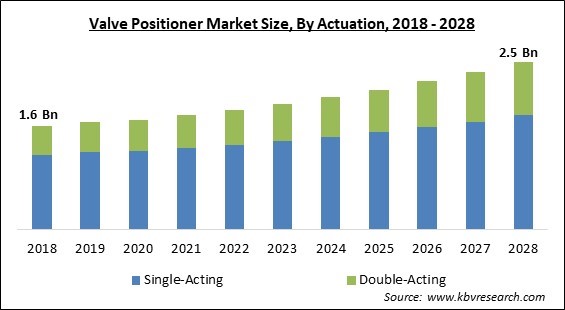

The Global Valve Positioner Market size is expected to reach $2.5 billion by 2028, rising at a market growth of 5.8% CAGR during the forecast period.

A valve positioner is equipment that operates on the feedback mechanism. The device fundamentally helps in positioning the valve accurately either by increasing or decreasing the pneumatic (air) load pressure on the actuator. The valve positioner detects the position of the valve and then proceeds to convey this data to another device, called an actuator, which then facilitates the movement of the valve. Generally, valve positioners are placed near the shaft end or on the top of the pneumatic actuator’s casing. Valve positioners extend support to industries in their operations and provide various solutions. Additionally, the use of valve positioners helps increase energy efficiency, monitor quality, and fulfil the changing environmental regulations.

Valve positioners can be used wherever pipelines' liquid or gaseous flow needs to be controlled. This control action is achieved when they are used with control valves as well as with other industrial valves like ball valves, butterfly valves, segment valves, and gate valves together with pneumatic actuators. These can also be used in controlling steam pipelines, which are used in power plants' energy transportation.

The need for valve positioners arises in the optimization and automation of processes. This is because accurately defined rates of flow are needed for optimization. Traditionally, actuators were directly used in such operations, but the provision of completely opening or shutting the valve posed a significant limitation to optimization and discouraged their use. On the other hand, it has been observed that when actuators are used in conjunction with positioners allows the intermediate-level control of actuators. This enhances resource-saving and efficiency optimization.

Additionally, valve positioners also aid in lowering the overall operating costs in a plant or process. Nowadays, numerous positioners are available that offer extensive control valve control and precise calibration and provide advanced diagnostics without hysteresis or error. Furthermore, the valve positioners are easy to install and aid in reducing setup time because of the availability of automatic collaboration features.

As a consequence of the COVID-19 outbreak, the oil and gas industry faced huge supply-side ill effects from the OPEC+ nations. The supply-side constraints, along with the demand-side shock, were unprecedented in this industry. This even induced an existential risk in many industries. The decreasing production of goods across many industries also influenced a slowdown in demand for valve positioners. Therefore, the pandemic had a negative impact on the valve positioner market.

Urbanization and population increase are causing a considerable expansion of the industrial infrastructure. The escalating problems in energy, transportation, healthcare, and education are receiving prompt and precise responses from several countries. Additionally, efforts are being made to respond to natural disasters while enhancing the inclusiveness, resilience, and sustainability of communities by incorporating the proper technology and managing them.

The utilization of digital and smart valve positioners has increased in the past few years owing to the rising use of big data analytics, AI, and ML. These valve positioners offer versatile, intelligent, and reliable valve control. Additionally, these valve positioners also gather critical values about the performance of valves and subsequently notify the operator or administrator if any discrepancies are observed. As a result, they significantly help in accurately managing valves and operations at large.

Depending on the region, sectors, and uses, standardization may vary. Numerous industries, such as energy & electricity, oil & gas, building & construction, and semiconductor, which have specific standard requirements, use different valves. In addition, firms are establishing manufacturing facilities in various places to address this issue, which requires further investments. Modern valve guidelines are dynamic that consider good engineering practice, shifting consumer preferences, technological.

Based on type, the valve positioner market is categorized into pneumatic valve positioner, electro-pneumatic valve positioner, and digital valve positioner. The digital valve positioner segment acquired the highest revenue share in the valve positioner market in 2021. These valve positioners are also called smart valve positioners. Their use has grown in the past few years owing to the rapid adoption of automated solutions in many process industries.

On the basis of actuation, the valve positioner market is divided into single-acting and double-acting. The double-acting segment recorded a significant revenue share in the valve positioner market in 2021. These types of actuators use a piston as its main element to operate the valves. Both sides of the actuator are pressurized alternatively for valve operation. These are widely used in instances where the fail last position is needed.

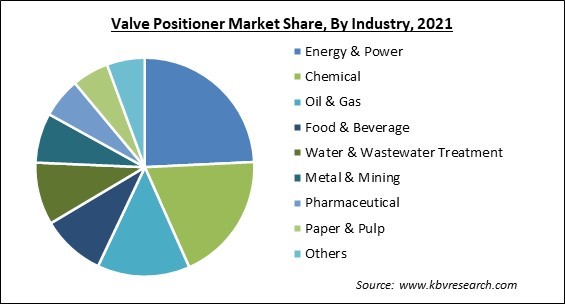

Based on industry, the valve positioner market is classified into oil & gas, water & wastewater treatment, energy & power, chemical, paper & pulp, pharmaceutical, metal & mining, food & beverage, and others. The energy and power segment witnessed the maximum revenue share in the valve positioner market in 2021. In the energy and power industries, valves are implemented widely. As a result, high demand for valve positioners arises from this industry. Valve positioners most preferred in these industries are digital, as they enhance cost savings, diagnostics, and performance.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.7 Billion |

| Market size forecast in 2028 | USD 2.5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5.8% from 2022 to 2028 |

| Number of Pages | 242 |

| Number of Tables | 400 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Actuation, Industry, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

On the basis of region, the valve positioner market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment recorded the highest revenue share in the valve positioner market in 2021. The high energy demand in the region has led to an expedited increase in the construction of energy plants, which has augmented the request for valve positioners. Additionally, valve positioners are widely used in the region’s rising energy & power and oil & gas industries.

Free Valuable Insights: Global Valve Positioner Market size to reach USD 2.5 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include ABB Group, Siemens AG, Schneider Electric SE, Emerson Electric Co., Baker Hughes Company, SMC Corporation, Flowserve Corporation, Valmet Oyj, Azbil Corporation and Badger Meter, Inc.

By Type

By Actuation

By Industry

By Geography

The global Valve Positioner Market size is expected to reach $2.5 billion by 2028.

Growing development of smart cities, urbanization, and industrialization are driving the market in coming years, however, Lack of governing policies and norms for standardization restraints the growth of the market.

ABB Group, Siemens AG, Schneider Electric SE, Emerson Electric Co., Baker Hughes Company, SMC Corporation, Flowserve Corporation, Valmet Oyj, Azbil Corporation and Badger Meter, Inc.

The expected CAGR of the Valve Positioner Market is 5.8% from 2022 to 2028.

The Single-Acting market is leading the segment in the Global Valve Positioner Market by Actuation in 2021; thereby, achieving a market value of $1.7 billion by 2028.

The Asia Pacific market dominated the Global Valve Positioner Market by Region in 2021; thereby, achieving a market value of $946 Million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.