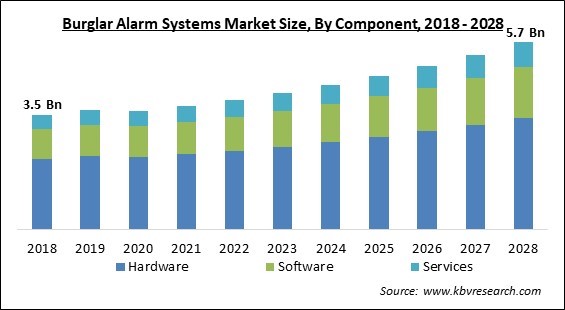

The Global Burglar Alarm Systems Market size is expected to reach $5.7 billion by 2028, rising at a market growth of 6.4% CAGR during the forecast period.

A burglar alarm system is a collection of electrical equipment and sensors linked to the main system that recognizes any unauthorized or forced entry into the premises and sends out alerts via alarms, hooters, and notifications. Burglar alarm systems are seen as a security necessity as the number of cases of offensive and unlawful acts (thefts, vandalism, etc.) continues to rise. Its acceptance is also fueled by a high level of fear among owners and a need to keep resources protected from incursion or destruction.

Recent technological advancements are lowering its costs and expanding its acceptance in both home and commercial settings. There are three primary types of burglar alarm systems. Wired refers to a system in which all components and electrical systems are connected via wires. Wireless refers to the use of Wi-Fi, Bluetooth, or any other radio technology to connect appliances. Hybrid refers to a system that uses both wired and wireless technology to communicate with the primary system. Because of the enormous variety of input devices available, installing a burglar alarm system is a sophisticated and complex operation with nearly endless combinations. They have the ability to detect motions prior to the actual aggressive threat. Each design or combination, however, has the same underlying premise.

First and foremost, appropriate hardware capable of detecting any intrusion-related activity must be deployed on the premises. This hardware varies a lot depending on the owner's needs, the environment, and the type of protection he or she requires. As a result, this stage is handled by installing burglar sensors, which detect a change in the normal environment and alert the control panel. Each sensor has a different way of working and it can be further adjusted to fit the space. The sensors' primary function is to detect any motion or forced entrance. There are numerous sensors available for detecting the same, however, their operation differs.

Many people had to work from home as offices from all non-essential sectors were shut down by governments of various countries. Thus, the safety of the house became an important issue for people. In the year 2020, the alarm sector saw a moderate demand around the world. The domestic segment has been identified as a prospective security system user. Alarm security systems have become more popular as a result of new business models, the presence of internet giants, and changing customer tastes. There were government-mandated lockdowns across the world.

IoT-based security systems ensure user safety by sending immediate notifications. Smart sensing identifies and informs the user of changes in motion, heat, and sound. With the availability of a vast number of high-quality data, IoT makes devices smarter. For example, the utilization of high-definition cameras, infrared vision, and night vision surveillance systems ensure that the specifics of any incident are available 24 hours a day, seven days a week. When actual movement occurs, motion activation records and transmits the data. DVR (digital video recording) devices aid in the retrieval of a specific event clip for a specific date and time from a larger recording.

Smart homes have the potential to make everyone’s, especially, old people’s lives more pleasant and secure. The development of these technologies is currently attracting a lot of attention from industry and policymakers. Emerging technologies, in theory, allow for the provision of a new set of services. The potential for deploying these technologies to increase people's safety and protection from robberies and burglaries is particularly significant. Sensor data can be collected by networked devices, which can improve decision-making on intervention and other measures. Furthermore, these gadgets can be used to teach and warn people about safety hazards.

The cost of the hardware, software and services required to establish a security system has a considerable impact on the adoption of home security solutions. As the burglar alarm systems become smarter and wireless, the price is only expected to increase for these systems. Because of the pricey hardware and consultancy fees, the upfront installation cost of a professionally installed system is higher. The cost of ownership, too, is significant as the system requires frequent maintenance, entails subscription payments, and replacement costs in case of any problems. Subscription costs levied by third-party monitoring companies often range from $150 to $1500.

Based on Application, the market is segmented into Residential and Commercial & Industrial. The residential segment acquired the largest revenue share in the burglar alarm systems market in 2021. Burglar alarm systems are becoming increasingly popular in the residential sector. Several product standards have been released by organizations in order to provide efficient alarm systems.

