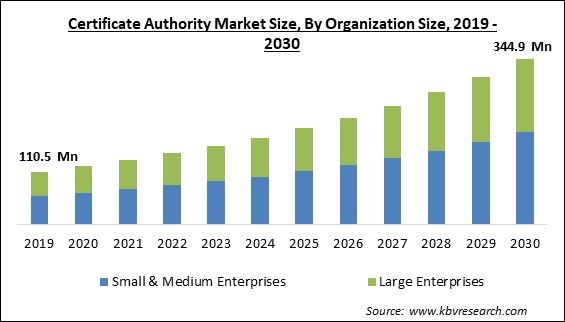

The Global Certificate Authority Market size is expected to reach $344.9 million by 2030, rising at a market growth of 11.2% CAGR during the forecast period.

Every medical website administrator must ensure that the site is HTTPS. For the SSL website security of the medical website, selecting the appropriate SSL certificate should also be the highest priority. Therefore, The Healthcare & Lifesciences segment would showcase 1/5th share in the market by 2030. Using an extended validation (EV) SSL certificate is advised because it provides the greatest validation and the necessary encryption level for medical websites. The healthcare industry is rapidly adopting cutting-edge technology to give patients a personalized, intuitive experience. The digital certificates help medical professionals protect patient health information on portable devices like laptops and smartphones. Additionally, healthcare businesses are concerned about the rise in cyberattacks on personally identifiable information (PII).

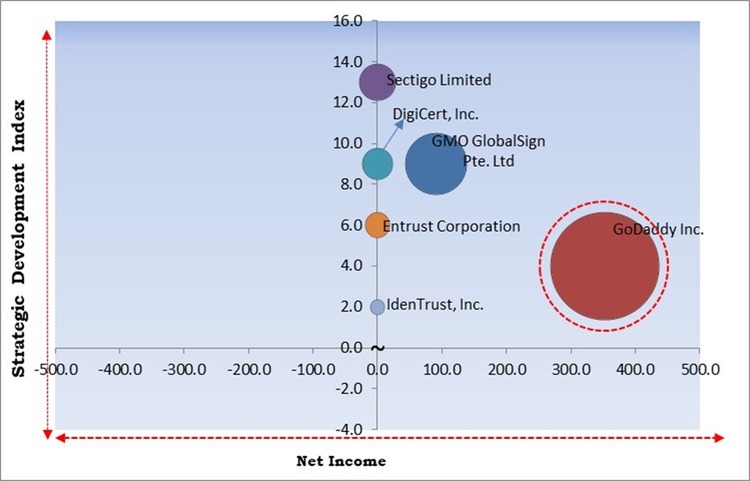

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In April, 2023, Entrust Corporation announced new features for its Zero Trust frameworks. The new features include Identity, for the protection of key data of organizations across different environments. Additionally, In February, 2023, GMO GlobalSign released Qualified Signing Service (QSS), a digital signing service for qualified electronic signatures. The service is cloud-compatible and has several benefits including risk mitigation, eIDAS regulation compliance, and mobile authentication services for employees.

Based on the Analysis presented in the KBV Cardinal matrix; GoDaddy Inc. is the forerunner in the Market. Companies such as GMO GlobalSign Pte. Ltd, Sectigo Limited, DigiCert, Inc. are some of the key innovators in the Market. In March 2023, GlobalSign introduced a new service feature for its Automated Certificate Management Environment (ACME). The new service would benefit the users by saving their time by eliminating the need for manual Certificate Signing Requests (CSRs) filings.

The recent push for HTTPS awareness has unintentionally led visitors to accept and trust any website employing HTTPS without questioning. Users have shown terrifying amounts of trust in websites displaying these characteristics without necessarily knowing how trustworthy they are, or even if they're an unauthorized replica of a website, due to the familiarity of seeing HTTPS in a web browser alongside the reassuring green padlock. Due to this development, hackers have increased the amount of HTTPS phishing websites to take advantage of end users' confidence and use it against them. By obtaining SSL/TLS certificates from recognized certificate authorities, legitimate websites can demonstrate their legitimacy and encrypt the communication method, making it more challenging for hackers to intercept or alter sensitive data. Thus, the market will grow in the upcoming years as HTTPS usage increases.

IoT traffic is projected to grow rapidly as companies across industries adopt IoT-enabled devices to improve operational efficiency and communication. However, the rapidly growing popularity of these IoT devices implies considerable room for future cyberattacks. As a result, numerous companies that deal with private and sensitive corporate information are anticipated to adopt a certificate authority. Security professionals can more effectively track users who access networks from numerous locations, the apps they use, and specific access periods through this tactic. It enables businesses to utilize their current IoT infrastructure and ensures safe and scalable certificate administration. The demand for privacy authority further increases due to the adoption of IoT across several industry sectors. During the forecast period, it is anticipated for demand to rise in the market.

