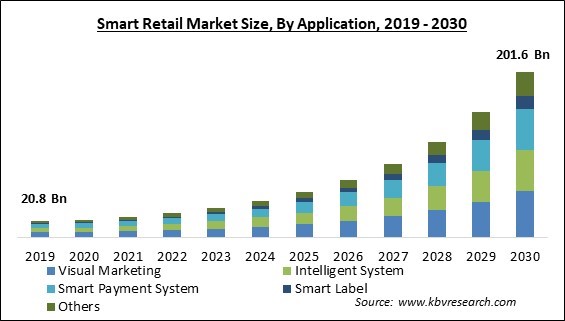

The Global Smart Retail Market size is expected to reach $201.6 billion by 2030, rising at a market growth of 27.8% CAGR during the forecast period.

Smart Payment System’s utilization is growing globally due to the rising demand for digital payment solutions after the consumer behavioral change caused by the pandemic and the digitization of retail outlets. Hence, Smart Payment System would generate approximately 1/4th share of the market by 2030. The popularity of digital payments has soared in both volume and value, while the usage of paper-based payment methods, such as demand drafts, and checks, has drastically decreased. For example, in 2021, 76% of persons worldwide had accounts with a bank, another financial institution, or a mobile money provider, up from 68% in 2017 and 51% in 2011, according to World Bank statistics. Globally, two-thirds of individuals currently send or receive digital payments, with emerging countries accounting for an increasing proportion from 35% in 2014 to 57% in 2021.

The major strategies followed by the market participants are Acquisitions as the key developmental strategy in order to keep pace with the changing demands of end users. For instance, In May, 2023, IBM Corporation took over Polar Security to strengthen its AI and hybrid cloud capabilities. Additionally, In March, 2021, Amazon.com, Inc. acquired Perpule, a retail startup based in Bengaluru, India. The acquisition provides Amazon with POS solutions developed by Perpule, thereby allowing it to serve its Indian customers in a better way.

Based on the Analysis presented in the KBV Cardinal matrix; Google LLC is the forerunner in the Market. Companies such as Cisco Systems, Inc, Intel Corporation, Honeywell International, Inc. are some of the key innovators in the Market. In July, 2021, Cisco Systems, Inc took over Socio Labs, Inc that complements Cisco's Webex event management portfolio and would allow the company to serve its event organizer customers in a better way.

Smart retail may have scope to develop due to the advancements in digital and internet technology, which also assist merchants in positioning their items, streamlining their operations, and structuring their value chains. The market is expanding quickly because of the growing use of Internet of Things (IoT) technology for various purposes, including worker skill modification, automated smart retail, and linked retail services. In the next years, these elements are projected to help the market expand.

The retail sector is experiencing transformation as a result of the arrival of intelligent technologies like artificial intelligence, machine learning, and the Internet of Things (IoT). These innovations allow for smooth, immersive experiences and rapid access to tailored options. Smart shops utilize mechanical components to enhance the customer experience, including self-identification of customers, product data, product selection, in-store navigation, and self-checkout. The expansion of the smart retail business is aided by such advances as well as the increased customer desire for immersive in-store shopping experiences.

Smart retail technology has a high return on investment since it takes money to make money for a relatively long period. As a result, retailers with limited resources for migration are taking longer to deploy complete smart solutions, which is expected to restrain the development of the market for smart retail devices. Also, disorganized stores may think installing an electronic shelf label (ESL) system costs too much. When a smart retail business grows, more shelves must be installed, and each one needs its own ESL tag. As a result, each electrical shelf's installation prices are rising. This limits merchants' ability to deploy the system, delaying sales of smart retail devices. These decreased sales of smart retail equipment will ultimately hamper the expansion of the smart retail business.

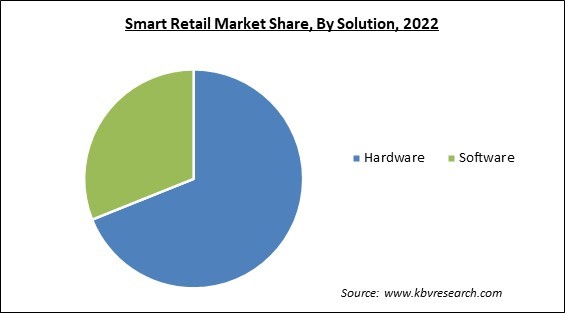

Based on solution, the market is divided into hardware and software. In 2022, the software segment garnered a significant revenue share in the market. One of the key reasons driving the market growth is the expanding usage of analytics software by retailers across the globe to comprehend unique end-user requirements and behavior, thereby enhancing consumer engagement and the shopping experience. Significant prospects for analytics in smart commerce are expected to result from this.

By application, the market is segmented into visual marketing, smart payment systems, intelligent systems, smart labels, and others. In 2022, the visual marketing segment witnessed the largest revenue share in the market. One of the key criteria for a smart retail solution to attract consumers is visual marketing via eye-catching storefronts, interior displays, digital signage, and modern lighting. Retailers can now concentrate on offering a seamless purchasing experience with no interruption from social media. These elements together are to blame for this expansion of the market.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 29.8 Billion |

| Market size forecast in 2030 | USD 201.6 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 27.8% from 2023 to 2030 |

| Number of Pages | 194 |

| Number of Table | 273 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Solution, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. Throughout the projected period, this region is predicted to dominate the market regarding revenue contribution. The U.S. economy is being restructured as digital technology is increasingly used in all application areas. The post-pandemic effect has touched the retail sector, which has accelerated the digital transformation of enterprises.

Free Valuable Insights: Global Smart Retail Market size to reach USD 201.6 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Amazon.com, Inc., Cisco Systems, Inc, Google LLC (Alphabet Inc.), Honeywell International, Inc., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), IBM Corporation, NCR Corporation, NVIDIA Corporation, Intel Corporation, and NXP Semiconductors N.V.

By Application

By Solution

By Geography

The Market size is projected to reach USD 201.6 billion by 2030.

The growing number of smart stores are driving the Market in coming years, however, Increasing High-End Device Maintenance Costs restraints the growth of the Market.

Amazon.com, Inc., Cisco Systems, Inc, Google LLC (Alphabet Inc.), Honeywell International, Inc., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), IBM Corporation, NCR Corporation, NVIDIA Corporation, Intel Corporation, and NXP Semiconductors N.V.

The Hardware segment is leading the Global Smart Retail Market by Solution in 2022 thereby, achieving a market value of $99.9 billion by 2030.

The North America market dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $70 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.