each connection. As a result, other connection technologies emerged, such as insulation-displacement connections and push-in connections (IDC).

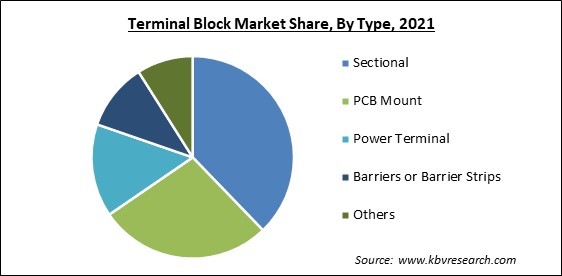

On the basis of Type, the Terminal Block Market is segregated into Barriers or Barrier Strips, Sectional, PCB Mount, Power Terminal, and Others. In 2021, the sectional terminal blocks segment acquired the largest revenue share of the terminal block market. The high adoption of NEMA and IEC DIN Rail sectional blocks in a variety of applications, including construction, harsh environments, discrete manufacturing, amusement park ride controls, conveyance lines, specialized machines, academic campuses, office buildings, and building automation, is the result of these advancements.

By Industry, the Terminal Block Market is segmented into Business Equipment, HVAC Systems, Power Supplies, Industrial Controls, Process Control Instruments, Telecom Equipment, Transportation, and Others. In 2021, the industrial controls segment recorded a substantial revenue share of the terminal block market. In industrial machinery including machine controls, switchgear, distribution panels, as well as measuring instruments, terminal blocks are frequently employed. The terminal block market for industrial controls is expanding because they are also utilized in industrial production, encompassing distributed control systems, supervisory control and data acquisition systems, and other control configurations, like programmable logic controllers.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 3.7 Billion |

| Market size forecast in 2028 | USD 5.4 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5.7% from 2022 to 2028 |

| Number of Pages | 214 |

| Number of Tables | 333 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Industry, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-Wise, the Terminal Block Market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Asia Pacific accounted for the largest revenue share of the terminal block market. The primary driver of the market's expansion is the increased industrialization of the region, especially in developing nations like China, India, and Indonesia. Additionally, it aids in fostering positive relationships with other nations, gaining market access, and avoiding non-compliance with stringent environmental rules in industrialized nations. The requirement for terminal blocks arises from the area automotive and consumer electronics firms' strong emphasis on using automation technologies to produce durable and high-quality products for a variety of applications.

Free Valuable Insights: Global Terminal Block Market size to reach USD 5.4 Billion by 2028

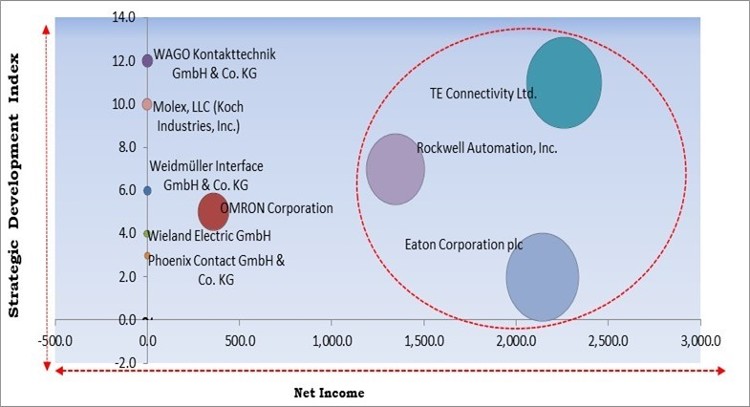

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; TE Connectivity Ltd., Eaton Corporation plc, Rockwell Automation, Inc. are the forerunners in the Terminal Block Market. Companies such as OMRON Corporation, WAGO Kontakttechnik GmbH & Co. KG, Molex, LLC (Koch Industries, Inc.) are some of the key innovators in Terminal Block Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include TE Connectivity Ltd., Omron Corporation, Eaton Corporation PLC, Rockwell Automation, Inc., Molex, LLC, Weidmüller Interface GmbH & Co. KG, WAGO Kontakttechnik GmbH & Co. KG, Wieland Electric GmbH, Ningbo Degson Electrical Co., Ltd., and Phoenix Contact GmbH & Co. KG.

By Industry

By Type

By Geography

The Terminal Block Market size is projected to reach USD 5.4 billion by 2028.

Widespread Urbanization Across The World are driving the market in coming years, however, Challenges In The Deployment Of Terminal Blocks restraints the growth of the market.

TE Connectivity Ltd., Omron Corporation, Eaton Corporation PLC, Rockwell Automation, Inc., Molex, LLC, Weidmüller Interface GmbH & Co. KG, WAGO Kontakttechnik GmbH & Co. KG, Wieland Electric GmbH, Ningbo Degson Electrical Co., Ltd., and Phoenix Contact GmbH & Co. KG.

The expected CAGR of the Terminal Block Market is 5.7% from 2022 to 2028.

The Process Control Instruments segment is leading the Global Terminal Block Market by Industry in 2021 thereby, achieving a market value of $1.4 billion by 2028.

The Asia Pacific market dominated the Global Terminal Block Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $2.0 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.