For commercial or financial websites that handle memberships, subscriptions, or anything identical, self-signed certificates are extremely dangerous. Attackers that issue self-signed certificates that can be used in man-in-the-middle (MITM) attacks expose users to data theft and other breaches. Lack of visibility is the self-signed certificates' major problem. Organizations can monitor certificates issued by certificate authorities. However, it is extremely difficult to track self-signed certificates that were granted without any formal request or approval process. If the corporate network is infiltrated, there is no way to determine whether a self-signed certificate (and its private key) has been compromised. As a result, users can get puzzled and worried about their security, which might make them reluctant to interact with systems that use self-signed certificates. These variables may adversely affect the market.

On the basis of vertical, market is categorised into BFSI, retail & ecommerce, government & defense, healthcare & life sciences, IT & telecom, travel & hospitality, education, and others. The BFSI segment witnessed the largest revenue share in the market in 2022. Phishing attacks and other identity theft frauds frequently target banks, credit unions, and other financial organizations. The industry is concentrating increasingly on online transaction security due to a significant increase in phishing and social engineering occurrences. These factors are causing the use of SSL certificates to increase, boosting the market.

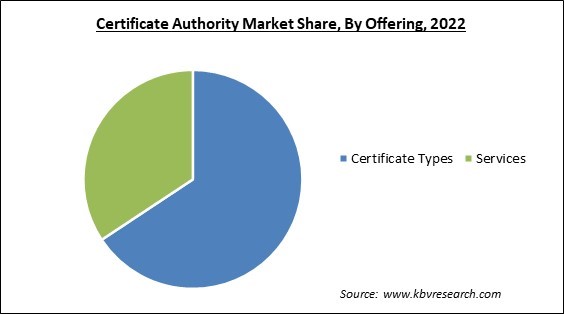

On the basis of offering, the market is segmented into certificate type and services. The certificate types segment dominated the market with the maximum revenue share. Online data privacy is the main benefit of authenticating with digital certificates. These digital certificates protect private data by encrypting all communications, including logins, emails, and online banking transactions, preventing them from being viewed by unauthorized parties.

By organization size, the market is classified into large organization and SMEs. In 2022, large organization recorded a remarkable revenue share in the market. An essential part of the cybersecurity architecture in large organizations is certificate authorities. They contribute to developing trust, secure communication, and integrity of digital exchanges and interactions across various platforms and devices. Numerous prominent enterprise software suppliers provide their own private CA.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 149.3 Million |

| Market size forecast in 2030 | USD 344.9 Million |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 11.2% from 2023 to 2030 |

| Number of Pages | 377 |

| Number of Table | 573 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Offering, Organization Size, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region generated the highest revenue share in the market. North America comprises sophisticated nations with cutting-edge technology and advanced infrastructure. The US and Canada are the biggest contributors in North America to the market due to their robust economies. In North America, the digital revolution is establishing the pace in several sectors, including banking, healthcare, e-commerce, and government services. The growth of cloud computing, Internet of Things (IoT) devices, and mobile apps have increased the demand for secure communication and data security, increasing the need for certificate authorities and digital certificates.

Free Valuable Insights: Global Certificate Authority Market size to reach USD 344.9 Million by 2030

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Sectigo Limited (GI Partners L.P.), DigiCert, Inc. (Clearlake Capital Group, L.P.), GMO GlobalSign Pte. Ltd (GMO Internet Group, Inc.), GoDaddy Inc., IdenTrust, Inc. (HID Global Corporation), Entrust Corporation, Certum (Asseco Data Systems S.A.), Actalis S.p.a (Aruba S.p.a.), WISeKey International Holding Ltd and Newfold Digital, Inc.

By Vertical

By Organization Size

By Offering

By Geography

This Market size is expected to reach $344.9 million by 2030.

Increased frequency of HTTPS phishing assaults are driving the Market in coming years, however, Utilizing self-signed certificates restraints the growth of the Market.

Sectigo Limited (GI Partners L.P.), DigiCert, Inc. (Clearlake Capital Group, L.P.), GMO GlobalSign Pte. Ltd (GMO Internet Group, Inc.), GoDaddy Inc., IdenTrust, Inc. (HID Global Corporation), Entrust Corporation, Certum (Asseco Data Systems S.A.), Actalis S.p.a (Aruba S.p.a.), WISeKey International Holding Ltd and Newfold Digital, Inc.

The expected CAGR of this Market is 11.2% from 2023 to 2030.

The Small & Medium Enterprises segment is leading the Market by Organization Size in 2022; thereby, achieving a market value of $194.5 million by 2030.

The North America market dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $139.8 million by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.