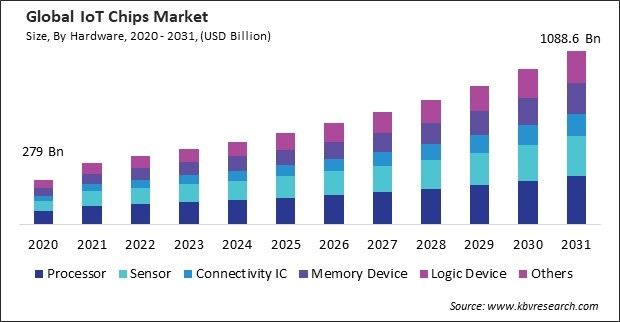

The Global IoT Chips Market size is expected to reach $1088.6 billion by 2031, rising at a market growth of 11.1% CAGR during the forecast period.

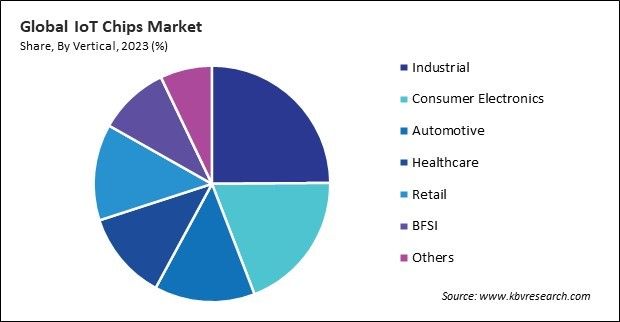

IoT chips play a crucial role in autonomous or self-driving vehicles by processing sensor data, running AI algorithms, and making real-time decisions to navigate the vehicle safely and efficiently. Consequently, the automotive segment would acquire nearly, 14% of the total market share by 2031. These chips power ADAS technologies that assist drivers in various aspects of vehicle operation, including lane-keeping assistance, adaptive cruise control, automatic emergency braking, and parking assistance.

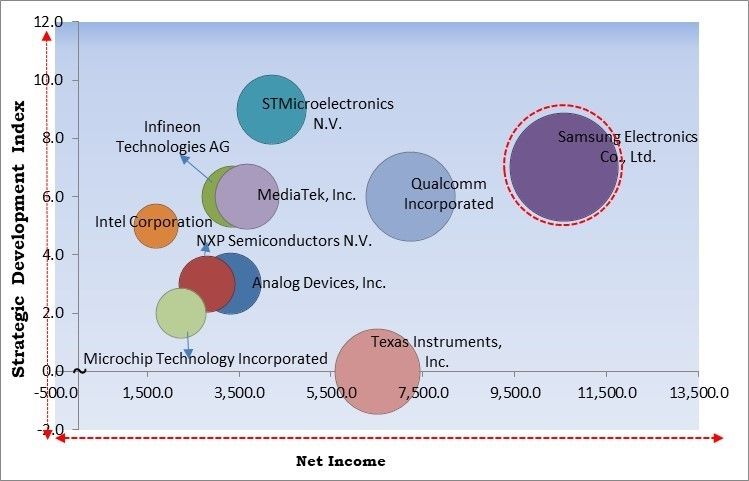

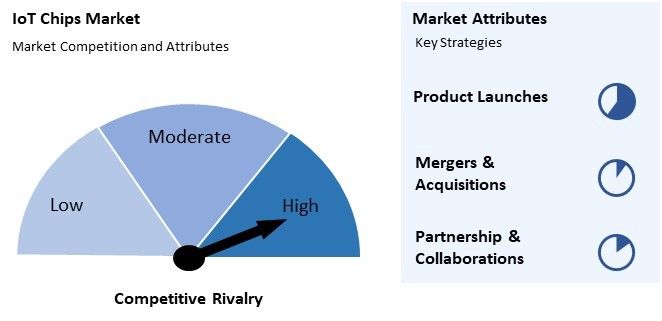

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, in April, 2024, Qualcomm Technologies unveiled new industrial and embedded AI platforms alongside a micro-power Wi-Fi SoC. The QCC730 Wi-Fi solution offers significant power savings for IoT products, while the RB3 Gen 2 Platform provides high-performance processing, on-device AI, and Wi-Fi 6E support for various applications like robots, drones, and connected cameras. The platform also integrates Qualcomm's AI Hub for optimized AI models. Moreover, in April, 2024, Infineon Technologies AG has unveiled its new PSOC Edge E8x MCU product family, designed to meet the highest certification level provided by the Platform Security Architecture (PSA) Certified program. The PSOC Edge E8x devices achieve PSA Certified Level 4 device certification by implementing an on-chip, hardware-isolated enclave for secured boot, key storage, and crypto operations. This robust embedded security certification ensures that IoT designers can develop edge applications with the highest levels of security, benefiting industries such as wearables, smart homes, printers, and payment terminals.

Based on the Analysis presented in the KBV Cardinal matrix; Samsung Electronics Co., Ltd. is the forerunner in the Market. In June, 2021, Samsung Electronics unveiled a range of new chipsets, including the third-generation mmWave Radio Frequency Integrated Circuit (RFIC) chip, the second-generation 5G modem System-on-Chip (SoC), and the Digital Front End (DFE)-RFIC integrated chip. These chipsets, compliant with 3GPP Rel.16 standards, will power Samsung’s next-generation 5G solutions, such as the 5G Compact Macro, Massive MIMO radios, and baseband units. Companies such as Qualcomm Incorporated, STMicroelectronics N.V., MediaTek, Inc. are some of the key innovators in Market.

