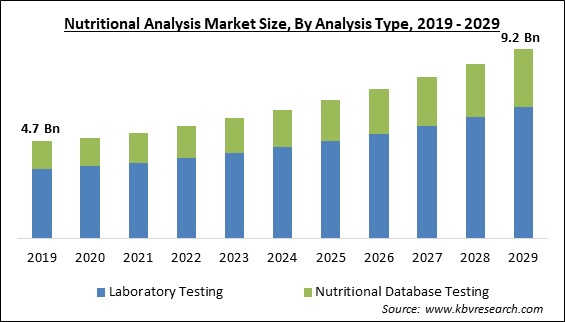

The Global Nutritional Analysis Market size is expected to reach $9.2 billion by 2029, rising at a market growth of 7.9% CAGR during the forecast period.

Nutritional analysis is performed to check the content of proteins, carbs, lipids, vitamins, minerals, sodium, and other ingredients to develop nutritional labeling on the product packaging's back. This analysis informs consumers of the number of micronutrients and macronutrients in the food products they buy, enabling them to make better-educated food and beverage purchases. In addition, the nutritional value of the food offerings as a whole is analyzed rather than the specific ingredients included.

The method of nutritional analysis also aids in the precise identification of all of the individual nutrients contained in any given food item. Therefore, to guarantee that the food is in line with numerous national and international requirements, a nutritional analysis of the food being produced or marketed should be completed. The primary nutritional analysis indicators include calorie content, cholesterol, moisture, total dietary fiber, fat, sugar, and profile of vitamins and minerals.

In addition, the number of vitamins in various food products is tracked and examined using the vitamin profile. The various product categories that fall under the category of nutritional analysis include drinks, snacks, bakery and confectionary, meat and poultry, dressings & condiments, desserts and dairy, fruits & vegetables, edible fats & oils, baby foods, sauces and other product categories. The development of new products, the labeling of those products, and regulatory compliance are the goals of nutritional analysis. A careful application of adequate, accurate, and precise analytical methodologies is the first step in obtaining reliable information on the nutrient composition of meals, which is essential.

When selecting the best methodologies for the food composition database, every analyst considers three crucial factors. First, a preference for techniques suggested or adopted by international bodies like the Association of Official Analytical Chemists (AOAC). Second, a preference for techniques whose dependability has been proven by team investigations involving numerous laboratories on a national or international scale. Choosing approaches that can be applied to various food kinds and matrices rather than those solely targeted for particular foods.

The state of the community's health, generally, and particularly during this new pandemic, was greatly influenced by nutrition and metabolic problems like obesity and diabetes. The severity and prognosis of COVID-19 appeared to be greatly influenced by lifestyle, metabolic problems, and immunological status. This made it crucial to consider how lifestyle choices and adhering to clearly defined healthy meals would affect people during the pandemic. Since inadequate nutrition and a poor diet could seriously impair immunity and increase vulnerability to viral diseases like SARS-CoV-2, governments worldwide bolstered their food policies, accelerating the need for nutritional analysis. Therefore, the pandemic had a favorable impact on the market.

In recent years, several nutrition information formats and words conveying health advantages have arisen on food packaging to aid customer decision-making. Numerous research projects have been carried out to investigate the effects of nutritional information on product labels and consumer purchasing decisions for each product. These findings may aid in improving nutrition labeling by the food sector and in developing a unique and compelling framework for the mandated application of nutrition information to benefit consumers by the governments. Therefore, the perception of transparency among consumers concerning food goods supports the demand for nutritional analysis, which supports the market's growth.

The quick industrialization of the food and beverage industry, raising the demand for nutrition analysis. The market for nutritional analysis in emerging nations is correlated with rapid industrialization, flourishing food trade, increased demand for better water quality, and expanding regulatory attention on consumer wellbeing. These have resulted in the environment and food safety laws being enforced with increased rigor. In addition, people are more conscious of food contamination due to rising industrialization in places. Implementing several food safety laws, therefore, promotes the expansion of the market.

International organizations like the World Bank, FAO, and WHO do not assist these developing nations. The existence and implementation of regulations governing the nutritional labeling of products significantly impact the market for nutritional analysis. However, political will determines how important and well these laws and regulations are implemented. Food manufacturers are unwilling to spend time and money on such studies because labeling is not required in these nations, so nutritional analysis testing businesses there do not do well. Thus, the nutritional analysis market cannot expand due to a lack of infrastructure and resources for food regulation.

