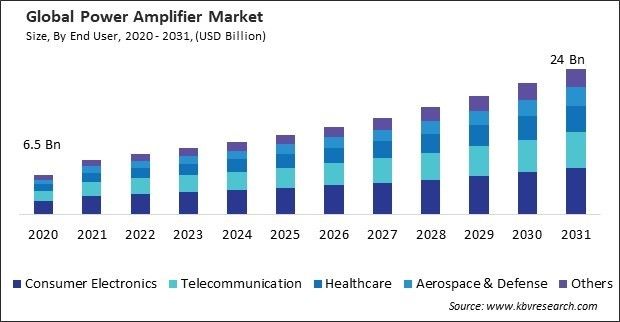

The Global Power Amplifier Market size is expected to reach $24 billion by 2031, rising at a market growth of 10.3% CAGR during the forecast period. In the year 2023, the market attained a volume of 23,571.9 thousand units, experiencing a growth of 20.7% (2020-2023).

Consumers demand broader coverage and reliable connectivity across various geographic areas, including urban, suburban, and rural environments. As per Statistics Canada, by 2020, 84% of Canadians owned a smartphone. In order to increase the coverage area of wireless networks and guarantee that users can remain connected even in places with spotty or patchy network coverage, power amplifiers are in charge of boosting signals. Therefore, the Consumer Electronics segment would capture $3,772.7 million revenue in the market by 2023. In terms of volume, the utilization of power amplifiers in this segment is expected to reach 27,762.2 thousand units by the year 2031. Power amplifiers ensure seamless connectivity by amplifying signals and maintaining signal integrity, even in challenging environments with obstacles or interference.

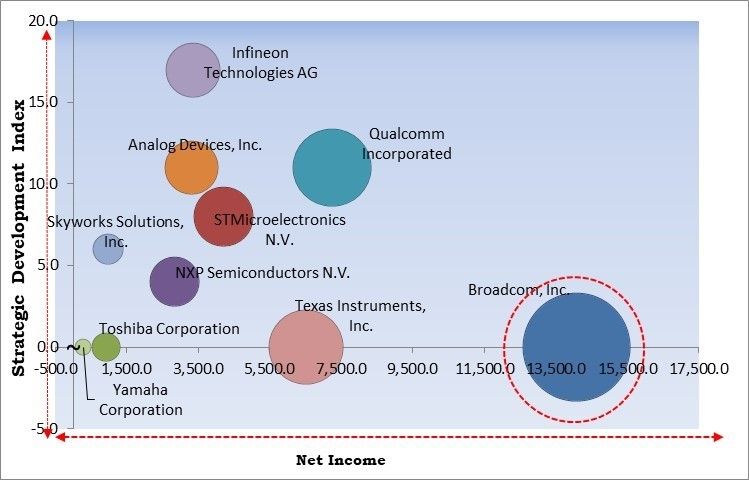

The major strategies followed by the market participants are Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, In October, 2023, Infineon Technologies AG took over GaN Systems Inc., to accelerate its GaN roadmap and further strengthen Infineon’s leadership in power systems by mastering all relevant power semiconductor technologies. Additionally, In August, 2021, NXP Semiconductors N.V. acquired Retune DSP. The acquisition strengthens NXP's capability in delivering performance-rich voice control solutions to its customers.

Based on the Analysis presented in the KBV Cardinal matrix; Broadcom, Inc. is the forerunner in the Market. Companies such as Qualcomm Incorporated, Texas Instruments, Inc., STMicroelectronics N.V. are some of the key innovators in the Market. In May 2023, Qualcomm Technologies, Inc. announced the acquisition of Autotalks. The acquisition adds Autotalk's V2X portfolio to Qualcomm's Snapdragon Digital Chassis portfolio.

The exponential growth in wireless communication technologies, including 5G, IoT, and smart devices, propels the market forward. These cutting-edge technologies are revolutionizing how people connect, communicate, and interact with the world around them, driving unprecedented demand for advanced power amplifiers that meet modern communication systems' evolving requirements. Hence, owing to these factors, there will be increased demand in the market.

IoT networks often utilize a variety of communication standards and protocols, including Wi-Fi, Bluetooth, Zigbee, LoRa, NB-IoT, and others, depending on the specific application requirements and environmental conditions. Power amplifiers need to be compatible with these diverse communication standards, supporting multiple frequency bands and modulation schemes to enable seamless connectivity and interoperability across different IoT devices and networks. Therefore, these factors will help in the expansion of the market.

