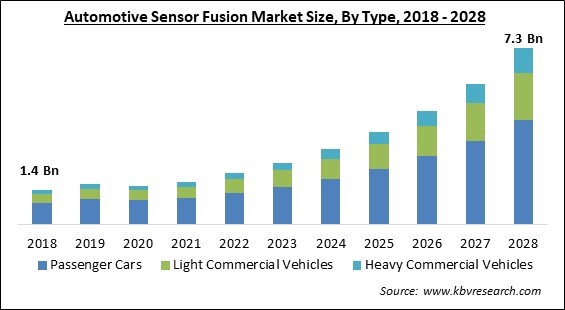

The Global Automotive Sensor Fusion Market size is expected to reach $7.3 billion by 2028, rising at a market growth of 22.8% CAGR during the forecast period.

The ability to merge information from different radars, lidars, and cameras to produce a single model or image of the space around a vehicle is referred to as sensor fusion. The model created as a result of balancing the strengths of the various sensors is more accurate. Vehicle systems can then employ more sophisticated behaviors using the data gathered through sensor fusion. There are benefits and drawbacks to each sensor type, or "modality," separately.

Even in adverse weather, radars are quite effective at calculating distance and speed, but they are unable to "see" the colour of a stoplight or read street signs. Cameras are excellent at interpreting signs or categorizing objects like humans, bicycles, and other vehicles. But they are quickly dazzled by debris, the light, the rain, the snow, or the night. Lidars are capable of precise object detection, but they lack the price or range of cameras or radar.

Utilizing software algorithms, sensor fusion combines the data from all of these different types of sensors to produce the most complete and accurate environmental model possible. Through a process called internal and external sensor fusion, it may also correlate data obtained from within the cabin. The information from numerous sensors of the same sort, such as radar, might also be combined by a vehicle via sensor fusion.

By taking advantage of slightly overlapping areas of view, this enhances perception. More than one sensor will pick up things simultaneously when more than one radar scans the area around a vehicle. The detection likelihood and reliability of things nearby the vehicle can be increased by fusing or overlapping the detections from those various sensors when interpreted by 360° perception software, which also produces a more accurate and trustworthy picture of the environment.

Due to the adoption of lockdown following the COVID-19 pandemic, which decreased demand for automotive sensor fusion, the COVID-19 pandemic had a detrimental impact on the expansion of the automotive sensor fusion market. Import and export restrictions caused a disruption in the supply chain. Both labour and raw materials were in short supply for manufacturers. A fall in working capital, a reduction in new car sales, a shutdown of production facilities, and a limited supply of auto parts. Since the manufacturing of automobiles is reliant on the sensor fusion industry, the outbreak is anticipated to have an effect on this business. However, because the advanced driver assistance system (ADAS) is so widely used in cars, it is anticipated that there will be a rise in the need for automotive sensors.

In order to reduce accidents and boost traffic safety, automakers have hastened the implementation of technology. Additionally, the government takes action to reduce traffic fatalities by mandating the inclusion of these technologies in all new cars. The government is being urged to enact severe restrictions relating to safety measures in vehicles by the sharp rise in traffic accidents. The requirements include installing an advanced emergency braking system, logging accidents, installing seat belt sensors that have passed crash tests, reversing sensors, and speed assistance in vehicles. The use of sensors like RADAR, LiDAR, cameras, and others allows advanced safety features like accident avoidance and mitigation, speeding warning and alerts, and adaptive cruise control system to detect and identify objects as well as track their movement The benefits of automotive sensor fusion are predicted to support market growth during the projection period.

Sensor fusion is the technique of combining data from various sensors using software algorithms to produce an equally thorough and accurate picture of the environment. In an automated driving system, sensors are essential for the perception of the environment around the car, and the use and functionality of numerous integrated sensors directly affect the viability and safety of automated driving vehicles. One of the key processes in automated driving applications is sensor fusion, which combines data from various sensors to lower uncertainty compared to using each sensor separately. The benefits of automotive sensor fusion are predicted to support market growth during the projection period.

Sensor data is gathered by autonomous vehicle systems, which then compute driving choices and communicate control signals to the vehicles. To combine the sensor outputs and give a more accurate image of the environment while reducing the uncertainties offered by sensor outputs, these systems are combined with multi-sensor fusion (MSF). Multi-sensor fusion (MSF) lacks knowledge of which sensors provide the most accurate data and how to appropriately combine the data the sensors produce; hence it is unable to completely remove uncertainties. It is projected that this aspect will limit market expansion.

On the basis of technology, the automotive sensor fusion market is segmented into radar sensor, IMU, image sensor, and others. In 2021, the IMU segment held the highest revenue share in the automotive sensor fusion market. An IMU is a sensor generally consisting of an accelerometer, gyroscope, and often a magnetometer. A device can get a complete picture of its orientation and motion state by looking at data from these sensors. The information provided by the sensors is used to hold a drone’s balance, enhance the heading of a home robot vacuum cleaner, change the orientation of a smartphone screen, and other motion-related applications.