Based on analysis type, the nutritional analysis market is categorized into laboratory testing and nutritional database testing. The laboratory testing segment recorded the maximum revenue share in the nutritional analysis market in 2022. The laboratory testing of food involves two key aspects. An in-depth analysis of the components that make up food products, as well as an estimation of the nutritional value of such products based on their chemical make-up, is what is referred to as an analysis of the constituent parts. This method is widely used to determine the exact nutritional benefits of packaged and processed products, hence supporting the segment's growth.

On the basis of product type, the nutritional analysis market is divided into bakery & confectionary, snacks, dairy, meat products, and others. The snacks segment recorded a significant revenue share in the nutritional analysis market in 2022. The snack category encompasses a variety of products, including popcorn, wafers, puffs, chips, crackers, and other similar items. The food items offered are characterized by their rich and appetizing flavors, achieved through diverse spice blends and flavor combinations, resulting in unique taste profiles. The popularity of snacks among consumers has increased production volumes, resulting in a higher demand for nutritional analysis.

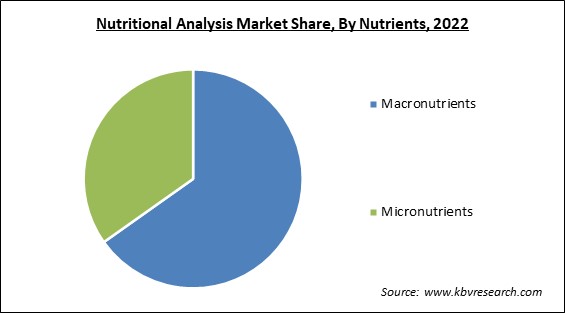

Based on nutrients, the nutritional analysis market is segmented into macronutrients and micronutrients. The micronutrients segment garnered a remarkable growth rate in the nutritional analysis market in 2022. The body requires micronutrients, minor types of nutrients, to function normally. The essential components required by the body comprise minerals, vitamins, and other chemical compounds. There is a growing importance of micronutrient consumption, which has led to an increase in demand for nutritional analysis of these nutrients.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 5.5 Billion |

| Market size forecast in 2029 | USD 9.2 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 7.9% from 2023 to 2029 |

| Number of Pages | 207 |

| Number of Table | 350 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Analysis Type, Nutrients, Product Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

On the basis of region, the nutritional analysis market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment procured the highest revenue share in the nutritional analysis market in 2022. The market in the North America region is experiencing growth due to increasing consumer demand for convenience food, functional food, on-the-go packaged food, and meal replacement food products. This demand has prompted food manufacturers to focus on producing accurate nutritional information on their food packaging to meet consumer needs.

Free Valuable Insights: Global Nutritional Analysis Market size to reach USD 9.2 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include SGS S.A., TTÜV Nord GroupV Nord Group, Eurofins Scientific SE, Intertek Group PLC, Microbac Laboratories, Inc., Compu-Food Analysis, Inc., Pat-Chem Laboratories LLC, ALS Limited, Lifeasible, Inc., and Opal Research And Analytical Services.

By Analysis Type

By Nutrients

By Product Type

By Geography

The Market size is projected to reach USD 9.2 billion by 2029.

Rising implementation of strict rules by regulatory bodies are driving the Market in coming years, however, Lack of resources and infrastructure for food control in emerging and underdeveloped nations restraints the growth of the Market.

SGS S.A., TTÜV Nord GroupV Nord Group, Eurofins Scientific SE, Intertek Group PLC, Microbac Laboratories, Inc., Compu-Food Analysis, Inc., Pat-Chem Laboratories LLC, ALS Limited, Lifeasible, Inc., and Opal Research And Analytical Services.

The Macronutrients segment acquired maximum revenue share in the Global Nutritional Analysis Market by Nutrients in 2022 thereby, achieving a market value of $5.7 billion by 2029.

The Bakery & Confectionery segment is leading the Global Nutritional Analysis Market by Product Type in 2022 thereby, achieving a market value of $2.7 billion by 2029.

The North America market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $3.2 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.