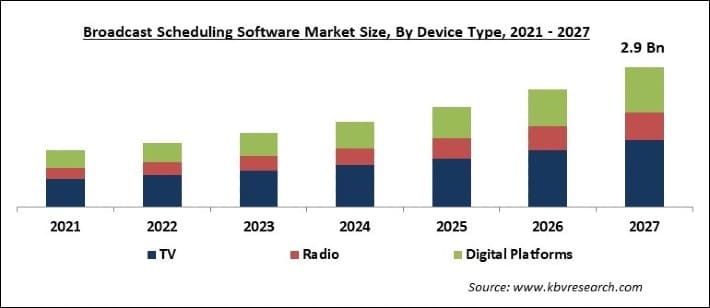

The Global Broadcast Scheduling Software Market size is expected to reach $2.9 billion by 2027, rising at a market growth of 16.4% CAGR during the forecast period. For creating better & great user experience, broadcast scheduling software aids in improved TV programming and planning. The workflow of production, broadcast department and advertising with regards to broadcast planning is managed by broadcast scheduling software.

The key role of broadcasting business is to increase power of collaborative computing with the help of broadcasting scheduling software. Traffic, credit control, and order management are streamlined with the help of this software. The platforms such as smart TVs, iOS setup boxes, android and among others help in the distribution of media content with the help of broadcast scheduling software. To control EPGs, programmed plans, and playlists channel owners & scheduling managers use this software so that they are able to manage any particular channel from anyplace or any device.

Some of the major factors propelling the growth of the global broadcast scheduling software marketing are the rise in adoption of cloud-based solutions and increasing complexity in broadcast media planning. Moreover, increasing popularity of streaming applications and rise in adoption of smart devices has been witnessed which led to driving the market growth. Efficiency, content, flexibility, event categorization, and automation are wide range of features of broadcast scheduling software that can be offered to broadcast management teams at any point of time.

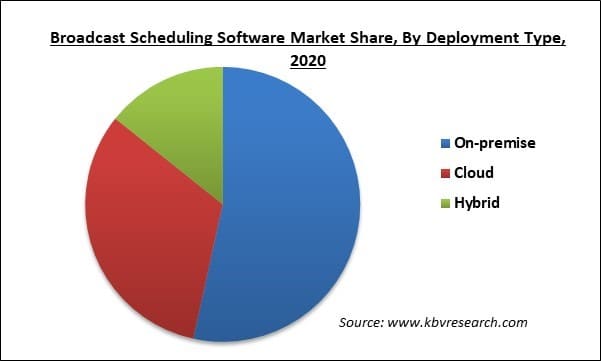

The technological disruptions have been witnessed in entertainment and media industry which created major changes in the broadcast industry. There has been a shift among the broadcasters from on-premise to cloud-based as the global COVID-19 pandemic has affected the market in various ways. Moreover, surge in the popularity of multimedia streaming applications and growing adoption rate of smart devices are encouraging the broadcasters to adopt broadcast management and scheduling solutions.

The broadcast networks of U.S. are trying to fill up the programming slots which are left open due to the cancellation of live sports due to the initial phase of COVID-19 epidemic. These network providers are trying to come up with new lineups which would be attractive for the customers who are forced to stay at their home and are looking for entertainment alternatives.

Based on Solution Type, the market is segmented into Software (Without Services) and Services. The software segment obtained the largest revenue shares in 2020 and would display its dominance during the forecast period. Factor like the rise in demand for broadcast scheduling solutions to schedule broadcasting content effectively and would make workflow flexible among several management teams is responsible for the growth of this segment.

Based on Deployment Type, the market is segmented into On-premise, Cloud and Hybrid. The on-premise segment obtained the largest revenue share in 2020 as a large number of broadcasters depend on traditional broadcasting system, mainly for emerging nations such as Brazil, China and India. In addition, the broadcasters operating in these nations are significantly serving the consumers, who are utilizing DTH TV and satellite, therefore depend on on-premise framework and systems.

Based on Application, the market is segmented into TV, Radio and Digital Platforms. The digital platform segment would likely to become the second biggest segment in the broadcast scheduling software. Moreover, the segment would showcase the largest growth rate during the forecast period. Factor such as rise in demand for global as well as national content for all the age groups is boosting the demand of the segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 1 Billion |

| Market size forecast in 2027 | USD 2.9 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 16.4% from 2021 to 2027 |

| Number of Pages | 201 |

| Number of Tables | 344 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Solution Type, Deployment Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America obtained the highest share in 2020 and would exhibit similar trend even during the forecast period. The presence of leading players in region and the early adoption of sophisticated broadcasting solutions and technologies are the factors responsible for the dominance of this region. U.S. obtained the maximum revenue share due to the rise in demand for sophisticated broadcast scheduling solutions and services from the broadcasters within the region.

Free Valuable Insights: Global Broadcast Scheduling Software Market size to reach USD 2.9 Billion by 2027

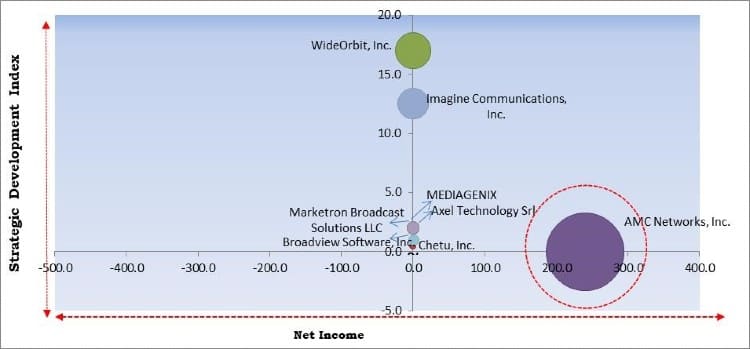

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; AMC Networks, Inc. is the major forerunners in the Broadcast Scheduling Software Market. Companies such as WideOrbit, Inc., MEDIAGENIX and Imagine Communications, Inc. are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include AMC Networks, Inc., Axel Technology Srl, Broadview Software, Inc., Chetu, Inc., Imagine Communications, Inc. (Harris Broadcast), MEDIAGENIX, Marketron Broadcast Solutions LLC, Schedule it Ltd., WideOrbit, Inc., and Advanced Broadcast Services Limited.

By Solution Type

By Deployment Type

By Application

By Geography

The global broadcast scheduling software market size is expected to reach $2.9 billion by 2027.

Rising complexity in broadcast media planning are driving the market in coming years, however, Low awareness and penetration of over-the-top (ott) and direct-to-home (dth) services in underdeveloped countries have limited the growth of the market.

AMC Networks, Inc., Axel Technology Srl, Broadview Software, Inc., Chetu, Inc., Imagine Communications, Inc. (Harris Broadcast), MEDIAGENIX, Marketron Broadcast Solutions LLC, Schedule it Ltd., WideOrbit, Inc., and Advanced Broadcast Services Limited.

The expected CAGR of the broadcast scheduling software market is 16.4% from 2021 to 2027.

Yes, There has been a shift among the broadcasters from on-premise to cloud-based as the global COVID-19 pandemic has affected the market in various ways.

The TV segment obtained the maximum revenue share in 2020. The growth of this segment is credited to a large population that is still willing to watch sports events and news on a conventional or a smart TV along with their friends and families.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.