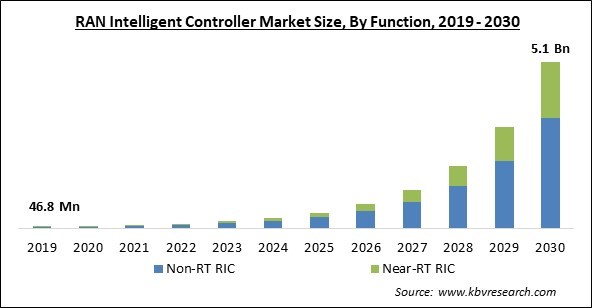

The Global RAN Intelligent Controller Market size is expected to reach $5.1 billion by 2030, rising at a market growth of 58.2% CAGR during the forecast period.

The upcoming 5G era can be described as limitless connectivity for everyone and intelligent automation that will improve people's lives and change industrial processes. Therefore, the 5G segment will capture 1/4th share in the market by 2030. More people rely on mobile connectivity in today's environment, and 5G is predicted to accelerate connectivity to supply mobile data services. To provide a limitless, high-speed, dependable, and secure internet experience and enable a wide range of use cases for society, 5G networks will integrate with 4G and alternative network technologies. The ability to work across industries, including finance, transportation, retail, and health, has allowed telecoms to go beyond connectivity and offer new, comprehensive services.

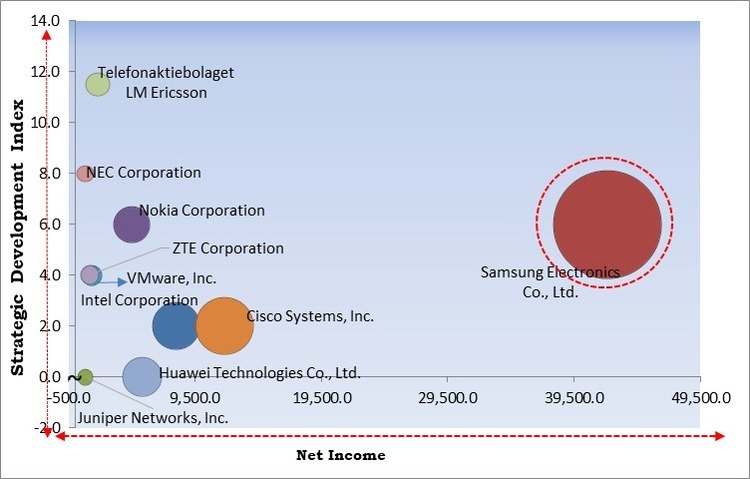

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In July, 2023, Intel teamed up with Ericsson to enable communications service providers to increase network capacity and energy efficiency by optimizing 4th Gen Intel Xeon Scalable processors with Intel vRAN Boost for Ericsson’s Cloud RAN (radio access network) solutions. Additionally, In March, 2023, Nokia Corporation collaborated with AT&T to drive innovation further to streamline the process and ensure a premium experience for end users.

Based on the Analysis presented in the KBV Cardinal matrix; Samsung Electronics Co., Ltd. is the forerunner in the Market. In October, 2022, Samsung Electronics Co., Ltd. partnered with Vodafone Group plc, to fasten the adaptability and Performance of 5G Open Radio Access. Networks (RAN) across Europe. Companies such as Cisco Systems, Inc., Intel Corporation, Nokia Corporation are some of the key innovators in the Market.

Network optimization is a key driver behind the RAN intelligent controller (RIC), enabling network operators to enhance the radio access network's (RAN) performance and efficiency. Due to the increased complexity of 5G networks and the need for efficient resource allocation, network optimization is crucial for ensuring optimal network performance and user experience. The RIC is a centralized intelligence hub that uses cutting-edge algorithms, artificial intelligence (AI), and real-time network insights to enhance various RAN components. The user experience, network capacity, and latency are all enhanced by using this optimization technique. The market will expand in the coming years due to the rising demand for network enhancement.

Open interfaces and ecosystem cooperation, which encourage interoperability, vendor neutrality, and innovation in the telecommunications industry, are the driving forces behind the RAN intelligent controller (RIC). Due to the RIC's emphasis on open interfaces and cooperation, network operators incorporate solutions from several providers, reduce vendor lock-in, and foster a competitive market. Open interfaces enable interoperability between different components and providers within the RAN architecture. The RIC's open APIs and established interfaces enable effortless network integration of base stations, antennas, and network management systems. By providing innovators with a space to collaborate and launch novel goods and services into the market, the RIC acts as a catalyst for industrial innovation, thereby propelling the growth of the market.

