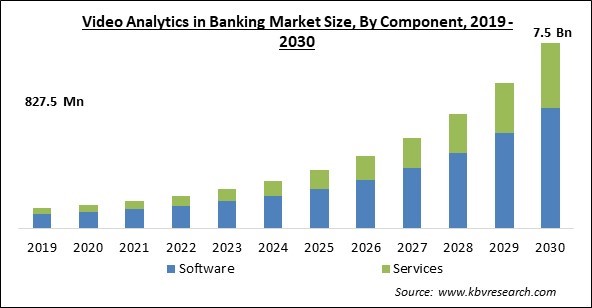

The Global Video Analytics in Banking Market size is expected to reach $7.5 billion by 2030, rising at a market growth of 24.9% CAGR during the forecast period.

The rapid expansion of e-commerce, online transactions, and digital services has led to a rapid expansion of the digital economy across the Asia Pacific region. Thus, the Asia Pacific region generated $374.9 million revenue in the market in 2022. This expansion has increased the need for video analytics to find and address potential fraud, security holes, and other irregularities in these digital transactions. Growing banking services, fintech developments, and increased digital payments contribute to the regional banking services sector's rapid growth. For anti-money laundering (AML) initiatives, fraud prevention, and regulatory compliance in this industry, these solutions are essential. Some of the factors impacting the market are increased use of cameras with high resolution, growing innovation within the financial sector, and governmental guidelines for CCTV surveillance.

Organizations can do precise and complex video analyses because of the rising deployment of high-resolution cameras like 4k or 8k. High-resolution movies also make it easier to recognize and analyze crowd members, set off alarms when specific criteria are fulfilled, filter and search videos, and, more precisely, derive insights from video metadata. Furthermore, more camera pixels offer better digital zoom capabilities to improve long-distance vision. Therefore, such developments are causing the banking industry to adopt video analytics, thereby propelling the growth of the market. Additionally, BFSI firms are boosting their investments in artificial intelligence (AI) and machine learning solutions to revolutionize the management of financial institutions so that they can offer improved services to end users and automate the required solutions. In addition, as the BFSI sector became more complicated and competitive, the need for industry-specific solutions grew to assist businesses in achieving their objectives. Major financial institutions like Bank of America, JPMorgan, and Morgan Stanley are making significant investments in data mining, HD security cameras, statistics, machine learning (ML), and AI technologies for the development of video analytics solutions to detect red flags like money laundering methods and for other fraud cases. This is expected to provide a lucrative opportunity for the growth of market.

However, despite the advantages provided by video analytics, there are numerous privacy issues that people have frequently brought up. Because of this, developed countries like the UK and the US are requiring the application of video analytics in banking, but only in specific locations and with limited capacity. For instance, in October of 2021, the European Parliament adopted a resolution that establishes limitations on the creation of individual face recognition databases as well as the application of facial recognition technology by law enforcement officers in public areas. As a result, it is projected that stringent regulations will limit the market expansion.

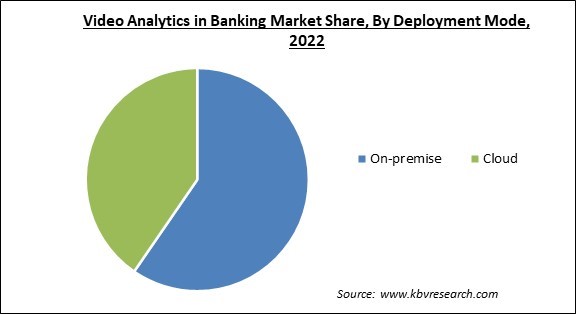

On the basis of deployment mode, the market is classified into on-premise and cloud. The on-premise segment acquired the largest revenue share in the market in 2022. An on-premise approach has several benefits for businesses that want more control over IT choices, setups, and modifications related to their video content analytics installations. An organization has more control over configurations and updates when it owns its hardware and software; for example, no modifications to the system may be performed without the end user organization considering the pros and cons and making judgments. In these cases, the end-user has complete authority over system expansion, updates, and management rather than the vendor.

Based on component, the market is characterized into software and service. The software segment garnered the highest revenue share in the market in 2022. Software that watches and analyzes video is known as video analytics software. Using automated algorithms, video analytics software can recognize, detect, and examine videos' actions, behavior, and content. The efficient operation of surveillance software can be greatly increased by video analytics. The closed-circuit television (CCTV) security cameras, a network video recorder (NVR), or a third-party plugin or built-in video management software (VMS) can all come pre-installed with video analytics software (CCTV software). Users may select the ideal hardware for the security surveillance infrastructure using an open VMS platform.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

By application, the market is divided into security & fraud detection, customer behavior analysis, queue management, ATM monitoring, and others. The ATM monitoring segment garnered a remarkable growth rate in the market in 2022. ATMs are becoming increasingly important in how clients conduct business as many banks close their physical locations to save money. ATMs are still seen as a necessary service despite the global transition to mobile and internet banking and projections of an eventually cashless future. Managers and IT teams can examine network availability issues, security breaches, and unsuccessful customer contacts more thoroughly with the help of real-time ATM monitoring and transaction data.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 1.3 Billion |

| Market size forecast in 2030 | USD 7.5 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 24.9% from 2023 to 2030 |

| Number of Pages | 242 |

| Number of Table | 351 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Application, Deployment Mode, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. The North America segment procured the highest revenue share in the market in 2022. The presence of many of the most prosperous financial software companies has aided the regional market's growth. These businesses include Citigroup, JPMorgan Chase, and Bank of America. Innovative banking security products like video analytics that can aid in process optimization and increase competitiveness are greatly needed by these firms. The sizeable and well-established information technology sector in North America has also aided in the development of such solutions.

Free Valuable Insights: Global Video Analytics in Banking Market size to reach USD 7.5 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Senstar Technologies Ltd., Zhejiang Dahua Technology Co., Ltd, Axis Communications AB (Canon, Inc.), AllGoVision Technologies Pvt. Ltd, IBM Corporation, Wipro Limited, Bosch Security Systems GmbH (Robert Bosch GmbH), Grekkom Technologies, Avigilon Corporation (Motorola Solutions), and Eagle Eye Networks, Inc.

By Component

By Application

By Deployment Mode

By Geography

This Market size is expected to reach $7.5 billion by 2030.

Increased use of cameras with high resolution are driving the Market in coming years, however, Governmental guidelines for CCTV surveillance restraints the growth of the Market.

Senstar Technologies Ltd., Zhejiang Dahua Technology Co., Ltd, Axis Communications AB (Canon, Inc.), AllGoVision Technologies Pvt. Ltd, IBM Corporation, Wipro Limited, Bosch Security Systems GmbH (Robert Bosch GmbH), Grekkom Technologies, Avigilon Corporation (Motorola Solutions), and Eagle Eye Networks, Inc.

The Cloud segment has shown the high growth rate of 26.8% during (2023 - 2030).

Security & Fraud Detection segment is leading the Market by Application in 2022 thereby, achieving a market value of $2.2 billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $2.5 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.