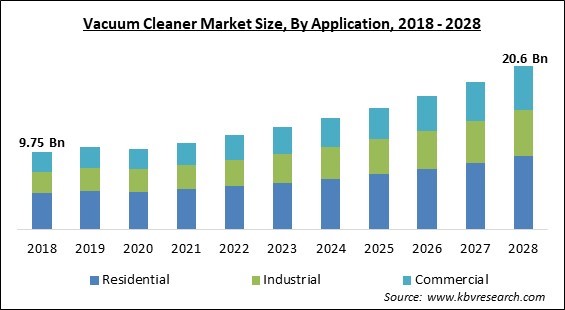

The Global Vacuum Cleaner Market size is expected to reach $20.6 billion by 2028, rising at a market growth of 9.6% CAGR during the forecast period.

A vacuum cleaner is a simple electric device that uses an air pump to collect dust and dirt from floors and other surfaces. A variation in air pressure is responsible for creating the suction in a vacuum. The pressure within the machine is decreased by a fan powered by an electric motor, which is frequently a universal motor. The dust is then effectively sucked into the bag as a result of atmospheric pressure forcing air across the surrounding objects like the carpet and through the nozzle.

According to tests, vacuuming may eliminate 96% of mature and 100% of baby fleas. High-efficiency particulate arrestor (HEPA) filters are increasingly becoming a common feature in many household vacuum cleaners. These filters are clean as well as work well against many dangerous bacteria, dust mites, and other impurities. In vacuum cleaners utilizing HEPA filters, UV disinfection technology is also provided. These filters are also easy to clean and maintain as they can be cleaned with water.

One of the main factors influencing the demand for them in the residential sector is the reduction in the time left for conducting home tasks as a result of the Work from Home (WFH) paradigm. Other important drivers responsible for the market's expansion include changing lifestyles, high disposable incomes, the rising purchasing power of the middle class, an increasing working population, and the need for equipment and appliances that are convenient to use.

Additionally, the development of robotic vacuum cleaners that are able to clean an area without the assistance of a human is also anticipated to benefit the market and fuel market expansion. For instance, Xiaomi introduced the Mijia sweeping robotic vacuum. This device aids in deep cleaning and gets rid of tough stains without the help of a person. The Mijia app can be used to control the gadget. The user can link the robot vacuum to additional smart home gadgets with the aid of this software.

Due to COVID-19, an increase in vacuum cleaner adoption has been noted. Vacuum cleaners are being used and preferred in a variety of locations to clean the area and lessen the risk of spreading dangerous illnesses to people. The COVID-19 outbreak established a number of limitations and requirements. As a result, it increased the need for cleaning personnel and contributed to a growth in the use of vacuum cleaners. This technology has been shown to be highly effective for thorough Cleaning and disinfection. Additionally, more hospitals were using robotic vacuum cleaners as it ensures hassle-free, automatic Cleaning of any living or working environment. The emergence of COVID-19 altered consumer preferences and opened up new market prospects. While initially seeing a decline in output, the vacuum cleaners market has been seen to rise steadily overall.

According to one definition, allergic diseases are immune system hypersensitivity disorders brought on by allergic inflammation induced by an allergen. Globally, respiratory allergies are one of the most prevalent types of allergies, and their incidence is rising. Numerous epidemiological studies have determined that the prevalence of these allergies ranges from 10 to 30%, with metropolitan regions often having a higher incidence of these allergies than rural ones. Therefore, the prevalence of allergies and lung diseases is pushing people to invest in vacuum cleaners, which in turn is boosting the growth of the market.

The development of eco-friendly vacuum cleaners is a major priority for manufacturers. The biggest opportunity for vacuum cleaner market players appears to be investing in integrated IoT technology, artificial intelligence, robots, and improvements in vacuum cleaners, including air filter technology, UV sterilization, and video surveillance by suppliers. Additionally, there is a growing market for autonomous home vacuum cleaners as a result of the general desire to cut down on cleaning time, particularly in households with several working members. Hence, the incorporation of innovative technologies in autonomous vacuum cleaners is significantly aiding in the expansion of the market in the coming years.

There is a huge affordability problem with many high-end vacuum cleaners. In developing nations, the middle class cannot afford advanced and highly efficient vacuum cleaners owing to their high prices. For instance, an advanced vacuum cleaner can cost between US$ 1,300 and 1,700, which is pricey when compared to other cleaning supplies for the home. Additionally, expensive maintenance costs are a major hindrance for household vacuum cleaners. Hence, these factors might force users to not buy vacuum cleaners and thus hamper the growth of the market.

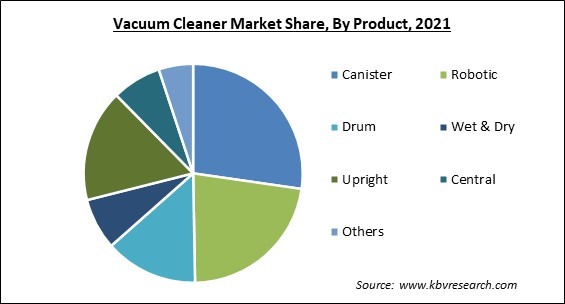

Based on product, the vacuum cleaner market is categorized into canister, central, drum, robotic, upright, wet & dry, and others. The upright segment acquired a promising growth rate in the vacuum cleaner market in 2021. Large surface areas covered by upright vacuum cleaners make them helpful in large homes. Traditional upright vacuum cleaners have been used from earlier times. A greater standard of cleaning precision is being introduced to household tasks, and health standards are both being improved by the rising popularity of upright vacuum cleaners.

