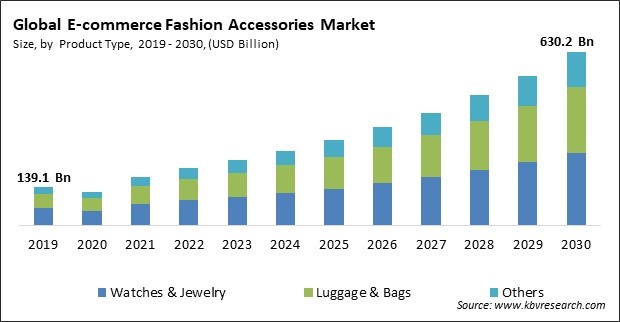

The Global E-commerce Fashion Accessories Market size is expected to reach $630.2 billion by 2030, rising at a market growth of 15.0% CAGR during the forecast period.

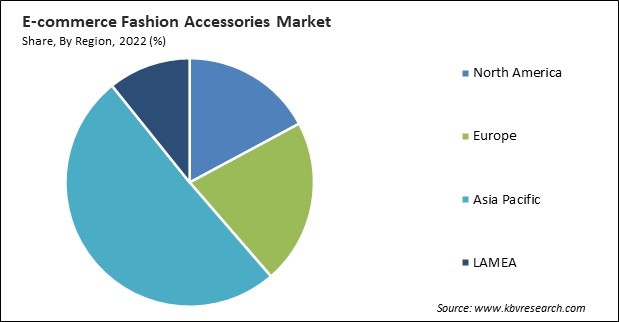

Rapid economic development occurs across Asia, with nations like India and China taking center stage. Therefore, the APAC region would acquire more than 50% share of the market by 2030. The growing attraction for the luxury lifestyle, increased purchasing capacity, and the influence of celebrity endorsement are boosting the market expansion in the APAC region. Increasing mobile usage and internet penetration are contributing to the market's growth. The second factor contributing to market expansion is the emergence of new business channels and formats. The rising disposable income of the populace is another crucial factor contributing to market expansion. Due to the above-mentioned factors, Asia-Pacific market demand is high and contributes significantly more to revenue generation.

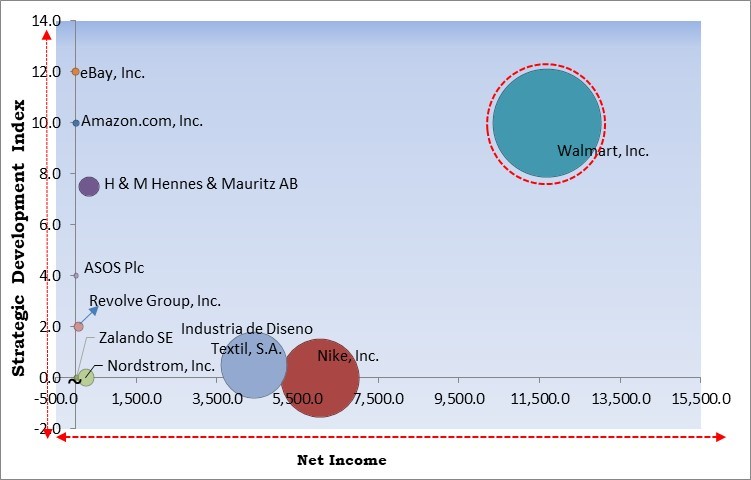

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In March, 2023, ASOS Plc came into partnership with Criteo to advertise endemic brands across the ASOS app. The partnership would strengthen Asos Media Group's (AMG) offerings and would provide advertisers across its platform with improved targeting and measurement capabilities. In addition, In June, 2022, H & M Hennes & Mauritz AB partnered with Google Cloud to enhance its customer experience and supply chain enablement using Google Cloud's data analytics capabilities. The partnership reinforces H&M's strategy of building better relationships with its customers.

Based on the Analysis presented in the KBV Cardinal matrix; Walmart, Inc. is the forerunner in the Market. In September, 2022, Walmart, Inc. signed a partnership with Claire's Holdings LLC, a fashion accessories provider, to launch Claire's fashion accessories and jewelry in Walmart stores. The partnership enforces Walmart's strategy of providing better shopping experiences to their customers. Companies such as Nike, Inc., Industria de Diseno Textil, S.A. and H & M Hennes & Mauritz AB are some of the key innovators in the Market.

