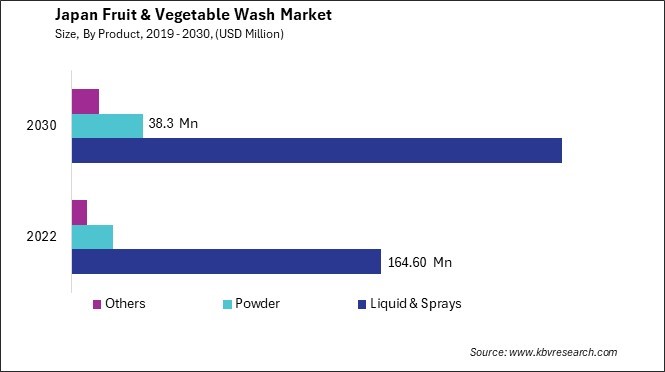

The Japan Fruit & Vegetable Wash Market size is expected to reach $313.6 Million by 2030, rising at a market growth of 6.2% CAGR during the forecast period. In the year 2022, the market attained a volume of 178.6 Tonnes, experiencing a growth of 5.1% (2019-2022).

The fruit & vegetable wash market in Japan has witnessed significant growth in recent years, driven by increasing consumer awareness regarding food safety and hygiene. As Japanese consumers become more health-conscious, there is a growing preference for products that promote cleaner and safer eating habits. In recent years, the industry has also witnessed the emergence of natural and eco-friendly fruit & vegetable wash products, reflecting a broader shift towards sustainability and environmental consciousness. Japanese consumers increasingly seek products free from harsh chemicals and artificial additives, opting for natural ingredients such as vinegar, citric acid, and plant-based surfactants.

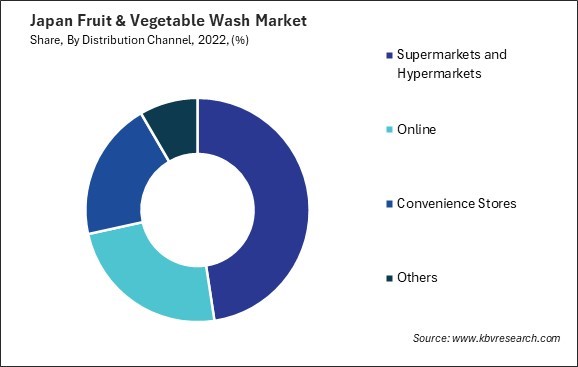

Moreover, the rise of e-commerce platforms has expanded the accessibility of fruit & vegetable wash products, enabling consumers to purchase them online conveniently. This has opened up new avenues for industry growth, particularly among urban consumers with limited access to traditional brick-and-mortar stores. Online retailers offer a wide range of product options, allowing consumers to compare prices, read reviews, and make informed purchasing decisions from their homes.

According to the International Trade Administration, in 2022, e-commerce sales of goods grew by 8.6% compared to the previous year, estimating the total e-commerce industry at USD 188.1 billion. As consumers in Japan continue to embrace the convenience and accessibility offered by e-commerce platforms, industries are adapting to meet evolving demands. This trend extends even to niche industries, such as Japan's fruit & vegetable wash market, where innovative solutions are emerging to cater to the growing consumer preference for cleanliness and food safety.

The COVID-19 pandemic has had a profound impact on Japan's fruit & vegetable wash market, as consumers have become increasingly concerned about the safety of their food in light of the pandemic. The outbreak has heightened awareness of the importance of proper food hygiene practices, leading to a surge in demand for fruit and vegetable wash products. As the pandemic continues to shape consumer behavior, Japan's fruit & vegetable wash market is poised to experience continued growth, driven by ongoing concerns surrounding food safety and hygiene.

The fruit & vegetable wash market in Japan has witnessed a notable surge in the presence of convenience stores offering such products. Japanese consumers' heightened awareness of food safety and hygiene has fueled the demand for fruit and vegetable wash products. With increasing concerns about pesticide residues, contaminants, and foodborne illnesses, consumers actively seek solutions to minimize risks associated with consuming unwashed produce. Convenience stores, being ubiquitous and easily accessible, capitalize on this growing awareness by stocking a variety of fruit and vegetable wash options, catering to the needs of health-conscious individuals.

