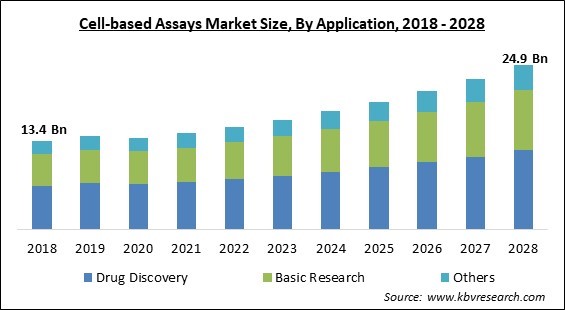

The Global Cell-based Assays Market size is expected to reach $24.9 billion by 2028, rising at a market growth of 8.2% CAGR during the forecast period.

Any type of experiment that is conducted inside a living cell is considered to be a cell-based assay. As a result of the breadth of this concept, there are a number of distinct cell-based tests. Assays that are performed on living cells can reveal information on a cell's viability, cytotoxicity, proliferation, senescence, as well as the death rate. These assays are based on reporter gene assays that have a high sensitivity due to the signal amplification that occurs during cell-signaling cascades.

Because of this, these assays are suitable for conducting an investigation of cell-signaling cascades. High-throughput screening, or HTS, formats typically make use of cell-based assays. Research and development expenditures have been boosted by a number of governmental and private organizations in an effort to find safer and more effective drugs.

In addition, developments in the technology of cell-based assays have made it possible for researchers to apply this method for drug discovery as well as investigations of toxicology. Cell culture processes, in which living cells are generated in vitro and utilized as model systems for analyzing the physiology and biochemistry of both healthy and diseased cells, serve as the foundation for the cell-based assay methodology, which is based on the idea of the cell-based assay.

In a regulatory environment, cell-based assays are frequently used for cytotoxicity screening, to evaluate the biological activity (potency) of drug substance and drug product, to determine the method of action, early-stage proof of primary studies, and in immunogenicity experiments to determine if antibodies produced by the person are neutralizing the drug product.

The COVID-19 pandemic caused major clinical trials and the research processes involved in the creation of new drugs to be interrupted. Patients are now only treated symptomatically despite the fact that a number of vaccines or antiviral medications for COVID-19 have either been authorized or are currently in the development stage. When developing vaccines as well as treatments, it is necessary to evaluate the antibodies produced to determine the functional efficacy of the antibodies to inhibit the target virus. In order to decrease the amount of time required for these assays while also increasing their throughput, cell-based assays are used. Because of this, there has been a major rise in the demand for cell-based tests, which can give an early indication of the hazardous properties possessed by potential drug candidates.

In the process of developing new drugs, cell-based assays are crucial components. In contrast to in vitro biochemical tests, cell-based assays offer a number of beneficial features. In contrast to biochemical assays, they provide responses that are tissue-specific and consistent while taking place in a microenvironment that is biologically relevant. A significant aspect that restricts the use of biochemical assays is the impossibility of preparing or purifying each and every target for biochemical measurement. This is one of the factors that contribute to the limitations of the applications of biochemical assays.

One of the major factors that are expediting the growth of the market is the significant number of developing countries all over the world. The low cost of labor and raw materials, the increased risk of infections, the growth in the number of research activities, and the technological advancements throughout the end-use sectors for cell-based assays in these emerging countries are anticipated to provide significant growth prospects for several major market players operating in the cell-based assays market.

The incorporation of high-throughput screening (HTS) along with high-content screening (HCS) methods has expanded the reliability of cell-based assays. However, these innovations have significantly increased the price of instruments and devices that are required to conduct experiments. In addition, the time and expense associated with each HTS method are directly related to the complexity of the target molecule; hence, the greater the complexity, the larger the cost.

By Application, the Cell-based Assays Market is segregated into Basic Research, Drug Discovery, and Other Applications. In 2021, the basic research segment acquired a significant revenue share of the cell-based assays market. The cell-based assays that make up the bulk of research in the life sciences are used with the goal of gaining a deeper comprehension of the myriad cellular processes that are involved in both health and illness. These assays are employed to identify an impact or event that occurred within a cell, examine the activities of genes, proteins, or the entire cell as well as the regulatory systems that control them, and screen for potential inducers or inhibitors for biological processes.

On the basis of End-user, the Cell-based Assays Market is categorized into Pharmaceutical and Biotechnology Companies, Academic & Research Institutes, and Contract Research Organizations. In 2021, the pharmaceutical and biotechnology companies garnered a substantial revenue share of the cell-based assays market. In the pharmaceutical business, cell-based assays have shown to be an efficient method for determining the influence that external stimuli or pharmacological compounds have on the overall activity of cells. In addition, cell-based drug screening assays have become increasingly popular in the field of drug discovery research.

