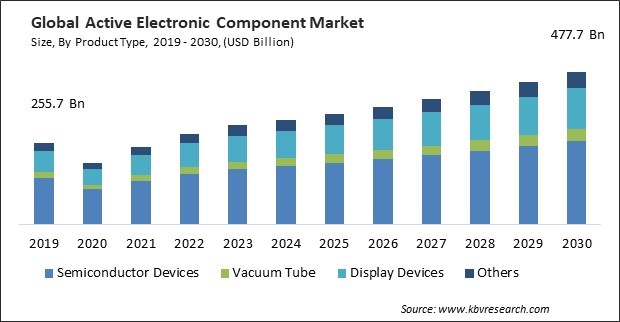

The Global Active Electronic Component Market size is expected to reach $477.7 billion by 2030, rising at a market growth of 6.4% CAGR during the forecast period. In the year 2022, the market attained a volume of 5,381.6 million units, experiencing a growth of 5.2% (2019-2022).

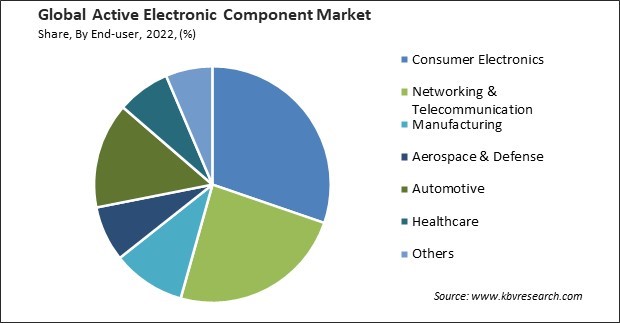

The trend of urbanization is linked to population growth. As more people move to urban areas, there's often an increased demand for consumer electronics due to the need for connectivity, entertainment, and productivity tools. Therefore, the Consumer Electronics segment would acquire around 30% share in the market by 2030. The rollout of 5G networks worldwide is expected to impact consumer electronics. Devices will need to support faster data speeds and lower latency, requiring components like RF (Radio Frequency) modules and antennas to enable 5G connectivity. The Internet of Things ecosystem is expanding, developing IoT devices for smart homes, wearables, and connected appliances. These devices require a range of electronic components, including sensors, microcontrollers, and wireless communication modules.

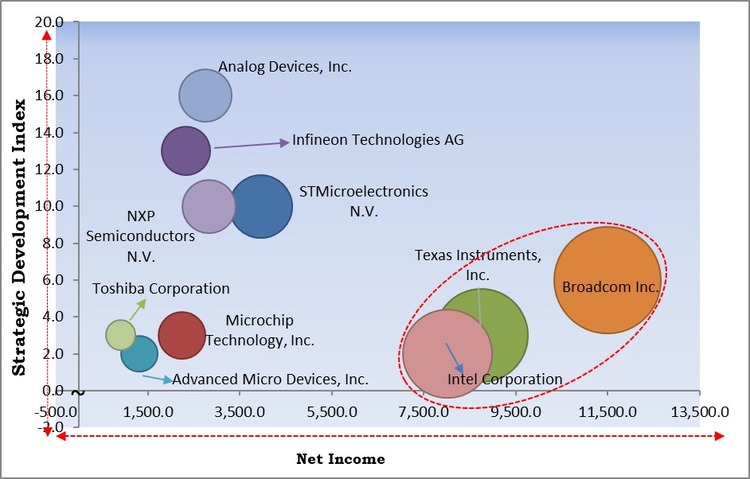

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In August 2023, Intel Corporation entered into an agreement with Synopsys, Inc., to serve the foundry customers of Intel by developing Intel 3 and Intel 18A using IP (intellectual property) and EDA (electronic design automation). Additionally, In June 2023, Infineon Technologies AG entered into a partnership with Kontrol Technologies Corp, to develop an algorithm-based solution which controls the legal controls and the boundary settings for vehicles.

Based on the Analysis presented in the KBV Cardinal matrix; Broadcom Inc., Intel Corporation and Texas Instruments, Inc. are the forerunners in the Market. In December, 2022, Broadcom Inc. collaborated with Rohde & Schwarz, to launch the automated test solution for Broadcom Wi-Fi 7 chipsets which supports simultaneous dual-band 2×2 IEEE 802.11be compliant operation. Companies such as Analog Devices, Inc., NXP Semiconductors N.V., STMicroelectronics N.V. are some of the key innovators in the Market.

Precision and accuracy are critical in industrial processes. Active components like sensors, encoders, and feedback control systems provide the necessary data and control mechanisms to ensure precise operations. Industrial automation systems, including programmable logic controllers, sensors, and actuators, streamline manufacturing processes, increasing productivity and reducing production time. Active electronic components facilitate the operation and communication of these systems. In addition, for efficiency and responsiveness, remotely monitoring and controlling industrial operations is essential. These factors will pose a lucrative prospect for the market in the coming years.

EVs use power electronics components like inverters and converters to manage the flow of electricity between the battery pack and the electric motor. These components control power delivery, regenerative braking, and charging. Battery Management Systems (BMS) components monitor the battery pack's state of charge, health, and temperature. They ensure safe and efficient operation while maximizing battery life. Electric drive systems include electric motors, motor controllers, and sensors. Moreover, autonomous vehicles use a variety of sensors, including radar, LiDAR, cameras, and ultrasonic sensors, to perceive their environment. Autonomous vehicles must communicate with other vehicles, infrastructure, and data centres. Electronic components for vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication are integral.