The expansion of connected devices spans various industries and applications, including smart homes, smart cities, healthcare, manufacturing, agriculture, transportation, and retail. The rapid expansion of connected devices contributes to developing interconnected IoT ecosystems where devices, sensors, and platforms collaborate to gather and exchange data, automate processes, and enable intelligent decision-making. Therefore, the market is expanding significantly due to the rise in demand for connected devices.

Industry 4.0 fosters the adoption of smart manufacturing and automation technologies that leverage these chips to connect and control manufacturing equipment, robotics, and production systems. These chips embedded in sensors and connected devices enable continuous machine performance monitoring, detecting anomalies and deviations from normal operating conditions. Thus, because of the rapid expansion of Industry 4.0, the market is anticipated to increase significantly.

High deployment and maintenance costs can act as barriers to entry for SMEs looking to adopt IoT solutions. SMEs may lack the financial resources and expertise required to invest in costly IoT deployments, including hardware, software, integration, and ongoing maintenance. IoT solutions' total cost of ownership (TCO) encompasses deployment and maintenance costs and factors such as energy consumption, data storage, compliance, and scalability. Thus, high cost of deployment and maintenance can slow down the growth of the market.

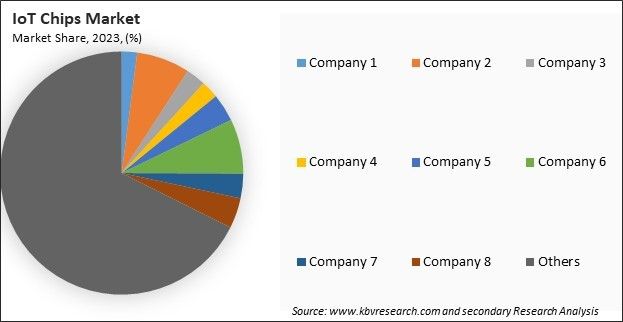

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

Challenges On the basis of hardware, the market is segmented into processor, sensor, connectivity IC, memory device, logic device, and others. The sensor segment covered a 23% revenue share in the market in 2023. Sensors serve as the primary data source in IoT ecosystems, capturing information about the physical environment, including temperature, humidity, pressure, motion, light, sound, etc. These sensors convert physical parameters into electrical signals that these chips can process and analyze, forming the foundation of data-driven decision-making and automation in IoT applications.

By vertical, the market is bifurcated into automotive, BFSI, retail, healthcare, consumer electronics, industrial, and others. The retail segment acquired a 13% revenue share in the market in 2023. These chips enable deploying smart retail solutions that leverage connected devices, sensors, and data analytics to optimize various aspects of the retail environment. For example, according to Invest India, the retail industry will reach $2 Trillion by 2032. These solutions include smart shelves, RFID tags, inventory management systems, smart checkout counters, and personalized shopping experiences enabled by IoT-enabled devices like beacons and digital signage.

Free Valuable Insights: Global IoT Chips Market size to reach USD 1088.6 billion by 2031

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the North America region led the market by generating 34% revenue share. North America is a hub for technological innovation, with leading semiconductor companies and IoT solution providers driving advancements in IoT chip technology. The smart home in North America is growing rapidly, fueled by the increasing popularity of smart home devices and home automation systems. The manufacturing sector in North America is embracing IIoT technologies to improve operational efficiency, optimize supply chain management, and enable predictive maintenance.

The competition in the market is intense, driven by factors like technological advancements, demand for connected devices, and the need for energy-efficient solutions. Key players such as Intel, Qualcomm and MediaTek compete by innovating in areas like processing power, connectivity options, and AI capabilities to capture market share and meet diverse industry needs.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 474.5 Billion |

| Market size forecast in 2031 | USD 1088.6 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 11.1% from 2024 to 2031 |

| Number of Pages | 270 |

| Number of Tables | 333 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Hardware, Vertical, Region |

| Country scope |

|

| Companies Included | Samsung Electronics Co., Ltd. (Samsung Group), STMicroelectronics N.V., Analog Devices, Inc., NXP Semiconductors N.V., Qualcomm Incorporated (Qualcomm Technologies, Inc.), Intel Corporation, MediaTek, Inc., Texas Instruments, Inc., Infineon Technologies AG and Microchip Technology Incorporated |

By Hardware

By Vertical

By Geography

This Market size is expected to reach $1088.6 billion by 2031.

Rise in demand for connected devices are driving the Market in coming years, however, High cost of deployment and maintenance restraints the growth of the Market.

Samsung Electronics Co., Ltd. (Samsung Group), STMicroelectronics N.V., Analog Devices, Inc., NXP Semiconductors N.V., Qualcomm Incorporated (Qualcomm Technologies, Inc.), Intel Corporation, MediaTek, Inc., Texas Instruments, Inc., Infineon Technologies AG and Microchip Technology Incorporated

The expected CAGR of this Market is 11.1% from 2024 to 2031.

The Processor segment led the Market by Hardware in 2023; thereby, achieving a market value of $307.9 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $361.6 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.