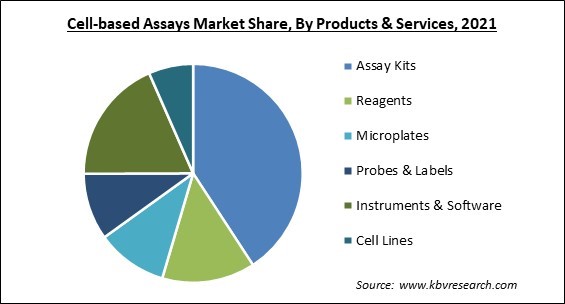

Based on Products and Services, the Cell-based Assays Market is segmented into Reagents, Assay Kits, Microplates, Probes & Labels, Instruments & Software, and Cell Lines. In 2021, the assay kits segment acquired the largest revenue share of the cell-based assays market. The rapidly increasing growth of the segment is attributed to the fact that it is useful in a wide variety of applications within the biopharmaceutical industry. Additionally, analytical tests for the assessment of specific analytes are performed with the use of reagents that may be found in assay kits. These tests are utilized for a wide variety of applications in different industries. Because they provide diagnostics practitioners with results that can be relied upon, the particular assay kits in concern are in high demand because they significantly reduce ambiguity.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 14.6 Billion |

| Market size forecast in 2028 | USD 24.9 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 8.2% from 2022 to 2028 |

| Number of Pages | 245 |

| Number of Tables | 385 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Application, Products & Services, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-Wise, the cell-based Assays Market is analyzed across north America, Europe, Asia-Pacific, and LAMEA. In 2021, North America accounted for the biggest revenue share of the cell-based assays market. The significant research that is carried out at a variety of research institutes all over the North American region and is jointly financed by university research institutes, as well as pharma giants across the region, is the primary factor that is bolstering the growth of the regional market. Furthermore, an increasing number of partnerships and collaborations within the region in order to boost the development of new and advanced approaches is fuelling the growth of the market in North America.

Free Valuable Insights: Global Cell-based Assays Market size to reach USD 24.9 Billion by 2028

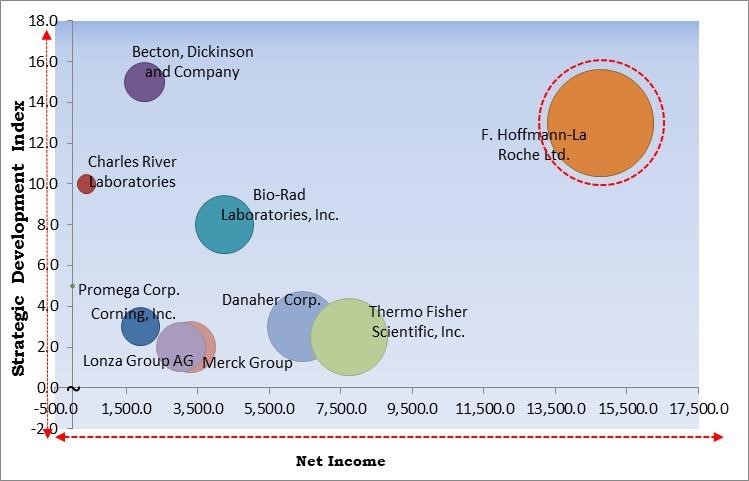

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; F. Hoffmann-La Roche Ltd. are the forerunners in the Cell-based Assays Market. Companies such as Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Danaher Corporation are some of the key innovators in Cell-based Assays Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Corning Incorporated, Charles River Laboratories International, Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd., Lonza Group AG, Merck Group, Promega Corporation and Thermo Fisher Scientific, Inc.

By Application

By End User

By Products & Services

By Geography

The Cell-based Assays Market size is projected to reach USD 24.9 billion by 2028.

An increasing number of applications of cell-based assays within drug discovery applications are driving the market in coming years, however, High cost of maintenance and ownership of equipment restraints the growth of the market.

Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Corning Incorporated, Charles River Laboratories International, Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd., Lonza Group AG, Merck Group, Promega Corporation and Thermo Fisher Scientific, Inc.

The expected CAGR of the Cell-based Assays Market is 8.2% from 2022 to 2028.

The Drug Discovery market is leading the Global Cell-based Assays Market by Application in 2021; thereby, achieving a market value of $11.9 billion by 2028.

The North America market dominated the Global Cell-based Assays Market by Region in 2021; thereby, achieving a market value of $9.9 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.