The semiconductor supply-demand imbalance can indeed have a significant impact on the market. As semiconductors become scarcer and more expensive due to supply imbalances, manufacturers of active electronic components may face challenges in sourcing the necessary semiconductor components. This can lead to production delays and reduced availability of active components. The rising prices of semiconductors can drive up manufacturing costs for active electronic components, potentially leading to higher prices for end consumers. This can affect the competitiveness of products and reduce profit margins for manufacturers. Longer lead times for semiconductor components can also extend the lead times for active electronic component manufacturers. Delays in receiving critical semiconductor inputs can disrupt production schedules and customer deliveries.

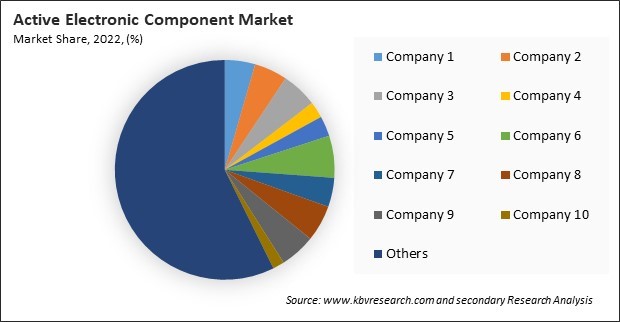

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

On the basis of end-user, the market is segmented into consumer electronics, networking & telecommunication, automotive, manufacturing, aerospace & defense, healthcare, and others. The automotive segment witnessed a promising revenue share in the market in 2022. The automotive industry is undergoing a major shift toward electric and hybrid vehicles. These vehicles rely heavily on advanced active electronic components, including power electronics, sensors, and control systems. The demand for components like power inverters, motor drives, and battery management systems is expected to surge as automakers expand their electric vehicle portfolios. ADAS technologies, such as adaptive cruise control, lane-keeping assistance, and automated emergency braking, are becoming standard features in modern vehicles. These systems heavily rely on sensors, radar, LiDAR, and cameras, driving the demand for high-performance sensors.

Based on product type, the market is divided into semiconductor devices, vacuum tube, display devices, and others. In 2022, the display devices segment garnered a considerable revenue share in the market. The consumer electronics industry continues to be a significant driver of demand for display devices, which includes smartphones, tablets, laptops, TVs, gaming consoles, and wearables. As consumers seek higher-resolution screens, faster refresh rates, and innovative form factors, manufacturers are under pressure to develop advanced display technologies to meet these demands. OLED (Organic Light-Emitting Diode) displays have gained popularity for their vibrant colors, deep blacks, and flexibility. Mini-LED and Micro-LED displays are also emerging as alternatives to traditional LCDs, offering improved brightness and contrast. These technologies are likely to witness increased adoption in various applications. All these benefits will help to boost the demand for display devices in the coming years.

The semiconductor devices segment is sub-segmented into diode, transistors, integrated circuits (ICs), and optoelectronics. In 2022, the transistors subsegment recorded a substantial revenue share in the market. Automobile electronics use transistors for engine control units (ECUs), infotainment systems, and safety features. The demand for transistors may increase as the automotive industry evolves with electric and autonomous vehicles. The rollout of 5G networks and the ongoing expansion of telecommunications infrastructure require a wide range of transistors, including RF transistors and power amplifiers. Transistors are key components in power electronics for voltage regulation and switching tasks.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 293.9 Billion |

| Market size forecast in 2030 | USD 477.7 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 6.4% from 2023 to 2030 |

| Number of Pages | 460 |

| Number of Table | 813 |

| Quantitative Data | Volume in Million Units, Revenue in USD Million, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Product Type, End-user, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the market is divided into North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific segment procured the highest revenue share in the market in 2022. Asia Pacific, particularly countries like China, Taiwan, South Korea, and Japan, has long been known as a manufacturing hub for electronic components and devices. Many leading semiconductor manufacturers and electronic component suppliers are based in this region. The Asia Pacific region is home to a significant portion of the world's population, driving high demand for consumer electronics. This includes smartphones, laptops, televisions, and other electronic devices relying on active components. Owing to these factors, the segment will proliferate in the future.

Free Valuable Insights: Global Active Electronic Component Market size to reach USD 477.7 Billion by 2030

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Technologies AG, Advanced Micro Devices, Inc., STMicroelectronics N.V., Microchip Technology, Inc., Analog Devices, Inc., Broadcom Inc., NXP Semiconductors N.V., Intel Corporation, Texas Instruments, Inc., Toshiba Corporation, Skillsoft Corporation.

By Product Type (Volume, Million Units, USD Million, 2019 to 2030)

By End User (Volume, Million Units, USD Million, 2019 to 2030)

By Geography (Volume, Million Units, USD Million, 2019 to 2030)

This Market size is expected to reach $477.7 billion by 2030.

Rising automation in a wide range of industries are driving the Market in coming years, however,Rising semiconductor supply-demand imbalance restraints the growth of the Market.

Technologies AG, Advanced Micro Devices, Inc., STMicroelectronics N.V., Microchip Technology, Inc., Analog Devices, Inc., Broadcom Inc., NXP Semiconductors N.V., Intel Corporation, Texas Instruments, Inc., Toshiba Corporation, Skillsoft Corporation.

In the year 2022, the market attained a volume of 5,381.6 million units, experiencing a growth of 5.2% (2019-2022).

The Semiconductor Devices segment is leading in the Market by Product Type in 2022 thereby, achieving a market value of $260.1 billion by 2030.

The Asia Pacific region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $243.6 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.