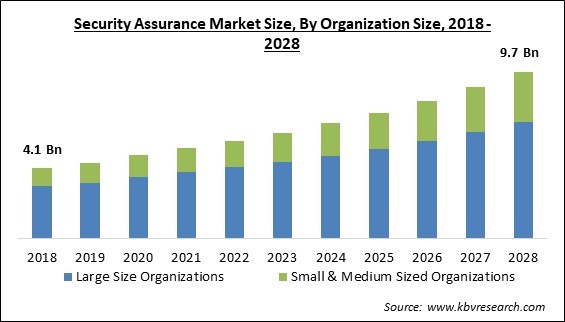

The Global Security Assurance Market size is expected to reach $9.7 billion by 2028, rising at a market growth of 9.3% CAGR during the forecast period.

Security assurance is a cutting-edge approach for establishing and controlling risks & threats to computer security. This group of technologies ensures that software is developed with a level of security that can resist the harm arising from the loss, incorrect use, disappearance, manipulation, or misuse of the data and resources it depends on. Services for security assurance aid companies in locating, assessing, and controlling security risks associated with mobile devices, business applications, and related technology environments.

Also, the market for security assurance is expanding due to enterprises' increased concerns about cyberattacks, the possibility of phishing, and malware. Moreover, IoT and BYOD are helping the market for security assurance develop. Global Security assurance services enable businesses to quickly identify, evaluate, and address security threats associated with mobile devices, enterprise applications, and related technological environments. But one of the primary obstacles facing the world's security assurance companies is the difficulty in providing hybrid cloud security.

Security assurance outlines defenses against hidden risks associated with goods, programs, or services. In accordance with a standard or comparison to a profile, it can be used to certify that a good or service has a given level of security. A wide variety of security assurance technologies, methods, and measurements are available. One of the most widely used standards is Common Criteria (CC).

A graduated scale of evaluation assurance levels is used by CC, which balances the level of certainty with the cost and practicalities of achieving that level of assurance. For example, testing for vulnerabilities cannot confirm that a system is fault-free; rather, it can only show whether the system is secure (or not) from the assaults employed to test it. Similarly, security assurance cannot guarantee that a product is risk-free to use, but when done well, it may establish a strong basis of confidence that it is secure to a certain extent.

The COVID-19 outbreak has had a significant effect on the development of the security assurance market, since rising smartphone adoption, connected device adoption, and the booming e-commerce industry all present attractive potential for the market's expansion. However, the global shutdown and economic downturn have ended the lack of skilled workers available everywhere. In turn, this will have an impact on the market for hardware wallets in 2020. In addition, worldwide crises in 2020 have been brought on by COVID in social, economic, and energy, as well as in medicine.

Bring Your Own Device (BYOD) has become extremely popular, and BaaS providers have committed a substantial amount of money to promote this trend. The amount of data collected by businesses globally is increasing due to this culture. The Internet of Things and the "bring your own device" movement, two new paradigms, have significantly altered the employment of smart applications in the government, retail, healthcare, and IT & telecommunications sectors. Improvements in the underlying technology and the broad adoption of next-generation network-powered solutions stimulate the development of security assurance applications. In light of this, the demand for security assurance is anticipated to increase over the next few years.

There has been a considerable rise in the capability of malicious software, such as viruses or Trojan horses, to penetrate, take control of, or cause harm to entire electronic information networks. Malware is widely utilized by cybercriminals who steal data or make monetary gains online to gain control of computers or other devices. This is done so that the device can be utilized immediately in dishonest activities such as fraud or other illegal acts. In addition, companies operating in the healthcare, banking, financial services, and government sectors are especially susceptible to these kinds of attacks because of the significance of the data generated in these areas. These factors are increasing the market growth.

Throughout the early stages of the system's development, several methodologies concentrated on eliciting and modeling the security needs of the system. Unfortunately, these approaches have not been extensively embraced since it is difficult to apply them to industries as a result of a mismatch between the current process of development and these methodologies. Furthermore, these techniques are not only challenging to understand but do not provide a documenting process for the security aspects of IT systems. It is anticipated that the adoption of security assurance will be limited due to these concerns, which would, in turn, limit the expansion of the market.

