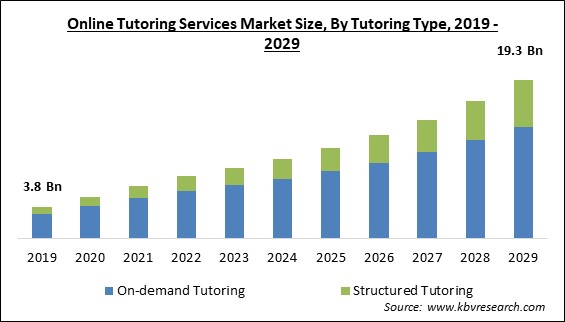

The Global Online Tutoring Services Market size is expected to reach $19.3 billion by 2029, rising at a market growth of 14.7% CAGR during the forecast period.

Online tutoring services are a form of tutoring that takes place in an interactive, digital, or connected environment. In this model, teachers and students are located in different geographical locations. The provision of online tutoring services is beneficial for students who require immediate assistance with their homework. In addition, such services present a distinctive and personalized approach to learning.

The online tutoring industry comprises three main categories of courses, namely language courses, STEM courses, and other courses. The STEM curriculum encompasses the primary fields of Science, Technology, Engineering, and Mathematics. The services, offered through channels such as international organizations & associations, private coaching, educational institutions, and others, are used by K–12 students, college students, in-service educators, and others.

The two primary formats utilized by online tutors are asynchronous and synchronous. The implementation of asynchronous tutoring is dependent on the completion of offline coursework. According to the tutoring process, the tutor sends students their assignments via email. The pupil is then responsible for completing their work and submitting it online. Asynchronous tools facilitate communication between students and instructors for additional assistance or clarification.

This communication can occur without needing both parties to be online simultaneously. The tutoring method known as synchronous tutoring is characterized by immediate and simultaneous communication between the student and the tutor. The successful implementation of this solution necessitates utilizing software that enables seamless direct communication between the involved parties through audio, video, or text.

The COVID-19 pandemic had a devastating impact on the economy. Lockdowns, widespread quarantines, and the requirement for social seclusion were brought on by the pandemic to stop the virus's spread. Additionally, the pandemic significantly disrupted the K–12 educational system. The worldwide lockdowns and sector closures also resulted in the closure of academic institutions and educational programs, which had a detrimental effect on education. Thus, online tutoring played a crucial part in repairing the education loss. The education sector is projected to benefit from online tutoring as many instructors have launched online education platforms assisting the education system. Therefore, the pandemic had a favorable impact on the online tutoring services market.

The market size has significantly changed in recent years due to the widespread adoption of mobile technology and rising education spending. Expenses have been incurred by businesses that rely on education technology for skill development. Market participants are taking extensive steps to endorse their products along with facilitating the learning experience for students through the portals. Businesses in the online tutoring sector are investing more in trends like gamification to increase user engagement. It is anticipated that gamification in online tutoring and e-learning will encourage a game-like response and engagement from students. Throughout the forecasted period, the demand for and the development of the market would increase due to this significant investment by governments and businesses.

The top competitors in the market have introduced new goods with enhanced capabilities. Increased interest in STEM subjects among parents, students, and other educational stakeholders is a significant factor driving the expansion of the online tutoring industry. STEM integrates a variety of subjects into a unified educational strategy centered on practical applications. Giving them the appropriate training gets them ready for employment in the STEM sector. The significant need for test preparation globally is one of the key factors boosting the development of the online tutoring industry.

One significant obstacle to market expansion is the lack of high-quality tutor training. Online tutoring services are provided by several market participants. However, the availability of certified teachers, the curriculum covered, and the teaching methods used by the online tutors have parents and kids concerned about the level of instruction and authenticity of the tutors. This is due to the lack of obligatory laws and regulations worldwide that should be maintained while beginning an occupation as an online tutor. As a result, these factors will pose a significant obstacle to the market's expansion in the coming years.

Based on tutoring type, the online tutoring services market is characterized into structured tutoring and on-demand tutoring. The on-demand tutoring segment garnered the highest revenue share in the online tutoring services market in 2022. Due to the widespread closure of schools caused by the coronavirus pandemic, the need for on-demand online tutoring has also increased. Tutors and content suppliers can get real-time updates on a student's progress by combining on-demand coaching with analytics software.

