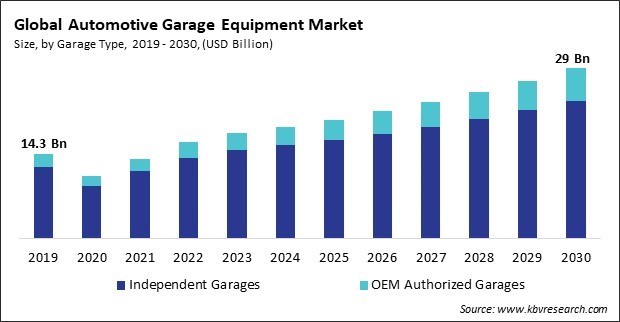

The Global Automotive Garage Equipment Market size is expected to reach $29.0 billion by 2030, rising at a market growth of 7.2% CAGR during the forecast period.

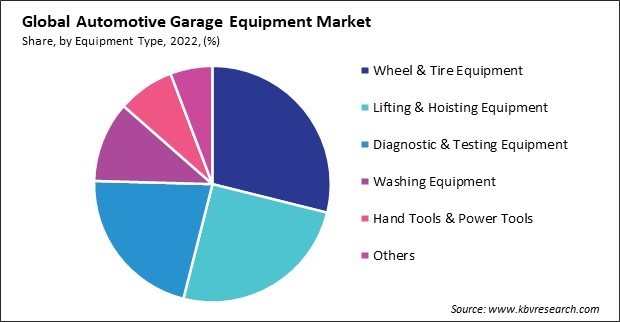

Diagnostic equipment accurately identifies vehicle issues by analyzing data from various systems. Therefore, thee diagnostic & testing equipment segment captured $3,505.5 million revenue in the market in 2022. Technicians can use OBD-II scanners, diagnostic software, and scan tools to pinpoint problems in the engine, transmission, electrical systems, and other components. Diagnostic equipment allows technicians to analyze the vehicle's electrical systems. This includes testing batteries, alternators, starters, and various electronic components. Accurate analysis of the electrical system helps prevent electrical failures and ensures the proper functioning of onboard electronics.

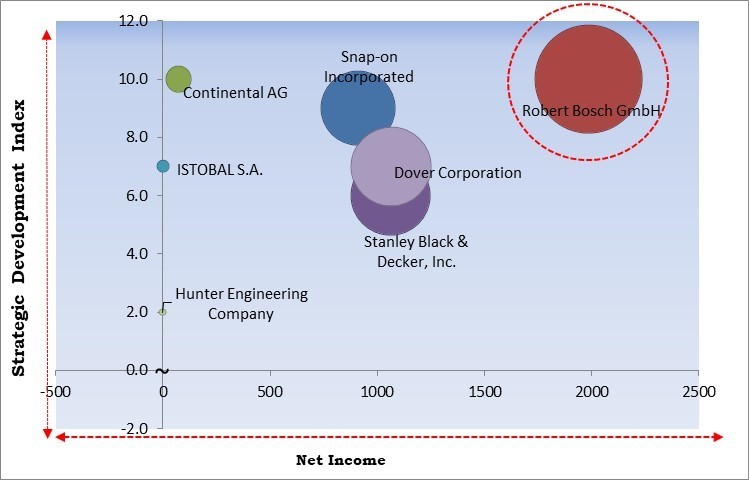

The major strategies followed by the market participants are Mergers & Acquisition and Partnerships, Collaborations & Agreements as the key developmental strategy to keep pace with the changing demands of end users. For instance, In July, 2023, Snap-on Incorporated expanded its partnership with INDYCAR, LLC and Indianapolis Motor Speedway, LLC. Additionally, the expanded partnership offers solutions to the technicians of both motorsports and other critical industries. Additionally, In November, 2023, Continental AG completed the acquisition of Vertech AB. Through this acquisition, the ContiTech group sector of Continental provided products and solutions packages to the industrial customers of Sweden and the countries of Northern Europe.

Based on the Analysis presented in the KBV Cardinal matrix; Robert Bosch GmbH is the forerunners in the market. In January, 2024, Robert Bosch GmbH formed a partnership with Qualcomm Technologies, Inc., a subsidiary of Qualcomm Incorporated. Under this partnership, the companies introduced the cockpit and ADAS integration platform based on the Snapdragon Ride Flex System-on-Chip (SoC). The cockpit and ADAS integration platform has the ability to run both the infotainment and the advanced driver assistance system (ADAS) functions on a single-on-chip (SOC). Companies such as Stanley Black & Decker, Inc., Snap-on Incorporated, Dover Corporation are some of the key innovators in the market.

