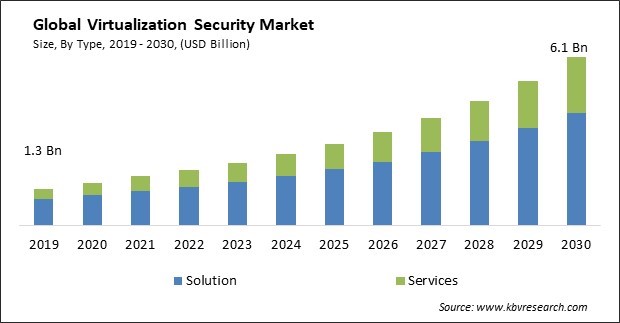

The Global Virtualization Security Market size is expected to reach $6.1 billion by 2030, rising at a market growth of 15.2% CAGR during the forecast period.

As organizations continue to migrate their applications into virtualized environments, the need for robust application security becomes increasingly vital. Consequently, the application security tools segment would generate approximately 30% share of the market by 2030. Application security tools within this segment are specifically designed to identify, assess, and mitigate vulnerabilities and threats that target applications running in virtualized environments. One of the primary drivers of the growth acquired by this subsegment is the growing sophistication of cyber threats targeting applications. As more critical business applications are virtualized, they become crucial targets for attackers seeking to exploit vulnerabilities or launch application-layer attacks.

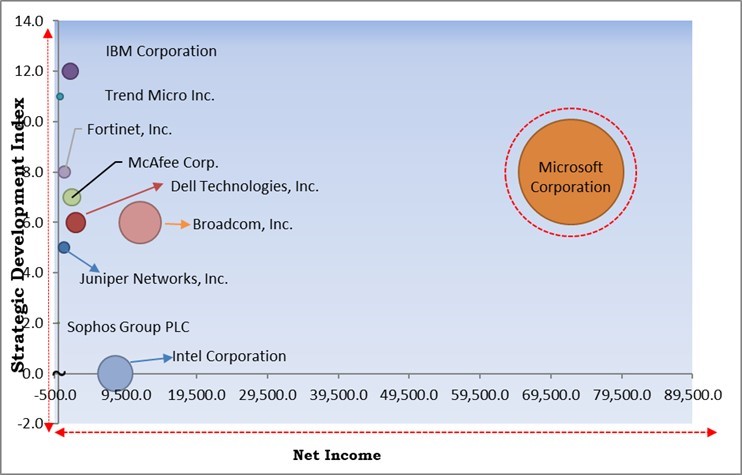

The major strategies followed by the market participants are Product Launches and Partnerships, Collaborations & Agreements as the key developmental strategy to keep pace with the changing demands of end users. For instance, In August 2023, Fortinet, Inc. introduced the FortiGate 90G, featuring the new security processing unit 5 (SP5) ASIC, offering top-tier AI-driven threat protection performance, scalability, and cost-efficiency. In March 2023, IBM Corporation collaborated with Cohesity, a leader in data security and management, to enhance data security and resilience in hybrid clouds. Under the collaboration, companies will launch IBM Storage Defender, integrating Cohesity's data protection.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation is the forerunner in the Market. Companies such as Fortinet, Inc., Broadcom, Inc., Dell Technologies, Inc. are some of the key innovators in the Market. In May, 2023, Dell Technologies, Inc. unveiled Project Fort Zero, an end-to-end Zero Trust security solution for global organizations to defend against cyberattacks. It will receive validation from the U.S. Department of Defense and expands Dell's security portfolio.

Organizations' adoption of virtualization technologies has been a significant and transformative trend in information technology (IT) and business operations. Server virtualization involves running multiple virtual machines (VMs) on a single physical server. This technology allows organizations to better use their server hardware by consolidating workloads. It also offers benefits like hardware abstraction, resource allocation, and easier management. Popular server virtualization platforms include VMware vSphere, Microsoft Hyper-V, and KVM. Furthermore, network virtualization abstracts network resources, enabling the creation of virtual networks within physical networks. The adoption of virtualization technologies has revolutionized IT operations and continues to evolve as organizations seek to leverage these technologies for enhanced efficiency, agility, and competitiveness. Therefore, the demand will increase significantly.

Increasing an organization's agility and adaptability to changing market conditions and client needs is one of the main objectives of digital transformation. Virtualization provides the agility and flexibility needed to quickly provision and scale IT resources, enabling organizations to respond to business needs rapidly. The attack surface expands as organizations adopt cloud services, IoT devices, and mobile technologies. Virtualization can create secure sandboxes for testing, isolating potentially vulnerable components, and enforcing access controls. Virtualization solutions, for example, virtual desktop infrastructure (VDI) and application virtualization, enable secure remote access to critical business applications and data, facilitating the transition to remote work. Therefore, all these factors will propel the demand in the market.

