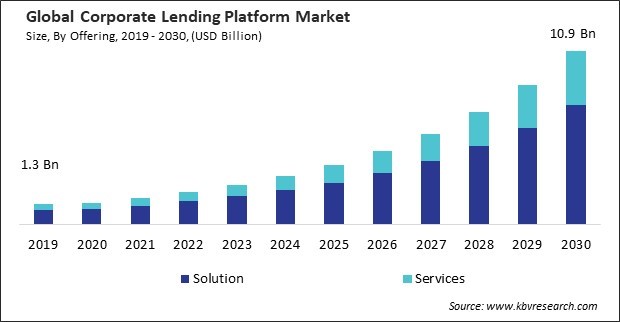

The Global Corporate Lending Platform Market size is expected to reach $10.9 billion by 2030, rising at a market growth of 23.5% CAGR during the forecast period.

Many SMEs struggle to access financing from traditional banks due to strict lending criteria, collateral requirements, and lengthy approval processes. Consequently, the SME lending segment by lending type would generate approximately 17.9% revenue share of the market by 2030. Corporate lending platforms offer a more accessible and efficient alternative, allowing SMEs to secure funding quickly and with fewer barriers. Small firms can invest in growth prospects using the financing provided by SME lending platforms.

Digital transformation enables lending platforms to automate and streamline the lending process, making it faster, more efficient, and more convenient for borrowers. Businesses can apply for loans online, upload necessary documentation digitally, and receive funding faster than traditional lending methods. This increased efficiency enhances the borrower’s experience and reduces the time and resources required for loan origination. Thus, growing digital transformation is driving the growth of the market.

Additionally, Corporate lending platforms leverage technology to automate and streamline the lending process, reducing manual intervention and paperwork. Borrowers can apply for loans online, submit documentation digitally, and receive funding faster than traditional lending methods. This streamlining of processes reduces administrative overhead and improves operational efficiency for lenders and borrowers. Hence, rising efficiency and cost reduction are propelling the market’s growth.

However, Corporate lending platforms rely on access to sufficient liquidity to fund loan originations and operations. Limited capital availability can constrain liquidity, particularly if investors or funding sources withdraw capital or reduce their commitments due to changing market dynamics or regulatory requirements. This liquidity constraint can hinder the growth and scalability of lending platforms and impact their ability to effectively serve businesses’ financing needs. Hence, limited capital availability hampers the growth of the market.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

Challenges Based on end user, the market is divided into banks, non-banking financial corporation (NBFC), and credit unions & others. In 2022, the non-banking financial corporation (NBFC) segment recorded a 29.09% revenue share in the market. Participating in corporate lending platforms allows NBFCs to diversify their funding sources beyond traditional bank loans or debt issuance. By accessing funding from institutional investors, peer-to-peer lenders, and other capital providers through these platforms, NBFCs can reduce their reliance on any single funding source and improve their overall funding stability and resilience.

On the basis of deployment mode, the market is segmented into cloud and on-premises. In 2022, the cloud segment attained a 55.87% revenue share in the market. Cloud-based lending platforms can be deployed and configured faster than on-premises solutions, reducing time-to-market for new lending products and services. This agility allows lenders to respond rapidly to market opportunities, launch innovative lending offerings, and stay ahead of competitors in a rapidly evolving industry landscape.

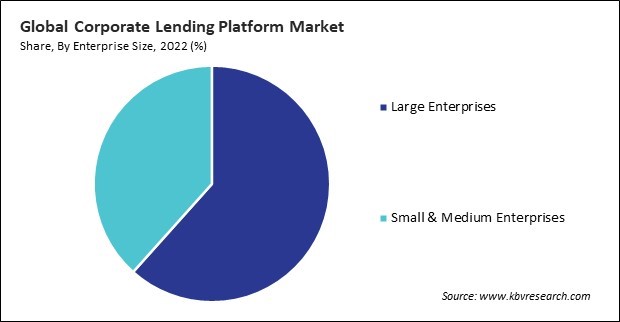

Based on enterprise size, the market is categorized into large enterprises and small & medium enterprises. The small & medium enterprises segment witnessed a 38.37% revenue share in the market in 2022. Many governments and regulatory authorities have implemented initiatives to support SME lending and fintech innovation, including regulatory sandboxes, financial incentives, and policy reforms. These initiatives create a favorable regulatory environment for corporate lending platforms to operate and expand their SME lending activities, driving further growth in the market.

By lending type, the market is divided into commercial lending, microfinancing lending, SME lending, agriculture lending, and others. In 2022, the commercial lending segment registered a 38.14% revenue share in the market. Commercial lending encompasses various financing needs, including real estate development, construction projects, equipment financing, working capital loans, and business expansion.

Based on offering, the market is divided into solution and service. In 2022, the solution segment garnered a 72.14% revenue share in the market. Corporate lending platforms offer solutions that streamline and automate the lending process, from application to approval and disbursement. This efficiency is highly valued by corporations looking to access financing quickly and with minimal hassle. These solutions often incorporate advanced risk assessment and management tools, providing lenders with better insights into the creditworthiness of potential borrowers.

The solution segment is subdivided into loan origination, underwriting, loan structuring, collateral management, compliance & regulatory management, loan monitoring & management, and others. In 2022, the loan origination segment attained the 26.86 % revenue share in the market. Corporations often require quick access to capital for various purposes, such as financing expansion plans and projects or managing cash flow

Free Valuable Insights: Global Corporate Lending Platform Market size to reach USD 10.9 Billion by 2030

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Europe region generated a 29.81% revenue share in the market. The Europe region is home to a large, diverse SME sector comprising millions of small and medium-sized enterprises. Many SMEs face challenges accessing traditional bank financing due to limited credit history, inadequate collateral, and cumbersome application processes.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 2 Billion |

| Market size forecast in 2030 | USD 10.9 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 23.5% from 2023 to 2030 |

| Number of Pages | 417 |

| Number of Tables | 730 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Offering, Deployment, Enterprise Size, Lending Type, End User, Region |

| Country scope |

|

| Companies Included | TATA Consultancy Services Ltd., Fidelity National Information Services, Inc., Fiserv, Inc., Oracle Corporation, Finastra Group Holdings Limited (Vista Equity Partners), Newgen Software Technologies Limited, Nelito Systems Pvt. Ltd. (DTS Corporation), Wipro Limited, Comarch SA, Temenos AG |

By Offering

By End User

By Deployment

By Enterprise Size

By Lending Type

By Geography

The Market size is projected to reach USD $10.9 billion by 2030.

Rising Efficiency and Cost Reduction are driving the Market in coming years, however, Constraint Of Limited Capital Availability restraints the growth of the Market.

TATA Consultancy Services Ltd., Fidelity National Information Services, Inc., Fiserv, Inc., Oracle Corporation, Finastra Group Holdings Limited (Vista Equity Partners), Newgen Software Technologies Limited, Nelito Systems Pvt. Ltd. (DTS Corporation), Wipro Limited, Comarch SA, Temenos AG

The expected CAGR of this Market is 23.5% from 2023 to 2030.

The Banks segment is leading the Market by End User in 2022, thereby achieving a market value of $5.02 billion by 2030.

The North America region dominated the Market by Region in 2022; thereby, achieving a market value of $3.7 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.