On the basis of distribution channel, the vacuum cleaner market is divided into online and offline. The online segment recorded the largest revenue share in the vacuum cleaner market in 2021. The expansion can be linked to the worldwide application of lockdown measures with varied degrees of rigor to prevent the transmission of COVID-19. Since cleaning has become a necessary component of daily life across all application domains, businesses have shifted to selling their goods online. The process of selling and demonstrating products virtually made a significant contribution to the segment's growth.

Based on application, the vacuum cleaner market is segmented into industrial, residential, and commercial. The commercial segment procured a remarkable growth rate in the vacuum cleaner market in 2021. The segment's expansion is owed to its efficiency, speed, and enhanced accuracy as a result of the integration of ever-improving technology. Commercial-grade vacuums are designed to be more efficient than residential vacuums and to withstand heavy use. In addition, these vacuums are designed to be used consistently for long periods of time and can manage challenging spills and messes.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 11 Billion |

| Market size forecast in 2028 | USD 20.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9.6% from 2022 to 2028 |

| Number of Pages | 329 |

| Number of Tables | 604 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Distribution Channel, Application, Product, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

On the basis of region, the vacuum cleaner market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured the highest revenue share in the vacuum cleaner market in 2021. Some of the main variables influencing demand for vacuum cleaners in the Asia Pacific region include the substantial presence of local businesses, the accessibility of inexpensive goods, and customers' high purchasing power. In addition, in emerging nations like India, Vietnam, Thailand, etc., the demand for vacuums is being aided by the growing electrification of remote regions and the widespread usage of online sales platforms.

Free Valuable Insights: Global Vacuum Cleaner Market size to reach USD 20.6 Billion by 2028

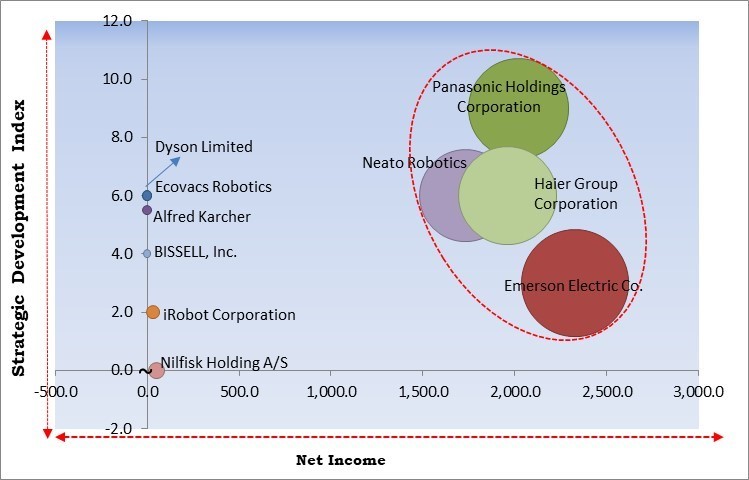

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Panasonic Holdings Corporation, Neato Robotics, Inc., Haier Group Corporation, and Emerson Electric Co. are the forerunners in the Vacuum Cleaner Market. Companies such as Ecovacs Robotics Co., Ltd., Alfred Karcher SE & Co. KG, BISSELL, Inc., and iRobot Corporation are some of the key innovators in Vacuum Cleaner Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Alfred Karcher SE & Co. KG, Dyson Limited, Ecovacs Robotics Co., Ltd., Emerson Electric Co., Haier Group Corporation, iRobot Corporation (Amazon.com, Inc.), Neato Robotics, Inc. (Vorwerk & Co. KG), Nilfisk Holding A/S, Panasonic Holdings Corporation, and BISSELL, Inc.

By Distribution Channel

By Application

By Product

By Geography

The global Vacuum Cleaner Market size is expected to reach $20.6 billion by 2028.

Growing awareness of indoor health as well as lung diseases and allergies are driving the market in coming years, however, High cost of vacuum cleaners and associated high electricity bills restraints the growth of the market.

Alfred Karcher SE & Co. KG, Dyson Limited, Ecovacs Robotics Co., Ltd., Emerson Electric Co., Haier Group Corporation, iRobot Corporation (Amazon.com, Inc.), Neato Robotics, Inc. (Vorwerk & Co. KG), Nilfisk Holding A/S, Panasonic Holdings Corporation, and BISSELL, Inc.

The expected CAGR of the Vacuum Cleaner Market is 9.6% from 2022 to 2028.

The Residential segment acquired maximum revenue share in the Global Vacuum Cleaner Market by Application in 2021 thereby, achieving a market value of $9.2 billion by 2028.

The Asia Pacific market dominated the Global Vacuum Cleaner Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $7.7 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.