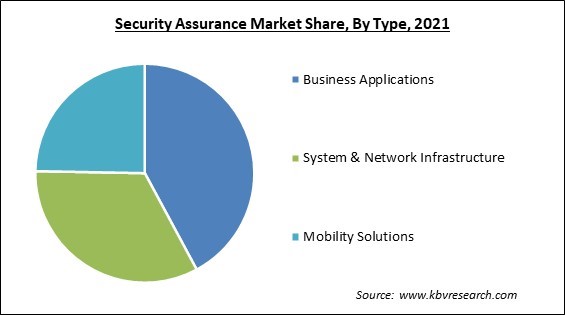

By type, the security assurance market is segmented into business applications, system & network infrastructure, and mobility solutions. In 2021, the mobility solutions segment procured a promising growth rate in the security assurance market. It is believed that the rapidly rising number of mobile devices worldwide is one of the driving causes behind the market expansion. In addition, networks are becoming more susceptible to cyberattacks as the demand for mobile devices and connections increases. As a result, the growth of the mobility solutions business has been accelerated.

Based on organization size, the security assurance market is categorized into large sized organizations and small & medium sized organization. The large sized organizations segment witnessed the largest revenue share in the security assurance market in 2021. This is as a result of surplus reserves and revenues that can be used for upgrading operations. In addition, the security is the major concern of most of the large businesses as a result of which the security assurance approach is widely being adopted by them. It is predicted to support the market growth in this segment.

On the basis of vertical, the security assurance market is fragmented into BFSI, IT & telecom, government & commercial offices, healthcare, retail, manufacturing and others. The IT & telecom segment recorded a remarkable revenue share in the security assurance market in 2021. This results from the market's quick growth and expansion due to the demand for instant communication. Systems need a security assurance framework to guarantee business continuity and data security. In addition, security intelligence necessitates a wide range of innovative solutions.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 5.3 Billion |

| Market size forecast in 2028 | USD 9.7 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9.3% from 2022 to 2028 |

| Number of Pages | 240 |

| Number of Table | 384 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Vertical, Organization Size, Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the security assurance market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the North America region led the security assurance market by generating the highest revenue share. Businesses are making investments in developing technologies in the North American region to increase productivity. The North America’s security assurance market is expanding due to the increased competition amongst cloud-based provider businesses, where key competitors are providing better information protection by guaranteeing quick access and greater customer outreach.

Free Valuable Insights: Global Security Assurance Market size to reach USD 9.7 Billion by 2028

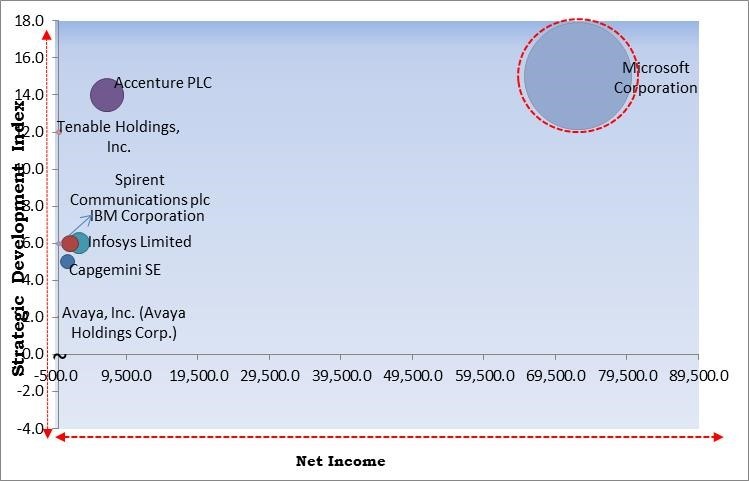

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation are the forerunners in the Security Assurance Market. Companies such as Accenture PLC, Infosys Limited, and Tenable Holdings, Inc. are some of the key innovators in Security Assurance Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Accenture PLC, Microsoft Corporation, Infosys Limited, IBM Corporation, Capgemini SE, Avaya, Inc. (Avaya Holdings Corp.), Spirent Communications plc, Tenable Holdings, Inc., Happiest Minds Technologies Limited and SAS Institute, Inc.

By Type

By Organization Size

By Vertical

By Geography

The global Security Assurance Market size is expected to reach $9.7 billion by 2028.

The growing threat of phishing & malware to enterprises are driving the market in coming years, however, Validation, elucidation, and modelling of security requirements Validation, elucidation, and modelling of security requirements restraints the growth of the market.

Accenture PLC, Microsoft Corporation, Infosys Limited, IBM Corporation, Capgemini SE, Avaya, Inc. (Avaya Holdings Corp.), Spirent Communications plc, Tenable Holdings, Inc., Happiest Minds Technologies Limited and SAS Institute, Inc.

The Business Applications segment acquired maximum revenue share in the Global Security Assurance Market by Type in 2021 thereby, achieving a market value of $3.9 billion by 2028.

The BFSI segment is leading the Global Security Assurance Market by Vertical in 2021 thereby, achieving a market value of $3 billion by 2028.

The North America market dominated the Global Security Assurance Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $3.3 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.