The Latin America, Middle East and Africa Medical Tubing Market would witness market growth of 9.7% CAGR during the forecast period (2024-2031). In the year 2027, the LAMEA market's volume is expected to surge to 384.31 kilo tonnes, showcasing a growth of 6.5% (2024-2031).

Silicone medical tubing is a prominent product type within the Market, valued for its exceptional properties and diverse applications in the healthcare industry. Silicone tubing offers superior biocompatibility, flexibility, and durability, making it suitable for various medical procedures such as fluid transfer, drainage, and peristaltic pumping. Thus, the Brazil market would utilize 12.48 kilo tonnes of Silicone medical tubing by 2031.

The Brazil market dominated the LAMEA Medical Tubing Market, by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $393.9 Million by 2031. The Argentina market is showcasing a CAGR of 10.9% during (2024 - 2031). Additionally, The UAE market would register a CAGR of 9.3% during (2024 - 2031).

Chronic diseases such as diabetes, cardiovascular diseases, respiratory disorders, and kidney diseases require ongoing treatment, management, and monitoring. Children, adults, and seniors are all at risk for noncommunicable diseases, which include bad diets, physical inactivity, tobacco smoke exposure, harmful alcohol use, and air pollution. It is integral to devices used to manage these conditions, including insulin pumps, infusion pumps, catheters for dialysis, and continuous positive airway pressure (CPAP) machines for sleep apnea. Respiratory support devices are commonly necessary for patients with chronic respiratory disorders like cystic fibrosis and chronic obstructive pulmonary disease (COPD).

With growing concerns about healthcare-associated infections (HAIs), there is an increased focus on incorporating antimicrobial properties into medical tubing to reduce the risk of microbial contamination. Additionally, advancements in sterilization methods, such as electron beam (e-beam) and gamma irradiation, enhance medical tubing products' safety and shelf life. There is a growing trend toward adopting single-use and disposable medical tubing to minimize the risk of cross-contamination, improve efficiency, and reduce costs associated with reprocessing and sterilization. Disposable tubing also eliminates the need for complex cleaning and validation processes, streamlining workflow in healthcare settings.

Saudi Arabia is witnessing significant growth in healthcare infrastructure, with the construction of new hospitals, medical centers, and specialty clinics. Rising healthcare spending in Saudi Arabia supports expanding healthcare services, medical technologies, and equipment procurement. Saudi Arabia is emphasizing preventive healthcare initiatives, health promotion, and wellness programs to address public health challenges and reduce the burden of chronic diseases. According to the International Trade Administration, in 2023, Saudi Arabia spent $50.4 billion on healthcare and social development, 16.96 percent of its 2023 budget, and education's second largest line item. Thus, due to these aspects, the market will expand across the LAMEA region in upcoming years.

Free Valuable Insights: The Worldwide Medical Tubing Market is Projected to reach USD 19.1 Billion by 2031, at a CAGR of 8.2%

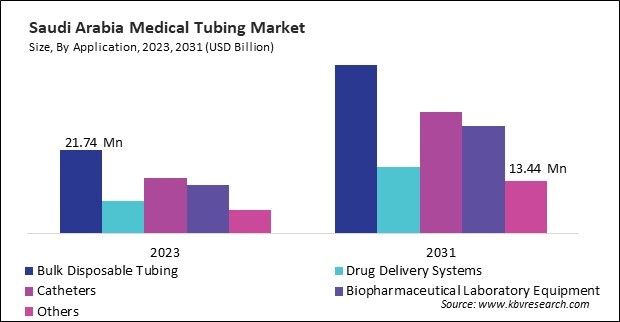

Based on Application, the market is segmented into Bulk Disposable Tubing, Drug Delivery Systems, Catheters, Biopharmaceutical Laboratory Equipment, and Others. Based on Product Type, the market is segmented into Polyvinyl Chloride, Silicone, Polyolefins, Polyimide, Polycarbonates, Polytetrafluoroethylene (PTFE), Fluorinated Ethylene Propylene (FEP), and Others. Based on countries, the market is segmented into Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria, and Rest of LAMEA.

By Application (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Product Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Country (Volume, Kilo Tonnes, USD Billion, 2020-2031)

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.