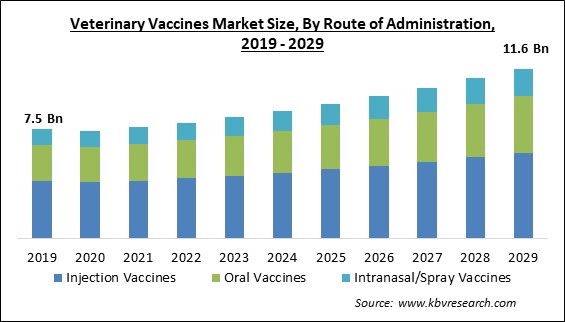

The Global Veterinary Vaccines Market size is expected to reach $11.6 billion by 2029, rising at a market growth of 5.8% CAGR during the forecast period.

Companion animal vaccines constitute approximately 1/5th share of the market by 2029. Younger pets may not be able to fight off certain infectious infections on their own, and older animals still need booster shots to maintain the vaccine's ability to prevent illness spread. Pet owners are providing almost all the facilities to their pets for a better and healthy life. For example, as per the People's Dispensary for Sick Animals (PDSA) PDSA Animal Wellbeing (PAW) report published in 2023, 53% of UK adults own a pet, including 29% of the adults in the UK who own a dog, 24% own a cat, and 2% own a rabbit. This leads to a rise in companion animal vaccines.

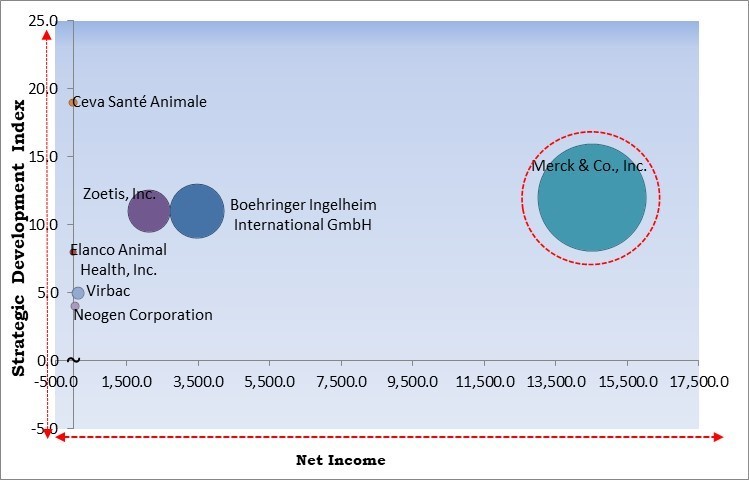

The major strategies followed by the market participants are Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September, 2021, NEOGEN Corporation acquired CAPInnoVet, Inc to offer NEOGEN a pathway into the parasiticide market and naturally aligns with NEOGEN's Animal Safety business segment. In addition, Ceva Santé Animale took over Zoovet and Biotecnofe in December 2022 for delivering access to a modern biotechnology facility. The facility would strengthen Ceva's activities in Latin America to aid pharmaceutical innovation.

Based on the Analysis presented in the Cardinal matrix; Merck & Co., Inc. are the forerunners in the Market. In August, 2022, Merck Animal Health, a division of Merck & Co., Inc., teamed up with Iowa State University, a public land-grant research university. This collaboration would be a public-private partnership that addresses complex requirements and expedites the delivery of animal health solutions to the industry. Companies such as Boehringer Ingelheim International GmbH, Ceva Santé Animale, and Zoetis Inc. are some of the key innovators in Market.

The demand for animal-derived foods such as cattle, veal, buffalo meat, mutton, lamb and goat meat, pork, poultry, milk, dairy products, and eggs are rising. Due to the high demand for animal dietary products, the livestock industry is anticipated to experience significant expansion. As a result, the need for livestock products like beef, milk, mutton, swine, and poultry (chicken and eggs) will increase rapidly in Asia, particularly in China and India. Increasing world population trends also contribute to the rise in demand for livestock. These aspects are boosting the market growth.

Over the past decade, vaccine technology has evolved significantly. This is primarily due to the constant emergence of novel diseases or the reappearance of diseases that have undergone mutation. Traditional live and inactivated vaccines are occasionally susceptible to mutation risks and have a limited shelf life. Likewise, the difficulty of strain/region specificity renders traditional vaccines ineffective. Technological advanced DNA and recombinant vaccines are being introduced to combat these restrictions. Thus, advancements in vaccine technology to increase its efficiency will surge the market growth in the projected period.

Manufacturers and vaccine distributors frequently use various vaccine storage and monitoring tools, including thermometers, refrigerators, and cold chain monitors. Depending on the size of the unit and the number of vaccines being stored, this can require a sizeable investment. Also, equipment for storing vaccines must be carefully chosen, routinely maintained (including professional servicing), and consistently monitored to maintain the necessary temperature. Because of the high costs associated with this technique, small organizations and companies with limited resources typically find it unsuitable, which is expected to hinder market growth in the projected period.