Moreover, Japan's aging population and busy urban demographics further underscore the significance of convenience in consumer purchasing decisions. As individuals seek ways to simplify their daily routines without compromising health and safety, the availability of fruit & vegetable wash products in conveniently located stores resonates strongly with their lifestyle preferences.

According to the Japan Franchise Association, the notable surge in convenience stores in Japan has been remarkable, reaching 57,544 by 2021. With Japan's population hovering around 125 million, this surge equates to an impressive ratio of approximately one convenience store for every 2,170 people. As these stores continue to expand their offerings, including fresh produce sections, there has been a rising interest in products like fruit & vegetable washes. This trend reflects a growing awareness of hygiene and food safety among consumers, presenting a lucrative opportunity for businesses operating in Japan's fruit & vegetable wash market.

The convenience store sector in Japan is renowned for its innovation and adaptability to consumer preferences. Recognizing the rising demand for convenient yet effective cleaning solutions for fresh produce, convenience store chains have swiftly responded by incorporating fruit and vegetable wash products into their offerings. Thus, convenience stores in Japan are increasingly stocking fruit & vegetable wash products to meet the demand for convenient and effective cleaning solutions.

In recent years, Japan has witnessed a growing trend towards healthier eating habits, particularly in the realm of fruit & vegetable consumption. This shift in dietary preferences has propelled the fruit & vegetable wash market into prominence as Japanese consumers become increasingly aware of the importance of food safety and hygiene. One of the driving forces behind this trend is the rising concern over pesticide residues and contaminants in produce. Consumers in Japan are now more cautious about the potential health risks associated with consuming fruits and vegetables that may carry harmful chemicals.

Moreover, with the increasing emphasis on overall wellness and preventive healthcare, many Japanese consumers are prioritizing fresh and organic produce in their diets. This has further bolstered the demand for fruit & vegetable wash products as individuals seek to maximize the nutritional benefits of their food choices while minimizing exposure to potentially harmful substances.

In response to these evolving consumer preferences, manufacturers in Japan are innovating and diversifying their product offerings to cater to different needs and preferences. This includes the development of organic and natural-based wash solutions, as well as products that are specifically formulated to target pesticides and microbial contaminants. Hence, Japan's growing focus on food safety and wellness is driving increased demand for fruit & vegetable wash products, prompting manufacturers to diversify their offerings to meet evolving consumer preferences.

The fruit & vegetable wash market in Japan has grown significantly in recent years as consumers increasingly prioritize food safety and hygiene. One prominent player in the Japanese fruit & vegetable wash market is Kirei Kirei. Known for its line of household cleaning products, Kirei Kirei has capitalized on its reputation for reliability and safety to introduce a fruit & vegetable wash specifically tailored to Japanese consumers. With a focus on natural ingredients and gentle yet effective cleaning formulas, Kirei Kirei has garnered a loyal following among households seeking to ensure the cleanliness of their produce.

Another key player in the Japanese fruit & vegetable wash market is Gekiyasu. As one of Japan's leading cleaning and hygiene products manufacturers, Gekiyasu has leveraged its extensive research and development capabilities to create a fruit & vegetable wash that meets the stringent standards of Japanese consumers. With an emphasizes convenience and affordability, Gekiyasu's product appeals to a wide range of customers looking for an easy and cost-effective way to clean their fruits & vegetables.

Additionally, companies like Pika Pika and Sawayaka offer innovative solutions in the fruit & vegetable wash market, catering to niche segments of consumers with unique preferences and requirements. Pika Pika, for example, specializes in eco-friendly cleaning products, appealing to environmentally conscious consumers who prioritize sustainability. Sawayaka, on the other hand, focuses on premium organic ingredients, targeting health-conscious individuals willing to pay a premium for the highest quality produce.

In recent years, Japan's fruit & vegetable wash market has also witnessed the entry of international players looking to capitalize on the growing demand for safe and clean food products. Companies like Ecover, a Belgian-based manufacturer of ecological cleaning products, have introduced their offerings to the Japanese industry, aiming to tap into the country's discerning consumer base. While facing stiff competition from established domestic brands, these international companies bring a wealth of experience and expertise to the global cleaning industry. Thus, Japan's fruit & vegetable wash market is characterized by intense competition and innovation as companies strive to meet consumers' evolving needs and preferences.

By Type

By End-user

By Product

By Distribution Channel

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.