The 5G wireless telecommunications infrastructure is based on older technologies, such as 4G LTE networks. The security of 5G networks will be at risk from any flaws that exist in those networks. To adopt 5G technology, more elements are needed, increasing the number of access points and network edges. Beamforming, tiny cells, cellular devices, and cellular towers are commonly used in 5G technology infrastructure. It expands the area that can be attacked online. A lot of these components also don't have any physical security features. These sections focus on particular use scenarios especially in sectors like automotive, healthcare, and essential infrastructure. As a result, the market has a significant security-related problem.

On the basis of function, the market is segmented into non-real-time-RAN intelligent controller (non-RT RIC) and near-real-time-RAN intelligent controller (Near-RT RIC). The near-real-time-RAN intelligent controller (Near-RT RIC) segment recorded a remarkable revenue share in the market in 2022. A telco edge or regional cloud is where the Near Real-Time RIC is located, and it often allows network optimization procedures that take ten milliseconds to 1 second to complete. The near RT RIC manages the cloud edge RAN infrastructure. Cloud-native microservice-based applications known as xApps are hosted by the near-RT RIC.

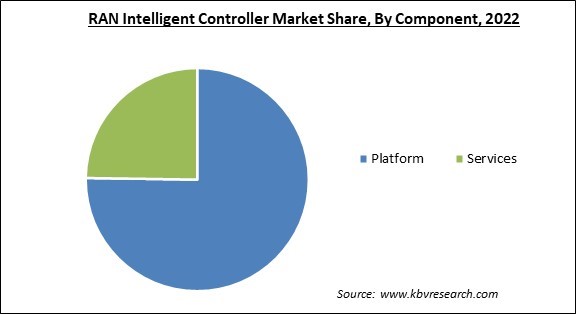

Based on component, the market is fragmented into platform and services. In 2022, the platform segment held the highest revenue share in the market. The growth of the segment is due to the provision of a centralized command center that organizes and manages various RAN tasks and resources, including base stations, antennas, and other network elements. To enhance user experience and network performance, the RIC platform makes intelligent decisions based on real-time data analysis and machine learning algorithms.

On the basis of application, the market is categorised into rApps and xApps. The xAPPs segment recorded a remarkable share in the market in 2022. xApps are programs created for the Near-RT RIC and must be executed in less than a second. Security, mobile, and radio resource management are among xApps' features or activities. As the algorithm would need to execute in tens or hundreds of milliseconds to guarantee user network access, optimizing network handovers is an example of an xApp. Additionally, xApps can provide QoS features like traffic control or congestion.

By technology, the market is classified into 4G and 5G. In 2022, the 4G segment witnessed the largest revenue share in the market. The fourth generation of wireless cellular technologies, or 4G, has gained a lot of global adoption. Additionally, it can grow in emerging nations like Sub-Saharan Africa, and operators aim to convert 2G and 3G users to 4G. To provide 4G clients with enhanced services, mobile network operators will utilize intelligent technology like RAN intelligent controllers.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 137.9 Million |

| Market size forecast in 2030 | USD 5.1 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 58.2% from 2023 to 2030 |

| Number of Pages | 269 |

| Number of Table | 404 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Function, Technology, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, North America region generated the highest revenue share in the market. Internet and smartphone use are highly prevalent in North America, which has a robust technology infrastructure. Additionally, regional government initiatives will probably support the development of the 5G and RAN intelligent controller markets. Aside from that, because of the emergence of 5G technology, the growth of mobile networks, the deployment of Internet of Things (IoT) gadgets, and the requirement for effective network management.

Free Valuable Insights: Global RAN Intelligent Controller Market size to reach USD 5.1 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Nokia Corporation, VMware, Inc., Intel Corporation, Samsung Electronics Co., Ltd. (Samsung Group), Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Cisco Systems, Inc., ZTE Corporation, NEC Corporation, Juniper Networks, Inc. and Telefonaktiebolaget LM Ericsson.

By Function

By Component

By Application

By Technology

By Geography

This Market size is expected to reach $5.1 billion by 2030.

Increasing need for network enhancement are driving the Market in coming years, however, Security issues with 5G restraints the growth of the Market.

Nokia Corporation, VMware, Inc., Intel Corporation, Samsung Electronics Co., Ltd. (Samsung Group), Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Cisco Systems, Inc., ZTE Corporation, NEC Corporation, Juniper Networks, Inc. and Telefonaktiebolaget LM Ericsson.

The Non-RT RIC segment is generating the highest revenue in the Market by Function in 2022; thereby, achieving a market value of $3.4 billion by 2030.

The rApps segment is leading the Global Market by Application in 2022; thereby, achieving a market value of $3.3 billion by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $1.7 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.