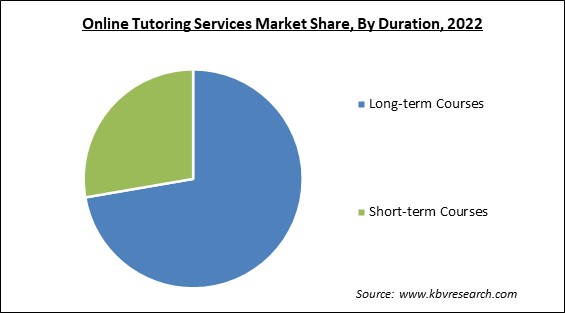

By duration, the online tutoring services market is divided into short-term courses and long-term courses. The short-term courses segment garnered a remarkable growth rate in the online tutoring services market in 2022. The rise in acceptance of short-term diploma programs with flexible tutoring schedules is responsible for the segment's growth. Short-term online courses provide a practical approach to learning at home or work. All locations with an internet connection allow users to access the course materials, assignments, and discussions.

On the basis of course type, the online tutoring services market is classified into language courses, science, technology, engineering, & mathematics (STEM) courses, and others. The science, technology, engineering, & mathematics (STEM) courses segment acquired the largest revenue share in the online tutoring services market in 2022. Some schools have partnered with online education platforms to provide regional educational broadcasts centered on various STEM course grade levels. Such a platform works as a knowledge network, enabling learners to interact with a teacher directly and receive individualized instruction.

Based on tutoring style, the online tutoring services market is segmented into test preparation service and subject tutoring service. The test preparation service segment acquired a substantial revenue share in the online tutoring services market in 2022. The large number of common admission tests given by most colleges explains the rise in demand for these services. The segment's expansion is also aided by fresh and innovative exam prep courses. Adaptive learning is essential for test preparation to assess the efficiency of the assessment.

On the basis of end-user, the online tutoring services market is fragmented into K-12, higher education, and others. The K-12 segment garnered the maximum revenue share in the online tutoring services market in 2022. The K-12 market's significant share can be ascribed to microlearning, which divides complex subjects into manageable portions using audio, videos, texts, and infographics. The popularity of microlearning among K-12 students has increased.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 7.5 Billion |

| Market size forecast in 2029 | USD 19.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 14.7% from 2023 to 2029 |

| Number of Pages | 267 |

| Number of Table | 500 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Tutoring Type, Duration, Course Type, Tutoring Style, End-user, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the online tutoring services market is analysed across North America, Europe, Asia Pacific, and LAMEA. The North America segment acquired the highest revenue share in the online tutoring services market in 2022. There is a sizable achievement gap between pupils from rich and underprivileged families in the United States. This high percentage in the region can be ascribed to the presence of prominent ICT solution providers with a sizable customer base. By taking advantage of its many features, including practice questions, flashcards, expert assistance, writing support, as well as AI-enabled capabilities, online tutoring enables students to plan their studies.

Free Valuable Insights: Global Online Tutoring Services Market size to reach USD 19.3 Billion by 2029

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Chegg, Inc., BYJU'S, Ambow Education Holding Ltd., ArborBridge, Inc., Beijing Magic Ears Technology Co., Ltd., Club Z, Inc., Teach Away, Inc., Nerdy, Inc. (Varsity Tutors), Vedantu Innovations Pvt. Ltd. and TutorEye, Inc.

By Tutoring Type

By Duration

By Course Type

By Tutoring Style

By End User

By Geography

The Market size is projected to reach USD 19.3 billion by 2029.

The emergence of innovations in the online education sector are driving the Market in coming years, however, Lack of credible and knowledgeable online tutors restraints the growth of the Market.

Chegg, Inc., BYJU'S, Ambow Education Holding Ltd., ArborBridge, Inc., Beijing Magic Ears Technology Co., Ltd., Club Z, Inc., Teach Away, Inc., Nerdy, Inc. (Varsity Tutors), Vedantu Innovations Pvt. Ltd. and TutorEye, Inc.

The Subject Tutoring Service market generated the high revenue in the Global Online Tutoring Services Market by Tutoring Style in 2022; thereby, achieving a market value of $15.4 billion by 2029.

The Long-term Courses market is leading the segment in the Global Online Tutoring Services Market by Duration in 2022; thereby, achieving a market value of $13.7 billion by 2029.

The North America market dominated the Market by Region in 2022; thereby, achieving a market value of $6.4 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.