The Europe Medical Tubing Market would witness market growth of 7.9% CAGR during the forecast period (2024-2031). In the year 2021, the Europe market's volume surged to 733.19 kilo tonnes, showcasing a growth of 19.3% (2020-2023).

Polyvinyl chloride (PVC) medical tubing is a widely used product type in the Market, valued for its affordability, versatility, and ease of processing. PVC tubing is prevalent in medical applications due to its excellent chemical resistance, flexibility, and transparency. Its ability to withstand a wide range of temperatures and sterilization methods, including steam autoclaving and ethylene oxide, makes it suitable for various healthcare settings. Therefore, the Germany market would utilize 201.24 kilo tonnes of Polyvinyl chloride (PVC) medical tubing by 2031.

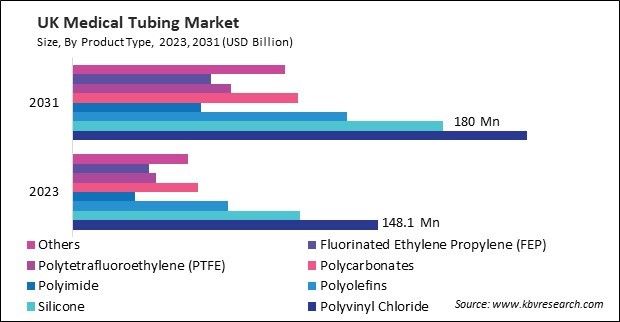

The Germany market dominated the Europe Medical Tubing Market, by Country in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $1,159 Million by 2031. The UK market is registering a CAGR of 7% during (2024 - 2031). Additionally, The France market would showcase a CAGR of 8.7% during (2024 - 2031).

Healthcare providers increasingly seek specialized tubing solutions tailored to specific applications and patient needs. Customized tubing, including materials, dimensions, and features such as antimicrobial properties or color-coding, is gaining popularity to enhance performance and patient comfort. The shift towards minimally invasive surgical techniques drives demand for advanced medical tubing to facilitate these procedures. Tubing with improved flexibility, kink resistance, and maritime capabilities is in high demand for applications such as endoscopy, laparoscopy, and robotic surgery.

There is a growing emphasis on the use of biocompatible materials in medical tubing to minimize the risk of adverse reactions and enhance patient safety. Materials such as silicone, polyurethane, and thermoplastic elastomers (TPEs) are increasingly favored for their biocompatibility, flexibility, and durability. Advances in extrusion technology, additive manufacturing (3D printing), and laser processing drive innovation in medical tubing manufacturing. 3D printing technology enables the customization and personalization of medical tubing products to meet the specific needs of patients and healthcare providers.

European healthcare policies and strategies for an aging population emphasize addressing the healthcare requirements of older people, fostering healthy aging, and improving the overall quality of life for seniors. Technological advancements in medical tubing materials, manufacturing processes, and product design have led to innovative tubing solutions catering to the specific needs of elderly patients in Europe. In Europe, home healthcare services and medical technologies support aging-in-place efforts, encouraging older adults to remain in their homes and communities. Thus, all these factors will uplift the regional market’s expansion in the coming years.

Free Valuable Insights: The Global Medical Tubing Market will Hit USD 19.1 Billion by 2031, at a CAGR of 8.2%

Based on Application, the market is segmented into Bulk Disposable Tubing, Drug Delivery Systems, Catheters, Biopharmaceutical Laboratory Equipment, and Others. Based on Product Type, the market is segmented into Polyvinyl Chloride, Silicone, Polyolefins, Polyimide, Polycarbonates, Polytetrafluoroethylene (PTFE), Fluorinated Ethylene Propylene (FEP), and Others. Based on countries, the market is segmented into Germany, UK, France, Russia, Spain, Italy, and Rest of Europe.

By Application (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Product Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Country (Volume, Kilo Tonnes, USD Billion, 2020-2031)

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.