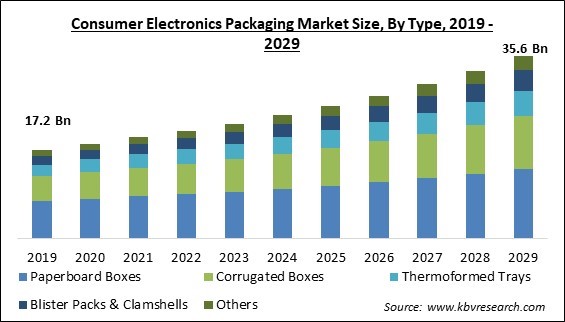

The Global Consumer Electronics Packaging Market size is expected to reach $35.6 billion by 2029, rising at a market growth of 8.0% CAGR during the forecast period.

The mobile phones emerged as the leader in Consumer Electronics Packaging Market and is expected to capture 1/5th share of the market, as most mobile phones are fragile, due to which the packaging that surrounds mobile phones contributes to the products' increased durability as well as their increased appeal. It guards the mobile device against damage from the outside world. Some of the factors impacting the market are Increasing penetration of consumer electronics, need for sustainable packaging, and strict standards and requirements for the packaging of goods.

Electronic equipment has a very high demand among the many kinds of technological consumer items found in homes. Televisions with larger screen sizes are becoming more popular, while on the other hand, the shrinking of electronic components is becoming more common. The growing use and adoption of consumer electronic products will increase the need for their packaging to safeguard them and their components in place, thus surging the market growth.

Electronics companies are placing greater emphasis on the consumer experience during unboxing a new electronic device by using sleek, easy-to-open packaging, which effectively safeguards the product. This is anticipated to create more growth opportunities for the market. However, the fact that natural processes cannot break down many plastic packaging wastes has a significant and detrimental impact on the natural environment. To address this problem, governments on every continent are working to enact stringent legal guidelines and standards that the packaging sector must follow. This results in an increase in the cost of operations consistent with the rise in the price of raw materials and decreasing the profits of companies in the market.

Based on type, the market is segmented into corrugated boxes, paperboard boxes, thermoformed trays, blister packs & clamshells and others. The paperboard boxes segment dominated the market with maximum revenue share in 2022. This is because it gives consumers easy-to-access storage and practical packaging that also looks good. Additionally, this packaging is especially safe for the environment because it is produced from recycled materials and comes in many forms and sizes. Hence, the characteristics like convenient storage and its environmental safety are expected to propel the segment's growth in the projected period.

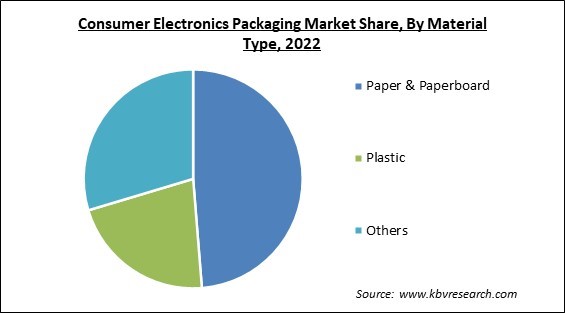

On the basis of material type, the market is divided into plastic, paper & paperboard and others. The plastic segment procured a promising growth rate in the market in 2022. This is because plastics are also frequently used in electronic packaging, but they provide a very distinct type of protection. The primary function of plastic in electronic packaging is to hold the electronic contents in position and prevent them from colliding with one another. In recent years, consumer electronics products have significantly integrated plastic products.

By application, the market is classified into mobile phones, computers, TVS, DTH & set-top boxes, music systems, printers, scanners & photocopy machines, camcorders & cameras, game consoles & toys, electronic wearables and others. The computers segment garnered a prominent revenue share in the market in 2022. This is owing to the fact that the computer is a tool that plays a significant part in the routine tasks that make up human beings' lives today. As a result of the enormous benefits offered, computers are increasingly being used in a wide variety of contexts, including education, banking, medical, research, business, homes, and so on.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 21 Billion |

| Market size forecast in 2029 | USD 35.6 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 8% from 2023 to 2029 |

| Number of Pages | 273 |

| Number of Table | 430 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Material Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region registered the highest revenue share in the market in 2022. This is due to the factors such as the growing popularity of electronic products like smart devices, digital cameras, smartphones, and televisions, the rapid advancement of packaging technology, and the rising demand for reliable and all-weather packaging in North America is boosting the market growth.

Free Valuable Insights: Global Consumer Electronics Packaging Market size to reach USD 35.6 Billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include DS Smith Plc., Smurfit Kappa Group plc, Sonoco Products Company, Billerud AB, The International Paper Company, JohnsByrne, Plastic Ingenuity, Stora Enso Oyj, UFP Technologies, Inc. and WestRock Company.

By Type

By Material Type

By Application

By Geography

The Market size is projected to reach USD 35.6 billion by 2029.

Need for sustainable packaging are driving the Market in coming years, however, Strict standards and requirements for the packaging of goods restraints the growth of the Market.

DS Smith Plc., Smurfit Kappa Group plc, Sonoco Products Company, Billerud AB, The International Paper Company, JohnsByrne, Plastic Ingenuity, Stora Enso Oyj, UFP Technologies, Inc. and WestRock Company.

The expected CAGR of this Market is 8.0% from 2023 to 2029.

The Paper & Paperboard segment acquired maximum revenue share in the Market by Material Type in 2022 thereby, achieving a market value of $16.9 billion by 2029.

The North America market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $12 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.