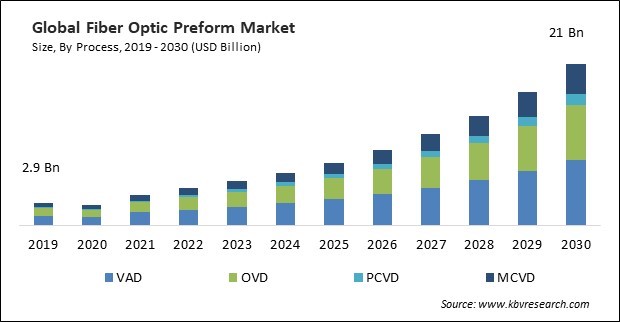

The Global Fiber Optic Preform Market size is expected to reach $21 billion by 2030, rising at a market growth of 20.5% CAGR during the forecast period.

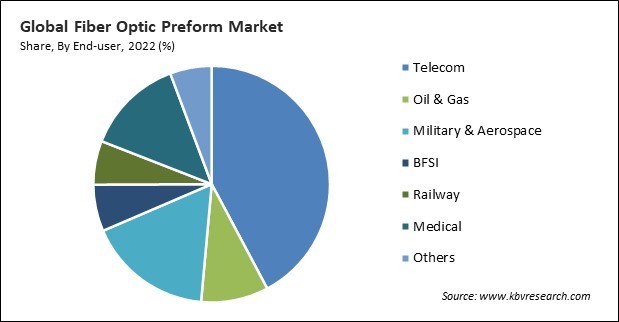

As 5G services progress towards commercialization, telecommunications service providers are placing significant importance on installing more recent 5G base stations to gain a competitive advantage in the marketplace. Therefore, Telecom segment generated $2019.3 million revenue in the market in 2022. The extensive implementation of 5G technology in developed and developing countries would create advantageous prospects for fiber optics suppliers. The optical fibers can swiftly transmit a substantial volume of data between two distinct locations.

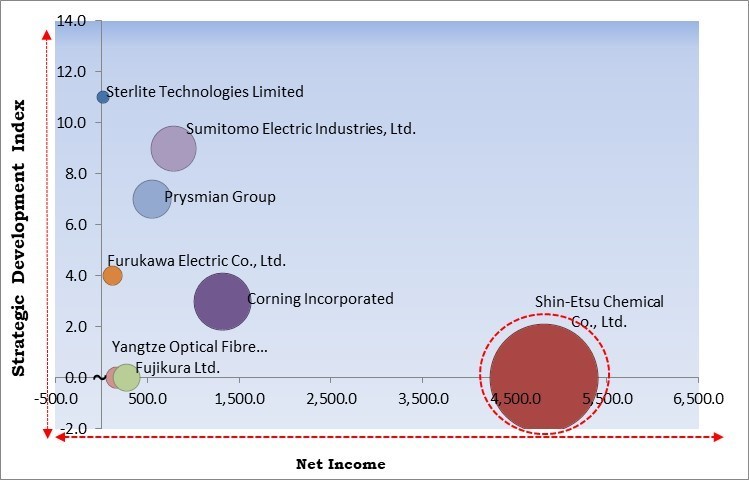

The major strategies followed by the market participants are Product Launches and Partnerships, Collaborations & Agreements as the key developmental strategy to keep pace with the changing demands of end users. For instance, In January, 2023, Prysmian launched 864-fiber version of its Sirocco HD microduct cables. The new Sirocco HD microduct cables feature Prysmian's BendBright-A2 200-µm single-mode bend-insensitive fiber that reduces the diameter of the cable. The product is designed to be installed into microducts. Moreover, In October, 2022, STL revealed multicore fibre and cable. The new product features Quad-core fibre connectivity and Quantum communication feasibility and reduces Carbon footprint.

Based on the Analysis presented in the KBV Cardinal matrix; Shin-Etsu Chemical Co., Ltd. is the major forerunner in the Market. Companies such as Sterlite Technologies Limited, Corning Incorporated and Sumitomo Electric Industries, Ltd. are some of the key innovators in the Market. In February, 2019, Sumitomo Electric Industries teamed up with Optoscribe, a supplier of 3D glass-based integrated photonics components. The collaboration is aimed at addressing the performance challenges faced by datacom and telecom applications and for further deployment of multicore fiber and related technologies.

The pandemic's impact on work habits and the rise of cloud-based technology have driven a sharp rise in the need for data centers. More land, buildings, air conditioning units, and electricity are needed to sustain the operational infrastructure around the clock. The factors driving the need for data centers include the rising need for high bandwidth capacity and data, mainly due to the rise in smartphone users, the quick adoption of cloud computing and digitization by businesses, and operational and development needs. Consequently, the market is growing because of the increased requirement for data centers.

