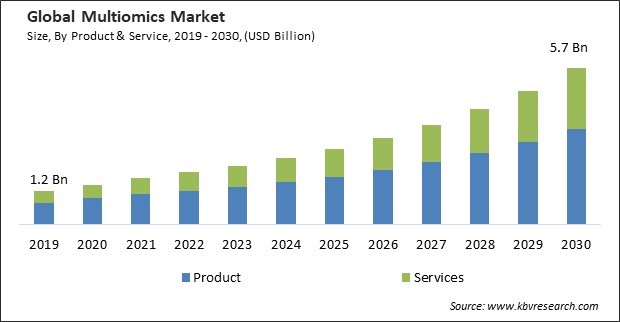

The Global Multiomics Market size is expected to reach $5.7 billion by 2030, rising at a market growth of 15.0% CAGR during the forecast period.

Metabolomics aids is understanding how individuals metabolize drugs, which is critical for precision medicine. Thus, Metabolomics segment acquired $215 million in 2022. It can predict drug responses and identify potential adverse reactions, leading to optimized therapeutic strategies. Therefore, these factors will propel the expansion of the metabolomics segment in the upcoming years. Discovering biomarkers linked to many diseases, such as cancer, cardiovascular disease, diabetes, and neurological problems, has become much easier with metabolomics. The identification of disease-specific metabolites holds promise for early diagnosis and personalized treatment.

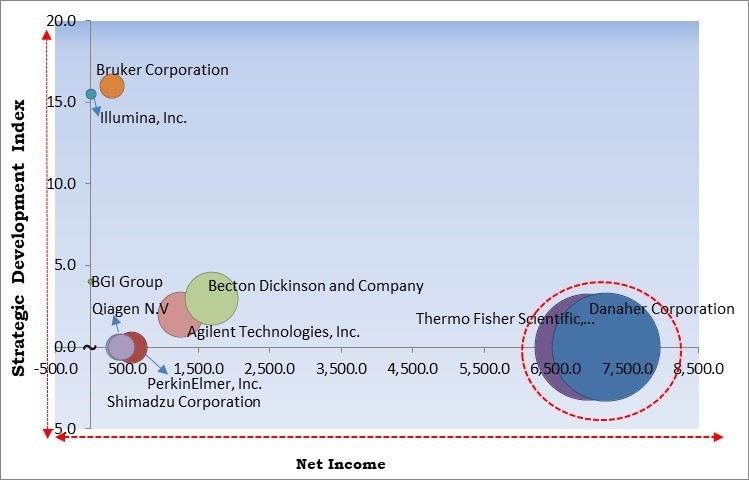

The major strategies followed by the market participants are Partnerships, Collaborations & Agreements as the key developmental strategy to keep pace with the changing demands of end users. For instance, In January, 2023, Bruker Corporation partnered with Biognosys AG. Under this partnership, both companies would create unique synergies between Biognosys’ versatile offerings of proprietary proteomics services, software, and kits, and Bruker’s pioneering timsTOF platform. Additionally, In November, 2022, BGI Group signed an agreement with the University of Pécs to launch a joint laboratory in Hungary. Additionally, this world-class facility would hasten the development of genomic sequencing and clinical diagnostic services.

Based on the Analysis presented in the KBV Cardinal matrix; Danaher Corporation and Thermo Fisher Scientific, Inc. are the forerunners in the Market. Companies such as Bruker Corporation, Illumina, Inc. and Becton Dickinson and Company are some of the key innovators in the Market. In January, 2022, Illumina, Inc. partnered with SomaLogic, a protein biomarker discovery and clinical diagnostics company. This partnership aimed to hasten the rapidly growing high throughput sector of the proteomics market.

High-throughput omics technologies have substantially reduced the cost of data generation. This cost-effectiveness has democratized access to multiomics research, making it more affordable for a wider range of researchers, institutions, and companies. As a result, more players are entering the market, fostering innovation and competition. This level of granularity is critical for identifying potential biomarkers and therapeutic targets. The lowered barriers to entry have fostered a thriving ecosystem of start-ups and companies specializing in omics technologies and services. These factors are expected to boost the demand in the future.

The emphasis on personalized medicine encourages healthcare providers and researchers to utilize multiomics technologies to a greater extent. This includes genomics, transcriptomics, proteomics, and metabolomics, which provide comprehensive insights into an individual's molecular and genetic makeup. This increased utilization leads to greater demand for multiomics services and solutions. Multiomics data can provide a detailed understanding of a patient's genetic predispositions, biomarker profiles, and disease risks. This integration boosts the demand for multiomics technologies and services. The demand for these data in personalized medicine has created opportunities for innovative start-ups and established companies to provide specialized services and technologies. Thus, these factors will drive the expansion of the market in the upcoming years.

Data sharing is vital for scientific collaboration and the advancement of multiomics research. However, the need to protect patient privacy and comply with regulations can limit the extent to which data can be shared. This may hinder collaborative research efforts and restrict the availability of multiomics datasets. Regulatory changes can be frequent and unpredictable. Organizations in this market must continuously monitor and adapt to evolving regulations, which can introduce uncertainty into their operations. Regulatory shifts can necessitate changes in data handling, research methodologies, and business models. These factors are expected to limit the growth of this market in the coming years.