Based on type, the market is segmented into porcine vaccines, poultry vaccines, livestock vaccines, companion animal vaccines, aquaculture vaccines and others. The porcine vaccines segment acquired a substantial revenue share in the market in 2022. This is because pigs can be vaccinated to prevent them from a number of illnesses, including tapeworm infections, porcine reproductive respiratory syndrome, porcine parvovirus, classical swine fever, and foot and mouth disease. Some vaccines, particularly live vaccines, provide strong immunity while inactivated vaccines provide vaccinated animals a shorter duration of protection, which is expected to aid the segment's growth.

By technology, the market is classified into live attenuated vaccines, inactivated vaccines, toxoid vaccines, recombinant vaccines and others. The live attenuated vaccines segment held the highest revenue share in the market in 2022. This is because live vaccinations make use of a disease-causing bacterium that has been weakened (or attenuated). These vaccines produce a potent and robust immune response because they closely resemble an actual infection that they assist to avoid. Most live vaccines only require 1 or 2 doses to provide lifetime protection from a germ and the disease it produces, thereby boosting the segment's growth.

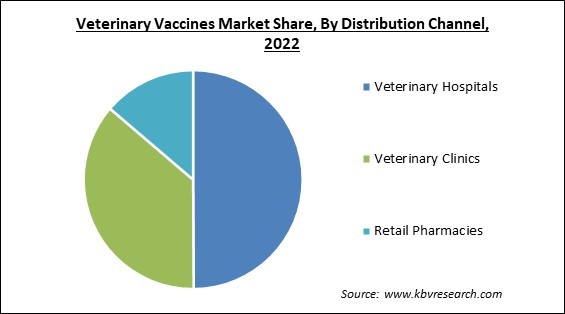

On the basis of distribution channel, the market is classified into veterinary hospitals, veterinary clinics and retail pharmacies. The veterinary clinics segment acquired a significant revenue share in the market in 2022. This is due to the majority of veterinary clinics providing preventative health care plans for the animals under their care. This strategy may prolong the pet's period of good health. Visits to these clinics can aid in maintaining the pet's top care. Also, these clinics veterinarian can further consult about matters relating to diet, exercise, immunizations, medications, and other concerns. Therefore, boosting the segment's growth.

Based on the route of administration, the market is bifurcated into injection vaccines, oral vaccines and intranasal/spray vaccines. The injection vaccines segment witnessed the largest revenue share in the market in 2022. The segment's expansion is predicted to be aided by the ease of administration of medications due to their sluggish absorption into the body. Additionally, the subcutaneous method of administration is less uncomfortable and speedier for animals. Furthermore, subcutaneous injectable administration is simpler to teach veterinary practitioners, which is further boosting the segment's growth.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 7.9 Billion |

| Market size forecast in 2029 | USD 11.6 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 5.8% from 2023 to 2029 |

| Number of Pages | 292 |

| Number of Table | 492 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Route of Administration, Type, Technology, Distribution Channel, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Australia, Malaysia, Brazil, Argentina, Egypt, Tanzania, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region led the market by generating the maximum revenue share in 2022. This is attributed to the increasing population of companion animals and the expansion of major players in several Asia Pacific nations. Animal husbandry is a significant source of income in numerous Asia-Pacific nations which is a significant reason for the region's large livestock population. In Asia-Pacific, the need for animal-based products like meat and milk is increasing, and so are livestock product revenues. Consequently, the adoption of veterinary vaccines has increased in this region as the necessity of maintaining animals' health and productivity increases.

Free Valuable Insights: Global Veterinary Vaccines Market size to reach USD 11.6 billion by 2029

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Zoetis, Inc., Merck & Co., Inc., Boehringer Ingelheim International GmbH, Elanco Animal Health, Inc., Virbac, Ceva Santé Animale, Neogen Corporation, Intas Pharmaceuticals Ltd. and Laboratoire LCV.

By Route of Administration

By Type

By Technology

By Distribution Channel

By Geography

The Market size is projected to reach USD 11.6 billion by 2029.

Technological advancement in vaccine to raise their efficiency are driving the Market in coming years, however, The high cost of storing veterinary vaccines restraints the growth of the Market.

Zoetis, Inc., Merck & Co., Inc., Boehringer Ingelheim International GmbH, Elanco Animal Health, Inc., Virbac, Ceva Santé Animale, Neogen Corporation, Intas Pharmaceuticals Ltd. and Laboratoire LCV.

The Veterinary Hospitals segment is generating highest revenue share in the Market by Distribution Channel in 2022, thereby, achieving a market value of $5.6 billion by 2029.

The Livestock Vaccines segment is leading the Market by Type in 2022 thereby, achieving a market value of $4.2 billion by 2029.

The Asia Pacific market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $4.2 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.