The dynamic nature of virtualized environments can lead to a lack of visibility into what is happening within the infrastructure. This can make it difficult to detect abnormal activities or security breaches. Ensuring proper isolation between VMs, containers, and microservices is crucial to preventing lateral movement of threats. Misconfigurations or vulnerabilities in isolation mechanisms can lead to security breaches. Securing individual microservices within containers can be challenging. Each microservice may have security requirements, and enforcing security policies for each can be complex. Automation tools and orchestration platforms must be secured in virtualized environments to prevent unauthorized access or malicious manipulation. Owing to these factors, there can be a decreased demand in the market.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

By vertical, the market is divided into BFSI, government & defense, IT & telecom, healthcare & life sciences, retail & eCommerce, manufacturing, education, and others. In 2022, the government & defense segment attained a significant revenue share in the market. Governments and defense organizations place a high premium on security due to the sensitive nature of their operations and data. They are often early adopters of advanced security technologies, including virtualization security solutions, to protect against cyber threats and espionage. Government agencies and defense organizations handle vast amounts of sensitive and classified information. The need to safeguard this data from theft or unauthorized access drives the adoption of virtualization security measures that can provide granular control and encryption. Therefore, the segment is expected to grow rapidly in the coming years.

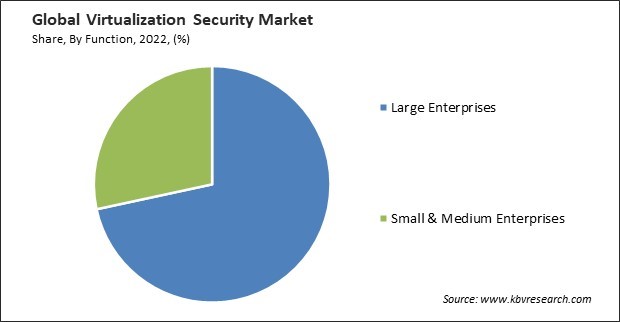

Based on organization size, the market is bifurcated into small & medium enterprises and large enterprises. In 2022, the large enterprises segment held the maximum revenue share in the market. Large enterprises typically have complex IT environments with many virtualized resources spread across data centers and cloud environments. Virtualization introduces unique security challenges, such as VM escape vulnerabilities, hypervisor attacks, and inter-VM communication risks. Large enterprises recognized the importance of addressing these concerns to safeguard their data and applications. Owing to these factors, there will be an increased demand in the large enterprises segment in the upcoming years.

By type, the market is divided into solutions and services. In 2022, the services segment garnered a substantial revenue share in the market. Managed security service providers (MSSPs) offer ongoing monitoring and management of virtualization security measures. This includes real-time threat detection, incident response, and the application of security patches and updates to keep virtualized environments secure. Security service providers offer training and educational programs for IT staff and employees to raise awareness about security best practices within virtualized environments. These programs help organizations build a security-conscious workforce. As a result, these factors will propel the demand in the service segment.

The solution segment is further segmented into anti-malware/anti-virus, application security tools, and data centers/servers security tools. The anti-malware/anti-virus subsegment procured the maximum revenue share in the market in 2022. Malware and viruses remain persistent and evolving threats in the digital realm. As organizations increasingly rely on virtualization to enhance operational efficiency and resource utilization, they must also defend against malware that can exploit vulnerabilities within virtualized environments. The anti-malware/anti-virus addresses this concern by providing real-time protection against various malware types, including viruses, Trojans, ransomware, and spyware. Therefore, the subsegment will witness an increased demand in the coming years.

On the basis of the deployment type, the market is segmented into on-premises and cloud. The on-premise segment witnessed the highest revenue share in the market in 2022. On-premise solutions give organizations greater control and customization over their virtualization security infrastructure. This level of control is significant for large enterprises with unique security requirements and sensitive data. On-premises virtualization security can offer the advantage of reduced network latency compared to cloud-based solutions, making it suitable for these use cases. These factors will boost the demand for virtualization security in the on-premises segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 2 Billion |

| Market size forecast in 2030 | USD 6.1 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 15.2% from 2023 to 2030 |

| Number of Pages | 366 |

| Number of Table | 553 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Organization Size, Deployment Type, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the virtualization security market is divided into North America, Europe, Asia Pacific, and LAMEA. The North America segment held the maximum revenue share in the virtualization security market in 2022. High-profile cyberattacks and data breaches have raised cybersecurity awareness in North America. Organizations increasingly invest in security solutions to protect their virtualized environments from evolving cyber threats, including those targeting virtualization technologies. North America has stringent data protection and privacy regulations, such as the California Consumer Privacy Act (CCPA). Compliance with these regulations requires organizations to implement security measures for virtualized environments. Owing to these factors, the North America segment will have a high demand.

Free Valuable Insights: Global Virtualization Security Market size to reach USD 6.1 Billion by 2030

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include IBM Corporation, Trend Micro Inc., Juniper Networks, Inc., Dell EMC (Dell Technologies, Inc.), Intel Corporation, Microsoft Corporation, Fortinet, Inc., Broadcom, Inc., Sophos Group PLC (Thoma Bravo) and McAfee Corp.

By Vertical

By Organization Size

By Type

By Deployment Type

By Geography

The Market size is projected to reach USD 6.1 billion by 2030.

Widespread adoption of virtualization technologies are driving the Market in coming years, however, Challenges related to the complexity of virtualized environments restraints the growth of the Market.

IBM Corporation, Trend Micro Inc., Juniper Networks, Inc., Dell EMC (Dell Technologies, Inc.), Intel Corporation, Microsoft Corporation, Fortinet, Inc., Broadcom, Inc., Sophos Group PLC (Thoma Bravo) and McAfee Corp.

The expected CAGR of this Market is 15.2% from 2023 to 2030.

The Solution segment is leading the Market by Type in 2022; thereby, achieving a market value of $4.1 billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $2,307.1 Million by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.