On the basis of type, the market is divided into single-cell multiomics and bulk multiomics. The bulk multiomics segment recorded the maximum revenue share in the market in 2022. The availability of sophisticated bioinformatics tools and data integration platforms has facilitated the analysis and interpretation of bulk multiomics data. Researchers can now perform cross-omics analyses with relative ease, identifying correlations and patterns across different data types. Bulk multiomics plays a pivotal role in the advancement of precision medicine. By analyzing an individual's multiomics profile, clinicians can tailor treatments to their unique molecular characteristics. This approach holds significant promise for improving patient outcomes and reducing adverse effects. Owing to these factors, there will be an increased demand in the bulk multiomics segment.

Based on product & service, the market is segmented into products and services. In 2022, the services segment garnered a significant revenue share in the market. The continued development of high-throughput omics technologies has made generating vast amounts of data possible. However, analyzing this data requires specialized expertise, leading to a greater reliance on services offered by dedicated providers. Multiomics data is inherently complex, with a multitude of variables and interactions. The interpretation of this data demands sophisticated bioinformatics and computational tools, creating a niche for service providers to offer data analysis and interpretation solutions. These factors are expected to propel the demand in the services segment.

The product segment is further subdivided into instruments, consumables, and software. In 2022, the instruments subsegment procured the highest revenue share in the market. Next-generation sequencing (NGS) platforms have witnessed remarkable advancements in sequencing capacity, read length, and data quality. These improvements have led to increased adoption of NGS for genomics and transcriptomics studies. Mass spectrometry technology has become more sensitive and capable of analyzing a broader range of molecules. This has expanded its use in proteomics and metabolomics research.

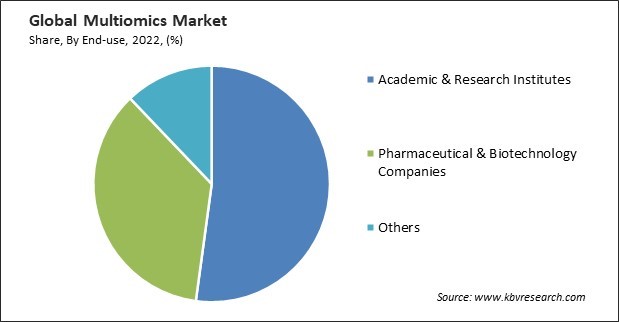

On the basis of end-use, the market is divided into academic & research institutes, pharmaceutical & biotechnology companies, and others. The academic and research institutes segment recorded the maximum revenue share in the market in 2022. Academic and research institutes have benefited from the growing availability of research funding from government sources and private foundations. Funding agencies recognize the importance of multiomics research in advancing scientific knowledge and addressing complex health and environmental challenges. This increased funding has allowed academic and research institutions to expand their multiomics research initiatives.

Based on platform, the market is segmented into genomics, transcriptomics, proteomics, metabolomics, and integrated omics platforms. The proteomics segment procured a promising growth rate in the market in 2022. Proteomic platforms can determine the functions of proteins, which is crucial for understanding their roles in various biological processes. This information is valuable for basic research and applied sciences. Proteomic analysis can also help in identifying proteins that can serve as therapeutic targets. In industries such as biopharmaceuticals, proteomic platforms are used for quality control to ensure the consistency and safety of products.

On the basis of application, the market is divided into cell biology, oncology, neurology, and immunology. The cell biology segment recorded the maximum revenue share in the multiomics market in 2022. Cell biology, in conjunction with multiomics, plays a crucial role in cancer research and precision oncology. Researchers can now profile the molecular alterations in cancer cells in unprecedented detail. This has led to the discovery of new drug targets, the development of targeted therapies, and the identification of resistance mechanisms. It also contributes to personalizing cancer treatment regimens, improving patient outcomes. Owing to these factors, the demand will rise in the segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 1.9 Billion |

| Market size forecast in 2030 | USD 5.7 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 15% from 2023 to 2030 |

| Number of Pages | 381 |

| Number of Table | 633 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Product & Service, Platform, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment procured the highest revenue share in the market in 2022. North America boasts a robust and well-funded research ecosystem with leading universities, academic institutions, and research organizations at the forefront of multiomics studies. These institutions have been driving research, publishing groundbreaking findings, and attracting substantial research funding. Thus, there will be increased demand in the segment.

Free Valuable Insights: Global Multiomics Market size to reach USD 5.7 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Thermo Fisher Scientific, Inc, Illumina, Inc., Danaher Corporation, PerkinElmer, Inc., Bruker Corporation, Qiagen N.V., Agilent Technologies, Inc., BGI Group, Becton, Dickinson, and Company, Shimadzu Corporation

By Type

By Product & Service

By End-use

By Platform

By Application

By Geography

This Market size is expected to reach $5.7 billion by 2030.

Rising advancements in high-throughput omics technologies are driving the Market in coming years, however, Continually evolving regulatory environment of multiomics restraints the growth of the Market.

Thermo Fisher Scientific, Inc, Illumina, Inc., Danaher Corporation, PerkinElmer, Inc., Bruker Corporation, Qiagen N.V., Agilent Technologies, Inc., BGI Group, Becton, Dickinson, and Company, Shimadzu Corporation

The expected CAGR of this Market is 15.0% from 2023 to 2030.

The Product segment gained the highest revenue in the Market by Product & Service in 2022; thereby, achieving a market value of $3.5 billion by 2030.

The North America region dominated the Market by Region in 2022; and would continue to be a dominant market till 2030, thereby, achieving a market value of $2.6 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.