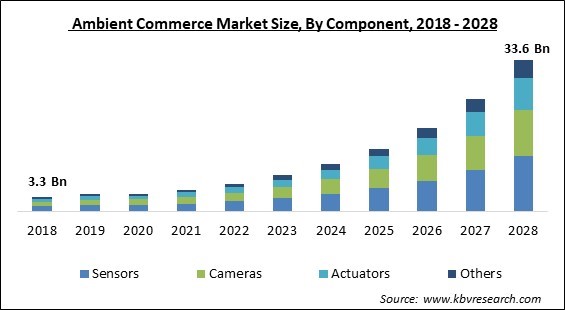

The Global Ambient Commerce Market size is expected to reach $33.6 billion by 2028, rising at a market growth of 32.4% CAGR during the forecast period.

With ambient commerce, also known as checkout-free retail, customers can leave stores with their desired goods in hand. Without the use of lines or cash registers, a variety of artificial intelligence (AI) technologies monitor their movements and automatically charge their accounts. Retailers are getting more inventive as they work to entice customers back into physical stores after the lockdown restrictions were relaxed. By implementing this method of shopping in a few of their branches, retailers like Amazon, Tesco, and Aldi are influencing the future of grocery shopping.

To give customers a multisensory purchasing experience, ambient commerce blends the internet of things (IoT), artificial intelligence (AI), augmented reality (AR), sensors, actuators, as well as other cutting-edge technology. The ease of purchasing, restocking, and cheaper store operating expenses are a few advantages of ambient commerce that can be used to explain the market's expansion. Additionally, it offers various e-commerce information, including data on financial transactions, consumer preferences, and behavioral trends.

Due to the fact that ambient commerce enables customers to leave businesses with the merchandise they want without waiting for the checkout procedure, it is sometimes referred to as checkout-free retail. There is no need to wait in long lines because a variety of AI technologies and cameras monitor the customer's activities and charge them for the purchased items immediately from their account or digital wallets.

The COVID-19 pandemic outbreak is anticipated to further stimulate the ambient commerce business. The pandemic has accelerated the adoption of online and contactless payment methods, leading many merchants to embrace cutting-edge technology like ambient computing. Retailers are implementing long-term strategies that can give their customers a sensory shopping experience while also providing the highest levels of safety and ease. Following the pandemic, consumer awareness of ambient products has increased.

Smart devices are distinctive electronic devices that can communicate, share, and collaborate with the user as well as other smart devices nearby. World's population growth has increased the use of smart cities and smart spaces for cost- and energy-effectiveness, which has increased the acceptance of smart houses. In smart homes, ambient intelligence can be used for a wide range of purposes, including music playback, voice interaction, podcast streaming, playing audiobooks, giving real-time information, and more. Owing to this, the ambient commerce market would grow over the projection period.

Numerous of these key elements of the consumer experience such as the absence of fitting rooms, interactions with retail associates, acceptance of cash payments, and in-store product testing were put to the ultimate test during the Covid-19 pandemic and the resulting social isolation. In-store checkout automation now heavily relies on radio-frequency identification (RFID) tags. As their name implies, RFID tags are very small strips of metal that send information via radio waves about the object to which they are attached. All these factors are supporting the market growth for ambient commerce.

Numerous retailers lack the necessary network and infrastructure components that the vast volumes of IoT data demand. Retailers need a cloud solution, a robust network, and end-user solutions such as tablets, barcode scanners, and mPOS to digitalize their physical stores. The retailers must make a significant investment in these items. Owing to these elements, the ambient commerce market growth may decline over the projection period.

Based on components, the ambient commerce market is segmented into sensors, actuators, cameras and others. In 2021, the sensors segment dominated the ambient commerce market with the maximum revenue share. Various characteristics, including light, temperature, closeness, pressure, and movement, are detected by ambient sensors. These criteria enable ambient commerce to design a setting that can provide its clients with sensory purchasing experiences.

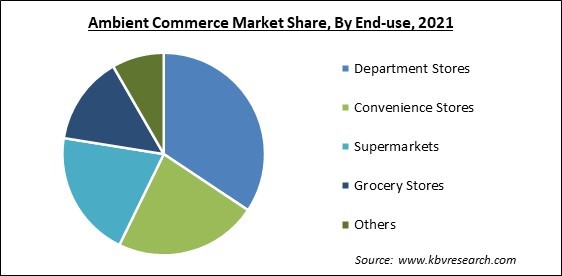

On the basis of end-use, the ambient commerce market is divided into grocery stores, convenience stores, supermarkets, department stores and others. In 2021, the convenience stores covered a substantial revenue share in the ambient commerce market. Despite the fact that in the preceding part the idea of ambient intelligence was still developed as a vision, some of the fundamental ideas have already been incorporated into business procedures. Simple AmI technologies are already utilized in the supply chain & manufacturing process to identify and track things. Due to this, the market would expand in this segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 4.8 Billion |

| Market size forecast in 2028 | USD 33.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 32.4% from 2022 to 2028 |

| Number of Pages | 166 |

| Number of Tables | 290 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the ambient commerce market is analyzed across the North America, Europe, Asia Pacific and LAMEA. The North America region led the ambient commerce market with the largest revenue share in 2021. Some significant market participants are present in North America, including Apple Inc. and Amazon.com. Businesses in North American nations are making significant investments in cutting-edge technologies like IoT, AI, and big data. Additionally, customers have shown to be more open to new technologies than in the past, which is encouraging the region's adoption of ambient commerce.

Free Valuable Insights: Global Ambient Commerce Market size to reach USD 33.6 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Apple, Inc., Amazon.com, Inc., Tesco PLC, Alibaba Group Holding Limited, Trigo Vision Ltd., Adroit Worldwide Media, Inc., Grabango Co., Zippin, Standard Cognition, Corp., and Sensei.

By End-Use

By Component

By Geography

The global Ambient Commerce Market size is expected to reach $33.6 billion by 2028.

Rising demand for smart gadgets are driving the market in coming years, however, Inadequate infrastructure restraints the growth of the market.

Apple, Inc., Amazon.com, Inc., Tesco PLC, Alibaba Group Holding Limited, Trigo Vision Ltd., Adroit Worldwide Media, Inc., Grabango Co., Zippin, Standard Cognition, Corp., and Sensei.

The expected CAGR of the Ambient Commerce Market is 32.4% from 2022 to 2028.

The Department Stores market is leading the Global Ambient Commerce Market by End-use in 2021, thereby, achieving a market value of $11 billion by 2028.

The North America market dominated the Global Ambient Commerce Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $12.5 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.