According to a new report, published by KBV research, The Global Corporate Lending Platform Market size is expected to reach $10.9 billion by 2030, rising at a market growth of 23.5% CAGR during the forecast period.

The Services segment is anticipated to have a CAGR of 25.3% during (2023 - 2030). As corporate lending becomes increasingly complex, borrowers seek guidance and expertise from service providers who can help them navigate the lending process. Service providers offer valuable insights, advice, and assistance to corporate borrowers in understanding their financing options, structuring loan transactions, and negotiating terms with lenders. This expertise enhances the borrower’s ability to access financing and secure favorable terms.

The Banks segment is leading the Global Corporate Lending Platform Market by End User in 2022, thereby achieving a market value of $5.02 billion by 2030. Banks use corporate lending platforms to diversify their loan portfolios. By participating in these platforms, banks can offer their customers a wider range of loan products beyond what they typically provide through traditional banking channels. This allows them to reach new market segments and serve customers with diverse financing needs.

The On-premises segment is poised to have a CAGR of 21.6% during (2023 - 2030). Some lending institutions, particularly larger banks, and financial institutions, have stringent security and compliance requirements that necessitate keeping their lending platforms on premises. By maintaining control over their infrastructure, these institutions can ensure that sensitive borrower data remains secure and compliant with regulatory standards.

The Large Enterprises segment is registering a strong potential in the Global Corporate Lending Platform Market by Enterprise Size in 2022, thereby achieving a market value of $6.3 billion by 2030. Large enterprises typically operate globally, with subsidiaries, divisions, and operations in multiple countries. Corporate lending platforms tailored for large enterprises offer support for multi-currency transactions, cross-border lending, and compliance with diverse regulatory environments. This enables large enterprises to manage their global financing needs more efficiently and effectively.

The Microfinance Lending segment is anticipated to have a CAGR of 23.2% during (2023 - 2030). Microfinancing lending aims to provide access to financial services for individuals and small businesses with limited access to traditional banking services. This includes underserved populations such as low-income individuals, women entrepreneurs, and rural communities. Corporate lending platforms offering microfinancing help bridge the financial inclusion gap by providing small loans, often with lower requirements and more accessible terms than traditional loans.

Full Report: https://www.kbvresearch.com/corporate-lending-platform-market/

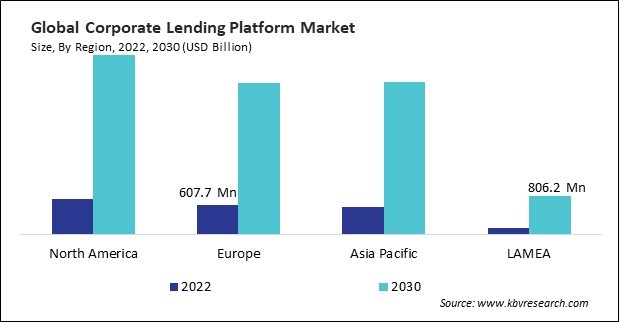

The North America region dominated the Global Corporate Lending Platform Market by Region in 2022; thereby, achieving a market value of $3.7 billion by 2030. The Europe region is experiencing a CAGR of 23% during (2023 - 2030). Additionally, The Asia Pacific market would showcase a CAGR of 24.4% during (2023 - 2030).

By Offering

By End User

By Deployment

By Enterprise Size

By Lending Type

Unique Offerings

Unique Offerings