As the vehicle parc expands, there is a proportional increase in the need for routine maintenance and repairs. Older vehicles require frequent servicing to address wear and tear, leading to a higher demand for garage equipment that can handle various tasks. Modern vehicles have advanced technologies, intricate electronics, and complex mechanical systems. While presenting maintenance challenges, the aging fleet also requires garage equipment with advanced diagnostic capabilities and specialized tools to address the complexity of newer vehicle models. With an aging fleet, there is a heightened emphasis on preventive maintenance to extend the lifespan of vehicles. This trend leads to the adoption of garage equipment that facilitates thorough inspections, timely component replacements, and preventive measures to address potential issues before they escalate. Thus, because of the increasing vehicle parc and aging fleet, the market is anticipated to increase significantly.

DIY enthusiasts often set up home garages or workshops to work on their vehicles. This has led to a surge in demand for compact, user-friendly, and versatile garage equipment suitable for home use, including hand tools, power tools, and portable automotive lifts. DIY enthusiasts often use diagnostic tools to identify and troubleshoot vehicle issues independently. The market for affordable and user-friendly diagnostic tools, such as OBD scanners and code readers, experiences growth as DIYers seek to perform their diagnostics. DIYers often have limited space in home garages, prompting the demand for portable and compact garage equipment. Portable toolkits, lightweight lifts, and space-saving storage solutions become popular among DIY enthusiasts looking for efficient and manageable setups. Hence, rising DIY automotive enthusiast community has been a pivotal factor in driving the growth of the market.

Small and independent automotive service providers, including local garages and repair shops, may struggle to make the initial investment required for advanced garage equipment. This barrier can limit the adoption of modern tools, hindering the growth of these businesses. The high cost of acquiring advanced garage equipment may impede the adoption of new technologies. Businesses may hesitate to invest in cutting-edge tools, limiting their ability to keep pace with technological advancements and industry trends. The financial burden of acquiring specialized tools may also affect individual technicians, particularly those in smaller businesses or self-employed professionals. High upfront costs can limit their ability to invest in their equipment, potentially affecting their career development and competitiveness. This imbalance may limit fair competition within the market.

Drivers

Drivers  Restraints

Restraints  Opportunities

Opportunities  Challenges

Challenges By equipment type, the market is categorized into lifting & hoisting equipment, diagnostic & testing equipment, wheel & tire equipment, hand tools & power tools, washing equipment, and others. In 2022, the wheel & tire equipment segment held the highest revenue share in the market. Wheel & tire equipment, including tire changers, streamline mounting and demounting tires. This efficiency saves technicians time and enhances the garage's overall productivity. Wheel balancers provide precise measurements and adjustments to ensure proper balance. Balanced wheels contribute to a smoother ride, improved fuel efficiency, and reduced wear on suspension components. Advanced wheel and tire equipment reduce the need for manual labor in tire-changing processes. Automatic or semi-automatic tire changers minimize physical effort, creating a safer and less labor-intensive working environment.

Based on garage type, the market is classified into OEM authorized garages and independent garages. The OEM authorized garages segment acquired a substantial revenue share in the market in 2022. OEM authorized garages can access the vehicle manufacturers’ latest repair and service information. This includes detailed specifications, technical bulletins, and software updates. Garages frequently invest in specialized tools and cutting-edge diagnostic equipment to meet these requirements. OEM authorized garages may use manufacturer-specific tools and equipment designed for vehicle models. These tools are often tailored to the unique specifications of the OEM’s engineering, contributing to the demand for specialized equipment.

Free Valuable Insights: Global Automotive Garage Equipment Market size to reach USD 29 Billion by 2030

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. The market in North America experiences continuous technological advancements. The diverse vehicle fleet in North America, comprising various makes and models, contributes to the demand for versatile garage equipment. The demand for advanced diagnostic equipment is particularly high in North America. The utilization of online sales channels for automotive garage equipment is growing in North America.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 16.3 Billion |

| Market size forecast in 2030 | USD 29 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 7.2% from 2023 to 2030 |

| Number of Pages | 220 |

| Number of Tables | 283 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Garage Type, Equipment Type, Region |

| Country scope |

|

| Companies Included | Stanley Black & Decker, Inc., ISTOBAL S.A., Snap-on Incorporated, Robert Bosch GmbH, VisiCon Automatisierungstechnik GmbH, Symach s.r.l., Dover Corporation, MAHA Maschinenbau Haldenwang GmbH & Co. KG, Continental AG, Hunter Engineering Company |

By Garage Type

By Equipment Type

By Geography

This Market size is expected to reach $29.0 billion by 2030.

Increasing vehicle parc and aging fleet are driving the Market in coming years, however, Adverse impact of high initial investment restraints the growth of the Market.

Stanley Black & Decker, Inc., ISTOBAL S.A., Snap-on Incorporated, Robert Bosch GmbH, VisiCon Automatisierungstechnik GmbH, Symach s.r.l., Dover Corporation, MAHA Maschinenbau Haldenwang GmbH & Co. KG, Continental AG, Hunter Engineering Company

The expected CAGR of this Market is 7.2% from 2023 to 2030.

The Independent Garages segment is generating highest revenue in the Market by Garage Type in 2022; there by, achieving a market value of $23.4 billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; there by, achieving a market value of $9.7 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.