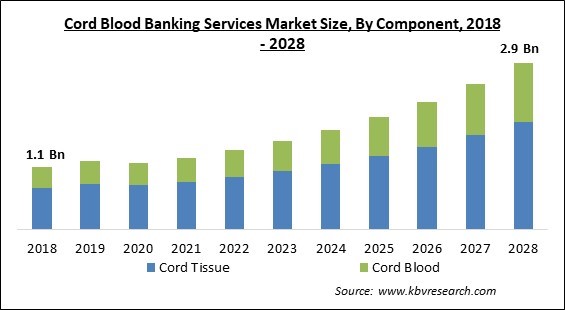

The Global Cord Blood Banking Services Market size is expected to reach $2.9 billion by 2028, rising at a market growth of 13.1% CAGR during the forecast period.

A large number of genetic illnesses can be treated with stem cells from cord blood, which is a major source of these cells. Chronic illnesses like cancer, blood diseases, diabetes, and immunological disorders can be treated with cord blood stem cells. Even while only a tiny amount of cord blood can be extracted from a single umbilical cord, it is the only type of stem cell that can be preserved for use in the future and contains a substantial number of stem cells.

These cells can be kept in cord blood banks for an average of 20 to 25 years and are obtained from hospitals and nursing homes for use in the future. The motivation of healthcare businesses to invest in research and the commercialization of cord blood stem cell therapies has increased as a result of the government authorities' support for cord blood stem cell research & clinical trials.

The market is currently more competitive, and businesses are working to spread the word about the advantages of cord blood banking. The Institute for Transfusion Medicine and Cord Blood Registry also teamed up to begin a multi-year project to raise awareness of cord blood cells. The expansion of the cord blood banking services market is anticipated to be aided by efforts that inform and advise expectant parents about the alternatives available for cord blood banking in relation to the various financial schemes for storage and donation.

Due to the lockdown measures in various countries and the delay in the collection and supply of cord blood used to treat diseases like immune disorders, blood diseases, diabetes, metabolic disorders, and cancer, the COVID 19 outbreak has had an impact on the expansion of the cord blood banking services industry. Numerous businesses in the market for cord blood banking services had to temporarily halt operations as a result of the COVID-19 pandemic in order to adhere to new rules put in place by the government to stop the disease's spread. The market for cord blood banking services was immediately impacted by this halt in operations in terms of revenue flow. As a result, the market experienced a gradual rebound throughout the course of the projected period.

More people are becoming aware of the therapeutic potential of stem cells worldwide. Health professionals are beginning to inform the parent and expecting populations about the significance and advantages of conserving cord blood stem cells, which is propelling the market's expansion.

One of the key reasons driving the growth of the market is the increase in public-private funding and investments in cancer research to lead to improvements in cancer detection and treatment. In the upcoming years, these investments from the public as well as private sources are anticipated to present new growth possibilities for market participants.

A cord blood bank should have accreditations that are acknowledged globally. The blood bank's accreditations attest to independent evaluations of the blood bank's competence, credibility, operational effectiveness, and quality control of processing and cryopreservation procedures to guarantee the security of the umbilical cord blood stem cells that are being stored. Certifications serve as quality controls to uphold standards.

On the basis of component, the cord blood banking service market is divided into cord blood and cord tissue. In 2021, the cord tissue segment held the largest revenue share in the cord blood banking services market. Due to the abundance of stem cells present in cord tissue, including hematopoietic stem cells (HSCs) and mesenchymal stem cells (MSCs), cord tissue is significant in cord blood banking services.

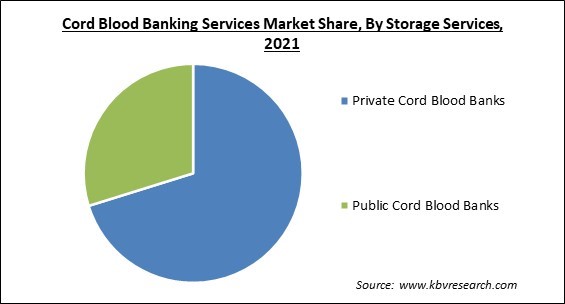

Based on storage services, the cord blood banking services market is segmented into public and private. In 2021, the public segment acquired a substantial revenue share in the cord blood banking services market. This is because of the high fee parents were had to pay for the collecting and storage of CB units. Furthermore, compared to state banks, the customer bases of private players are growing as a result of their marketing strategies which would contribute to the market growth in this segment.

By application, the cord blood banking service market is fragmented into cancer disease, diabetes, blood disease, immune disorders, metabolic disorders, and others. In 2021, the diabetes segment garnered the largest revenue share in the cord blood banking services market. Diabetes affected 422 million people in 2014, up from 108 million in 1980. Compared to high-income countries, prevalence has been increasing more quickly in low-income as well as middle-income nations.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.2 Billion |

| Market size forecast in 2028 | USD 2.9 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 13.1% from 2022 to 2028 |

| Number of Pages | 197 |

| Number of Tables | 358 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Storage Services, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the cord blood banking service market is analyzed across the North America, Europe, Asia Pacific and LAMEA. In 2021, the North America segment led the cord blood banking services market by generating maximum revenue share. This is because of the region's extensive private player presence and high level of public awareness. In addition, the growth of healthcare infrastructure as well as a growing number of clinical trials in the treatment of leukaemia would propel the cord blood banking market in the region.

Free Valuable Insights: Global Cord Blood Banking Services Market size to reach USD 2.9 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include AMAG Pharmaceuticals, Inc., Americord Registry LLC, StemCyte, Inc., Cordlife Group Limited, cordvida, Cryo-Cell International, Inc., CryoHoldco de LatinoAmérica and Vita 34 AG

By Component

By Storage Services

By Application

By Geography

The Cord Blood Banking Services Market size is projected to reach USD 2.9 billion by 2028.

Rising Awareness of Stem Cells' Therapeutic are driving the market in coming years, however, Stringent Accreditation & Licensing Standards A Challenge to Market Growth restraints the growth of the market.

AMAG Pharmaceuticals, Inc., Americord Registry LLC, StemCyte, Inc., Cordlife Group Limited, cordvida, Cryo-Cell International, Inc., CryoHoldco de LatinoAmérica and Vita 34 AG

The expected CAGR of the Cord Blood Banking Services Market is 13.1% from 2022 to 2028.

The Private Cord Blood Banks market acquired the maximum revenue share in the Global Cord Blood Banking Services Market by Storage Services in 2021; thereby, achieving a market value of $1.9 billion by 2028.

The North America market dominated the Global Cord Blood Banking Services Market by Region in 2021; thereby, achieving a market value of $1.0 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.