By vehicle type, the automotive sensor fusion market is classified into passenger car, light commercial vehicle, and heavy commercial vehicle. The heavy commercial vehicle segment garnered a substantial revenue share in the automotive sensor fusion market in 2021. Sensor fusion does not penetrate heavy commercial vehicles. The vehicle height, longer range, and distance do, however, necessitate more cameras and radar for sensor fusion. Due to fleet managers' growing desire to transition to cutting-edge safety technology, trucks are anticipated to embrace sensor fusion technology before buses.

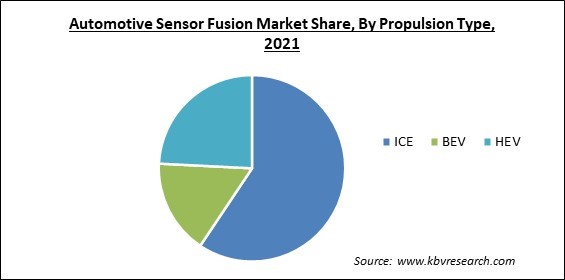

Based on propulsion type, the automotive sensor fusion market is divided into ICE, BEV, and HEV. The ICE segment witnessed the largest revenue share in the automotive sensor fusion market in 2021. A starter motor that will start the engine is installed in almost all cars. The starter battery feeds the alternator. The alternator, which the engine turns, recharges the battery. The electricity produced is used to power all auxiliary operations, including spark plugs, lights, and fans, as well as to recharge the starter battery. Alternator load adjustments may be possible in more sophisticated automobiles depending on the situation.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.8 Billion |

| Market size forecast in 2028 | USD 7.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 22.8% from 2022 to 2028 |

| Number of Pages | 235 |

| Number of Tables | 363 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Propulsion Type, Vehicle Type, Technology, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the automotive sensor fusion market is analyzed across North America, Europe, Asia, and LAMEA region. The North America region projected a prominent revenue share in the automotive sensor fusion market in 2021. The region's automotive sensor fusion market is expanding as a result of the growing use of advanced driver assistance systems (ADAS) and the development of autonomous vehicle technologies in commercial and passenger cars. The development of autonomous and semi-autonomous vehicles has been facilitated by strict governmental rules aimed at enhancing road safety. As a result, the market for automotive sensor fusion is anticipated to benefit greatly from the spike in the use of autonomous vehicles.

Free Valuable Insights: Global Automotive Sensor Fusion Market size to reach USD 7.3 Billion by 2028

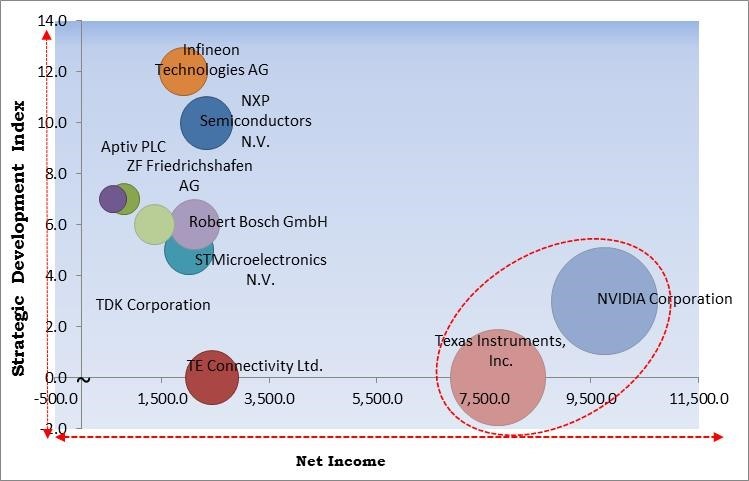

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Texas Instruments, Inc. and NVIDIA Corporation are the forerunners in the Automotive Sensor Fusion Market. Companies such as Infineon Technologies AG, NXP Semiconductors N.V., and Robert Bosch GmbH are some of the key innovators in Automotive Sensor Fusion Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include NVIDIA Corporation, NXP Semiconductors N.V., Robert Bosch GmbH, TE Connectivity Ltd., Infineon Technologies AG, ZF Friedrichshafen AG, TDK Corporation, STMicroelectronics N.V., Aptiv PLC, and Texas Instruments, Inc.

By Propulsion Type

By Vehicle Type

By Technology

By Geography

The global Automotive Sensor Fusion Market size is expected to reach $7.3 billion by 2028.

Government safety regulations that are strict are driving the market in coming years, however, A malfunctioning electronic sensor system in the vehicle restrict growth restraints the growth of the market.

NVIDIA Corporation, NXP Semiconductors N.V., Robert Bosch GmbH, TE Connectivity Ltd., Infineon Technologies AG, ZF Friedrichshafen AG, TDK Corporation, STMicroelectronics N.V., Aptiv PLC, and Texas Instruments, Inc.

The expected CAGR of the Automotive Sensor Fusion Market is 22.8% from 2022 to 2028.

The Passenger Cars segment acquired maximum revenue share in the Global Automotive Sensor Fusion Market by Vehicle Type in 2021 thereby, achieving a market value of $4.3 billion by 2028.

The Asia Pacific market dominated the Global Automotive Sensor Fusion Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $2.6 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.