Based on Component, the market is segmented into Hardware (Alarm Sensors, Motion Detection Sensors, Central Monitoring Receiver, Remote Terminal Unit, and Door/ Window Sensors), Software, and Services. The services segment procured a significant revenue share in the burglar alarm systems market in 2021. Providers of burglar alarm systems are emphasizing investments in smart technologies. It combines AI and IoT to provide end-users with full alarm solutions. Integrating wireless systems alternatives and remote monitoring tools with burglar alarm systems is projected to enhance demand for security software solutions, according to market players.

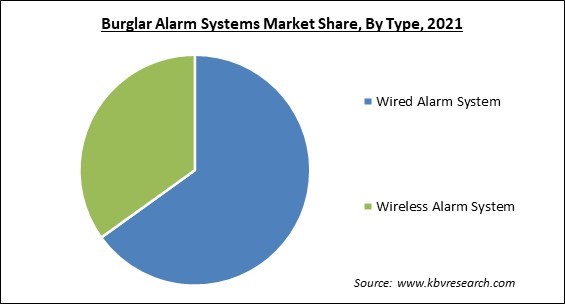

Based on Type, the market is segmented into Wired Alarm System and Wireless Alarm System. The wired alarm segment acquired the highest revenue share in the burglar alarm systems market in 2021. Due to technology improvements and safety concerns, burglar alarm systems have become more popular in recent years. Electrical field, vibration, audio, capacitance, and photoelectric beam sensors are among the technologies utilized in burglar alarms. A hardwired alarm system uses a network of cables hidden throughout the walls and floors of the home to connect the sensors to the control panel.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 3.7 Billion |

| Market size forecast in 2028 | USD 5.7 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 6.4% from 2022 to 2028 |

| Number of Pages | 266 |

| Number of Tables | 443 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America acquired the highest revenue share in the burglar alarm systems market in 2021. Mergers and acquisitions are allowing market companies to expand their footprints across the area. ASSA ABLOY, for example, bought Spectrum Brands, Inc., a hardware and home improvement subsidiary, in September 2021. Spectrum Brands, Inc. is a residential security systems supplier established in the United States.

Free Valuable Insights: Global Burglar Alarm Systems Market size to reach USD 5.7 Billion by 2028

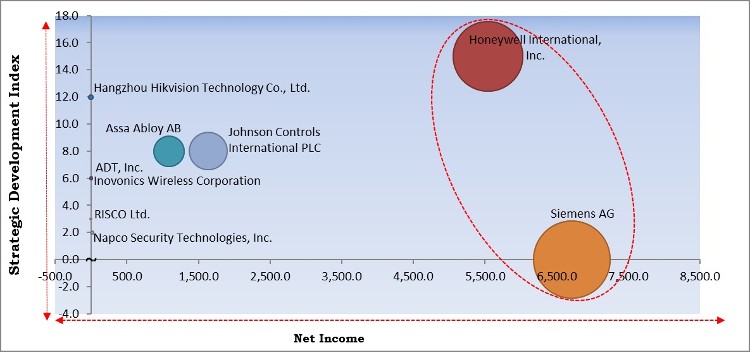

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Siemens AG and Honeywell International, Inc. are the forerunners in the Burglar Alarm Systems Market. Companies such as Johnson Controls International PLC, Assa Abloy AB, Hangzhou Hikvision Technology Co., Ltd. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include ADT, Inc., Assa Abloy AB, Hangzhou Hikvision Technology Co., Ltd., Honeywell International, Inc., Johnson Controls International PLC, Siemens AG, Napco Security Technologies, Inc., RISCO Ltd., Inovonics Wireless Corporation, and Banham Security.

By Application

By Component

By Type

By Geography

The global alarm systems market size is expected to reach $5.7 billion by 2028.

The Integration of Internet of Things (IoT) in Burglar Alarm Systems are driving the market in coming years, however, High Cost of Deploying, Operating and Maintaining Burglar Alarm Systems limited the growth of the market.

ADT, Inc., Assa Abloy AB, Hangzhou Hikvision Technology Co., Ltd., Honeywell International, Inc., Johnson Controls International PLC, Siemens AG, Napco Security Technologies, Inc., RISCO Ltd., Inovonics Wireless Corporation, and Banham Security.

The expected CAGR of the alarm systems market is 6.4% from 2022 to 2028.

The Hardware segment acquired maximum revenue share in the Global Burglar Alarm Systems Market by Component in 2021, thereby, achieving a market value of $3.37 billion by 2028.

The North America market dominated the Global Burglar Alarm Systems Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $2.13 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.