The Internet has become a vital component of contemporary culture, influencing its numerous dimensions. Massive growth in demand for access to the Internet has ensued from the pervasive adoption of smartphones, Internet of Things (IoT) devices, and various other technological innovations. In the coming years, it is anticipated that virtually everyone, irrespective of location, will have access to the Internet. Due to the subsequent exponential increase in data consumption, a dependable communication infrastructure will be required to accommodate the growing needs. The proliferation of data will spur the installation of additional fiber optic cables and subsystems, thereby propelling the growth of the market.

Crews may be hindered in their efforts to bore or excavate trenches where the fiber has to be buried by rugged terrain. The installation process of fiber-optic cables frequently necessitates the utilization of excavations or boring-to-lay cables across extensive distances. This can be complex, particularly when confronted with varied topography, including congested urban areas, mountainous regions, or undersea installations. Consequently, the obstacles associated with fiber optic installation impede the expansion of the market.

Based on process, the market is divided into OVD, VAD, PCVD, and MCVD. The VAD segment procured the highest revenue share in the market in 2022. Vapor axial deposition (VAD) can manufacture superior quality preforms that exhibit low attenuation and remarkable transmission characteristics. VAP is the predominant technique utilized in the production of fiber forms. The process entails the disposal of diverse substances, including silica, onto a rotating shaft, which is subsequently ejected into the ultimate optical fiber. This technique has emerged as an extraordinary technique for mass-producing large glasses and has facilitated optical fiber fabrication.

Based on end-user, the market is categorized into telecom, oil & gas, military & aerospace, BFSI, medical, railway, and others. The military and aerospace segment garnered a remarkable growth rate in the market in 2022. In addition to its usage in temperature monitoring, optical fiber is also used in the military and aerospace industries for communication and signal transfer. Because fiber optic cables are lighter and smaller, they can be helpful. In the aircraft industry, many countries saw an increase in domestic commercial aviation income passenger kilometers over pre-pandemic levels. The demand for new airplanes, as well as aftermarket goods and services, surged because of this growth in air travel. In the defense industry, recent geopolitical difficulties and an emphasis on military modernization led to a strong demand for fiber optics, primarily for next-generation weapons and capabilities.

On the basis of type, the market is divided into single-mode, multi-mode, and plastic optical fiber. The multi-mode segment recorded the largest revenue share in the market in 2022. In addition to a significantly broad core, multi-mode typically employs an extended wavelength of light. As a result, multi-mode optical fibers exhibit an enhanced capability to collect light emitted by the laser source. Multi-mode fibers are often less expensive and easier to work with, making them suitable for shorter-distance applications within local area networks (LANs) and data centers.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 4.8 Billion |

| Market size forecast in 2030 | USD 21 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 20.5% from 2023 to 2030 |

| Number of Pages | 278 |

| Number of Table | 404 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter's 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Process, End-user, Region |

| Country scope |

|

| Companies Included | Corning Incorporated, Optical Cable Corporation, Sterlite Technologies Limited, Prysmian Group, Furukawa Electric Co., Ltd., Sumitomo Electric Industries, Ltd., Yangtze Optical Fibre and Cable Joint Stock Limited Company, Hengtong Group Co., Ltd., Fujikura Ltd. and Shin-Etsu Chemical Co., Ltd. |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region witnessed the maximum revenue share in the market in 2022. The primary catalysts for the region's expansion are the rising prevalence of end-use industries, the expanding telecom sector, and internet usage. Asia-Pacific has experienced a notable upswing in the development of telecommunication infrastructure, which can be attributed to several factors, including the growing need for high-speed internet access, the expansion of 4G and 5G networks, as well as the increasing penetration of smartphones.

Free Valuable Insights: Global Fiber Optic Preform Market size to reach USD 21 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Corning Incorporated, Optical Cable Corporation, Sterlite Technologies Limited, Prysmian Group, Furukawa Electric Co., Ltd., Sumitomo Electric Industries, Ltd., Yangtze Optical Fibre and Cable Joint Stock Limited Company, Hengtong Group Co., Ltd., Fujikura Ltd. and Shin-Etsu Chemical Co., Ltd.

By Process

By End-user

By Type

By Geography

This Market size is expected to reach $21 billion by 2030.

Rising expansion of data centers are driving the Market in coming years, however, Significant barriers during installation restraints the growth of the Market.

Corning Incorporated, Optical Cable Corporation, Sterlite Technologies Limited, Prysmian Group, Furukawa Electric Co., Ltd., Sumitomo Electric Industries, Ltd., Yangtze Optical Fibre and Cable Joint Stock Limited Company, Hengtong Group Co., Ltd., Fujikura Ltd. and Shin-Etsu Chemical Co., Ltd.

The expected CAGR of this Market is 20.5% from 2023 to 2030.

The Telecom segment is generating highest revenue in the Market, by End-user in 2022; thereby, achieving a market value of $8.4 Billion by 2030.

The Asia Pacific region dominated the Market, by region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $11 Billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.