Wider access to the internet, both in developed and emerging markets, has been a significant driver of e-commerce growth. More people have access to online shopping platforms, leading to an expanded customer base. The proliferation of smartphones and tablets has made it easier for consumers to shop online, allowing them to purchase anytime and anywhere. Mobile apps and mobile-responsive websites have become essential tools for e-commerce businesses. E-commerce offers unparalleled convenience. Customers can shop 24/7 without the need to visit physical stores. This convenience has become even more critical with busy lifestyles and the impact of the COVID-19 pandemic. With the continuous expansion of the e-commerce industry, it is expected that the market will rise in the coming years.

Social media platforms, particularly Instagram and Pinterest, serve as virtual marketplaces where consumers can discover new fashion accessories and styles. Users follow fashion influencers, brands, and celebrities whose posts feature these accessories. As a result, users often come across products they might not have encountered through traditional advertising or in physical stores. Fashion influencers and bloggers are pivotal in promoting fashion accessories through sponsored posts and brand collaborations. Influencers have dedicated followings, and their endorsements can drive significant traffic to e-commerce platforms. These influencers often share their style, showcasing how fashion accessories can be integrated into daily outfits, making them relatable and aspirational to their followers. The combination of social media and e-commerce has created a dynamic synergy that continues to reshape the fashion industry.

Counterfeit products divert revenue away from legitimate businesses. E-commerce fashion accessory retailers lose sales and potential growth opportunities as counterfeit items undercut their prices. Counterfeit products can tarnish the reputation of legitimate fashion accessory brands. Customers who unknowingly purchase fake items may associate a negative experience with the brand and, in turn, become wary of online shopping. Counterfeit products erode consumer trust in the market. When customers receive substandard or fake items, they may become hesitant to make future online purchases, affecting the overall market's growth. Counterfeit fashion accessories often lack the quality and safety standards of authentic products. These factors will decline the market growth in the coming years.

On the basis of product type, the market is segmented into watches & jewelry, luggage & bags, and others. In 2022, the watches and jewelry segment dominated the market with the maximum revenue share. The watches & jewelry segment consists of a variety of watches and jewelry. Fine jewelry is created of precious metals, such as gold, silver, titanium, and other metals, and modern jewelry comprises jewelry. Youthful consumers frequently purchase watches and jewelry via e-commerce because they assist price-conscious consumers. In addition, eCommerce provides a transparent and reliable process and supply of timepieces and jewelry, contributing to its popularity. Consequently, its rising demand increases the market's revenue generation.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 207.2 Billion |

| Market size forecast in 2030 | USD 630.2 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 15% from 2023 to 2030 |

| Number of Pages | 164 |

| Number of Table | 174 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The LAMEA region garnered a significant revenue share in the market in 2022. The growth of the market in the region can be attributed to the region's expanding opportunities and various investments in new eCommerce channels. High internet penetration in the region also contributes to the expansion of the market. The aforementioned factors make the region considerably easier to penetrate than the steadily maturing market.

Free Valuable Insights: Global E-commerce Fashion Accessories Market size to reach USD 630.2 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include H & M Hennes & Mauritz AB, Walmart, Inc., Amazon.com, Inc., Nike, Inc., Industria de Diseno Textil, S.A. (Inditex S.A.), eBay, Inc., ASOS Plc (Frasers Group), Revolve Group, Inc., Zalando SE, and Nordstrom, Inc.

By Product Type

By Geography

This Market size is expected to reach $630.2 billion by 2030.

Growing social media influence are driving the Market in coming years, however, Rising availability of counterfeit products restraints the growth of the Market.

H & M Hennes & Mauritz AB, Walmart, Inc., Amazon.com, Inc., Nike, Inc., Industria de Diseno Textil, S.A. (Inditex S.A.), eBay, Inc., ASOS Plc (Frasers Group), Revolve Group, Inc., Zalando SE, and Nordstrom, Inc.

The expected CAGR of this Market is 15.0% from 2023 to 2030.

The Asia Pacific region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $325.9 Billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.