Price-sensitive markets may prioritize affordability over advanced features or performance, limiting the demand for premium power amplifier products. As a result, manufacturers may struggle to penetrate new market segments or expand their customer base beyond price-sensitive sectors. This limits revenue growth opportunities and constrains the overall market size for power amplifiers. Therefore, these factors can lead to reduced demand for power amplifiers in the upcoming years.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

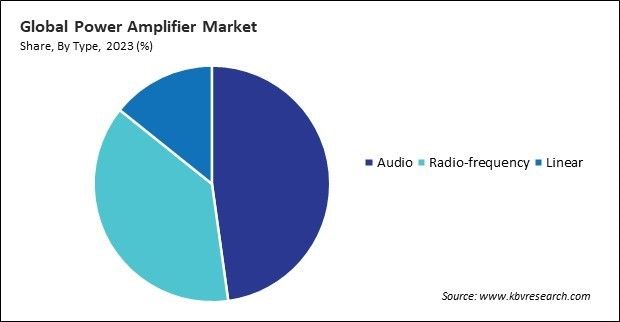

Challenges Based on type, the market is segmented into audio, radio, and linear. The audio segment 48% revenue share in the market in 2023. In terms of volume, the utilization of audio amplifier is expected to reach 32,308.0 thousand units by the year 2031. The growing demand for high-quality audio reproduction in consumer electronics, home entertainment systems, automotive infotainment, and professional audio applications has fueled the adoption of audio power amplifiers. Consumers increasingly seek immersive audio experiences characterized by clear, detailed sound and rich bass response, driving demand for power amplifiers capable of delivering high-fidelity audio performance.

Based on end user, the market is divided into consumer electronics, healthcare, aerospace & defense, telecommunication, and others. In 2023, the healthcare segment witnessed 17% revenue share in the market. Also, the segment utilized 3,540.5 thousand units of power amplifier in 2023. The trend towards portable, handheld, and point-of-care medical devices necessitates power amplifiers that are compact, lightweight, and energy-efficient. Portable ultrasound scanners, handheld ECG monitors, and point-of-care diagnostic devices require power amplifiers capable of delivering sufficient signal strength while operating on battery power or low-voltage supplies. Hence, these factors will help in the growth of the segment.

On the basis of material, the market is divided into gallium nitride (GaN), gallium arsenide (GaAs), and silicon germanium (SiGe). The silicon germanium (SiGe) segment recorded 49% revenue share in the market in 2023. SiGe technology offers inherently low noise characteristics, making it suitable for applications requiring high signal-to-noise ratios and low distortion. Therefore, these factors can boost the demand in the segment.

Free Valuable Insights: Global Power Amplifier Market size to reach USD 24 billion by 2031

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured more than 2/5th revenue share in the market in 2023. In terms of Volume, there were 11,193.5 thousand units of power amplifier were sold in the year 2023 in this region. The region's growing middle class, rising disposable incomes, and increasing urbanization fuel demand for smartphones, tablets, smart TVs, gaming consoles, and other electronic devices that rely on power amplifiers for signal amplification and transmission. Hence, the segment will grow rapidly in the upcoming years.

The market is fiercely competitive, driven by technological innovation and diverse industry demands. Key players vie for dominance through R&D investments, aiming to enhance performance, efficiency, and integration capabilities. Competition intensifies across sectors like consumer electronics, telecommunications, and defense, where companies strive to differentiate with smaller form factors, ruggedness, and compliance with stringent specifications. Market dynamics prompt continual evolution, with firms expanding product portfolios to cater to varied customer needs. Overall, competition in the market is robust, characterized by innovation, strategic partnerships, and effective marketing strategies as companies vie for market leadership and differentiation.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 11 Billion |

| Market size forecast in 2031 | USD 24 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 10.3% from 2024 to 2031 |

| Quantitative Data | Volume in Thousand Units, Revenue in USD Billion, and CAGR from 2020 to 2031 |

| Number of Pages | 355 |

| Number of Tables | 643 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Material, End User, Region |

| Country scope |

|

| Companies Included | NXP Semiconductors N.V., Qualcomm Incorporated, Broadcom, Inc., STMicroelectronics N.V., Skyworks Solutions, Inc., Analog Devices, Inc., Infineon Technologies AG, Texas Instruments, Inc., Toshiba Corporation, Yamaha Corporation |

By Type (Volume, Thousand Units, USD Billion, 2020-2031)

By End User (Volume, Thousand Units, USD Billion, 2020-2031)

By Material

By Geography (Volume, Thousand Units, USD Billion, 2020-2031)

This Market size is expected to reach $24 billion by 2031.

Wireless Communication Proliferation Fueling Demand are driving the Market in coming years, however, Cost Constraints and Price Sensitivity Among Consumers restraints the growth of the Market.

NXP Semiconductors N.V., Qualcomm Incorporated, Broadcom, Inc., STMicroelectronics N.V., Skyworks Solutions, Inc., Analog Devices, Inc., Infineon Technologies AG, Texas Instruments, Inc., Toshiba Corporation, Yamaha Corporation

In the year 2023, the market attained a volume of 23,571.9 thousand units, experiencing a growth of 20.7% (2020-2023).

The Consumer Electronics segment is generating the maximum revenue in the Market by End User in 2023; thereby, achieving a market value of $7.7 billion by 2031.

The Asia Pacific region dominated the Market by Region in 2023; thereby, achieving a market value of $10.9 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.