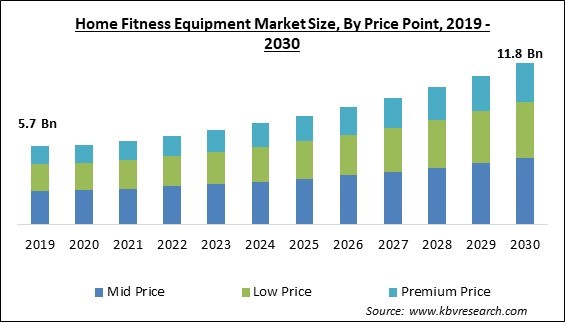

The Global Home Fitness Equipment Market size is expected to reach $11.8 billion by 2030, rising at a market growth of 7.9% CAGR during the forecast period.

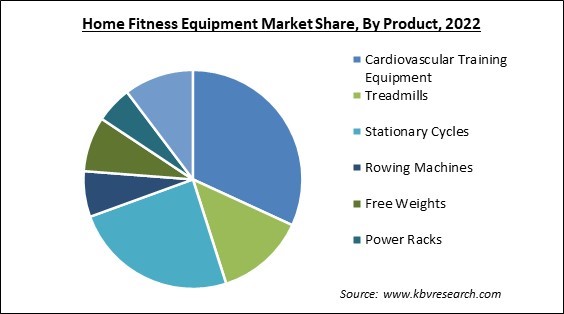

Treadmills are one of the most popular pieces of fitness apparatus for use at home. Therefore, Treadmills segment would capture approximately 1/5th share of the market by 2030. A treadmill is an exercise apparatus for jogging or strolling to maintain fitness. To remain competitive, treadmill manufacturers are introducing Internet of Things (IoT)-infused electronic treadmills with inventive new features. The rising segment expansion is a consequence of the growing number of fitness fanatics. Some of the factors impacting the market are increasing health consciousness among consumers, increasing adoption of an active lifestyle by obese individuals, and increased preference for alternative forms of exercise.

Home fitness equipment removes the hassle of commuting to a gym to use the apparatus and is highly cost-effective in the long term. Numerous innovations, such as the advent of applications that allow customers to select their trainers for online classes or home visits to satisfy the user's specific and customized fitness needs, such as bodybuilding, eventually occurred in this market segment. In addition, as consumer health awareness has increased, so has the demand for this apparatus, resulting in market expansion. The increasing rates of obesity in the urban population, caused by a fast-paced lifestyle and the consumption of unhealthy food, have increased the demand for residential fitness apparatus as people pay more attention to their health and fitness. This is mainly attributable to the growing awareness of the advantages of a healthy and active lifestyle among the obese population. Therefore, the market is predominantly driven by the rising health consciousness of individuals worldwide, product innovation, and home exercises.

However, one of the main factors inhibiting the growth of the market is the increasing popularity of other forms of exercise. Yoga's increasing popularity is due to its reputation as a therapy for the body and psyche. These alternative forms of exercises help in maintain the fitness targets of consumers without spending money on equipment, which is further an ideal case for consumers looking for saving money. Consequently, the increase in alternative forms of exercise may limit the demand for residential fitness apparatus throughout the forecast period.

Based on price point, the market is segmented into low price, mid price, and premium price. In 2022, the premium price segment accounted for a sizeable revenue share of the market. Typically, high-end home fitness equipment includes cutting-edge technology, like virtual training programs, interactive touchscreens, personalized exercises, and advanced monitoring capabilities. These features make the workout experience more immersive and engaging. Some expensive fitness equipment accommodates specialized fitness disciplines or exercise techniques that may not be easily accessible with less expensive options.

Based on product, the market is segmented into cardiovascular training equipment, treadmills, stationary cycles, rowing machines, elliptical & others, free weights, and power racks. The market segment with the highest revenue share in 2022 was cardiovascular training equipment. Strength and cardiovascular training equipment are increasing their proportion of the market, dominated by cardiovascular equipment. This expansion is due to the increased use of the apparatus, which aids patients with diabetes, hypertension, and cardiac disease to live healthier lives.

Based on the distribution channel, the market is segmented into dealers, online, direct distribution, retailers, and others. In 2022, retailers represented a substantial portion of the market's revenue. The availability of affordable home fitness apparatus makes it accessible to more consumers. Frequently, third-party retailers offer a variety of price points to accommodate various budgets. Third-party retailers often stock various technologically sophisticated products to appeal to a broad spectrum of customers, driving this market segment's expansion.

Based on end user, the market is segmented into households, apartments, and gyms in apartments. The gym in apartment segment dominated the market in 2022 with the highest revenue share. This is because people increasingly order and install home fitness equipment and prefer apartments with gym facilities or those that provide an array of options in a contactless environment. And due to the pandemic, customer engagement has increased in this segment. This segment's expansion has also enabled online retailers to expand their product selection and availability.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 6.5 Billion |

| Market size forecast in 2030 | USD 11.8 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 7.9% from 2023 to 2030 |

| Number of Pages | 306 |

| Number of Table | 500 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Price Point, Product, Distribution Channel, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America led this market in 2022, thereby registering the highest revenue share. This is a result of the increased acceptability of activities for physical wellness, weight management, improving physical stamina, and developing muscular strength, in addition to the expanding health consciousness of consumers. In addition to a growing obese population and rising health concerns, the region's market is driven by other significant factors.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Icon Health & Fitness, Inc. (IHF Holding, Inc.), Johnson Health Tech Co., Ltd, Amer Sports, Core Health & Fitness, LLC, Nautilus, Inc., Technogym S.p.A., Hoist Fitness Systems, PureGym Limited (Pinnacle Bidco plc), Hammer Sport AG, and Rouge Fitness

Free Valuable Insights: Global Home Fitness Equipment Market size to reach USD 11.8 Billion by 2030

By Price Point

By Product

By Distribution Channel

By End User

By Geography

This Market size is expected to reach $11.8 billion by 2030.

Increasing adoption of an active lifestyle by obese individuals are driving the Market in coming years, however, Increased preference for alternative forms of exercise restraints the growth of the Market.

Icon Health & Fitness, Inc. (IHF Holding, Inc.), Johnson Health Tech Co., Ltd, Amer Sports, Core Health & Fitness, LLC, Nautilus, Inc., Technogym S.p.A., Hoist Fitness Systems, PureGym Limited (Pinnacle Bidco plc), Hammer Sport AG, and Rouge Fitness

The Dealers segment acquired maximum revenue share in the Market by Distribution Channel in 2022; thereby, achieving a market value of $3.7 billion by 2030.

The Mid Price segment is leading the Market by Price Point in 2022; thereby, achieving a market value of $4.9 billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $4.2 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.