The USA Switchgear Monitoring System Market size is expected to reach $602.8 million by 2030, rising at a market growth of 7.2% CAGR during the forecast period.

The switchgear monitoring system market in the United States has witnessed significant growth in recent years, driven by the increasing demand for reliable and efficient electrical distribution networks. One of the key drivers of the switchgear monitoring system market in the U.S. is the rising emphasis on grid modernization and the integration of smart technologies. As the country continues to upgrade its aging electrical infrastructure, there is a growing need for advanced monitoring solutions to enhance the performance and reliability of switchgear equipment.

The increasing focus on renewable energy sources, such as solar and wind power, has also contributed to the growth of the switchgear monitoring system market. Integrating these intermittent energy sources into the grid requires sophisticated monitoring and control systems to manage the variability and ensure a stable power supply.

The switchgear monitoring system market in the United States is experiencing a surge in demand due to the growing need for reliable and continuous electricity generation. As the nation increasingly relies on a diverse energy mix, incorporating renewable sources such as wind and solar, effective switchgear monitoring becomes paramount. One of the key drivers for the escalating demand is the expanding integration of smart grids and advanced energy infrastructure across the U.S. These modern grids require sophisticated switchgear monitoring systems to ensure the seamless flow of electricity, minimize downtime, and prevent disruptions in power supply. With the rising adoption of renewable energy sources, the intermittent nature of wind and solar power makes it imperative to have robust switchgear monitoring to manage fluctuations and maintain grid stability.

Moreover, the aging power infrastructure in the U.S. has led to an increased focus on upgrading and retrofitting existing systems. As utilities and energy providers invest in modernizing their electrical grids, the demand for advanced switchgear monitoring solutions has grown significantly. These systems play a crucial role in preventing equipment failures, reducing maintenance costs, and enhancing the overall reliability of the power distribution network.

According to the U.S. Energy Information Administration in 2022, the United States witnessed a net electricity generation of approximately 4,243 billion kilowatt-hours (kWh), equivalent to 4.24 trillion kWh, from utility-scale generators. Additionally, an estimated 58.51 billion kWh (or approximately 0.06 trillion kWh) was generated through small-scale solar photovoltaic (PV) systems. Within the same year's U.S. utility-scale electricity generation landscape, fossil fuels (comprising coal, natural gas, and petroleum) accounted for roughly 60%, nuclear energy contributed around 18%, and renewable energy sources constituted approximately 22% of the total generation.

Examining the switchgear monitoring system market in the U.S., the electricity generation scenario for 2022 reveals a diverse landscape with a significant share still attributed to fossil fuels, albeit with a notable presence of nuclear and renewable energy sources. The switchgear monitoring system market is influenced by this dynamic mix of energy sources, emphasizing the need for robust monitoring solutions to ensure efficient and reliable performance across the evolving energy infrastructure Thus, the surge in demand for switchgear monitoring systems in the U.S. is driven by the imperative for reliable electricity amidst a diversifying energy landscape, necessitating advanced monitoring solutions for grid stability.

The oil and gas sector's increasing reliance on advanced technologies has significantly impacted the switchgear monitoring system market in the United States. Switchgear monitoring systems ensure the reliable and efficient operation of electrical networks within the oil and gas industry, where uninterrupted power supply is paramount for critical operations. In recent years, the oil and gas sector in the United States has witnessed a surge in exploration, production, and refining activities. As these operations become more sophisticated and technologically advanced, there is a growing need for robust electrical infrastructure to support the energy-intensive processes involved. Switchgear monitoring systems provide real-time data and analytics that help operators manage and optimize the performance of electrical equipment, enhancing reliability and reducing downtime.

The United States' transition towards increased domestic oil and gas production has further fueled the demand for advanced monitoring solutions. Switchgear monitoring systems offer predictive maintenance capabilities, allowing operators to identify potential issues before they lead to costly failures. In the oil and gas industry, where downtime can have severe financial implications, proactive maintenance is crucial for maximizing operational efficiency.

According to the U.S. Energy Information Administration, in December 2021, the United States witnessed a surge in oil production, reaching 11.7 million barrels per day (b/d) and natural gas production, totaling 120.0 billion cubic feet per day (Bcf/d). Subsequently, throughout 2022, there was a notable uptick in U.S. oil and natural gas production, with oil reaching 12.1 million b/d and natural gas achieving 121.1 Bcf/d by December 2022. This upward trajectory underscores the dynamic growth and expansion within the U.S. energy sector during this period. The increased output emphasizes the critical role of advanced switchgear monitoring systems to ensure the energy infrastructure's efficiency, reliability, and safety. Hence, as U.S. crude oil and natural gas production continues to thrive, the switchgear monitoring system market is poised to play a pivotal role in supporting and optimizing the nation's energy production and distribution networks.

The switchgear monitoring system market in the United States is dynamic and competitive, with several key players vying for industry share. Switchgear monitoring systems play a crucial role in ensuring the reliability and efficiency of electrical power distribution systems by continuously monitoring and assessing the condition of switchgear components. These systems help prevent unexpected failures, reduce downtime, and optimize maintenance activities.

ABB is a global leader in power and automation technologies in the U.S. and has a strong presence in the switchgear monitoring system market. The company offers a range of advanced monitoring solutions that provide real-time data and analytics to improve the performance of switchgear equipment. Similarly, Siemens is another major player in the switchgear monitoring system market, providing innovative solutions for the efficient monitoring and management of electrical infrastructure. Their comprehensive portfolio includes advanced monitoring devices and software that enhance the reliability of switchgear operations.

One notable player in the U.S. switchgear monitoring system market is Schneider Electric. Schneider Electric is a multinational corporation with a significant presence in the United States. The company offers a range of switchgear monitoring solutions that leverage advanced technologies such as IoT (Internet of Things) and cloud computing. Their systems provide real-time data on the performance and condition of switchgear, enabling predictive maintenance and reducing downtime.

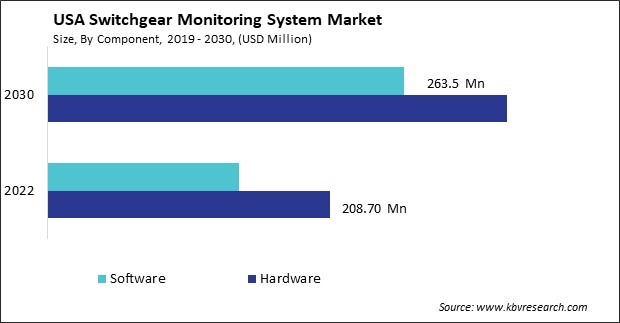

By Component

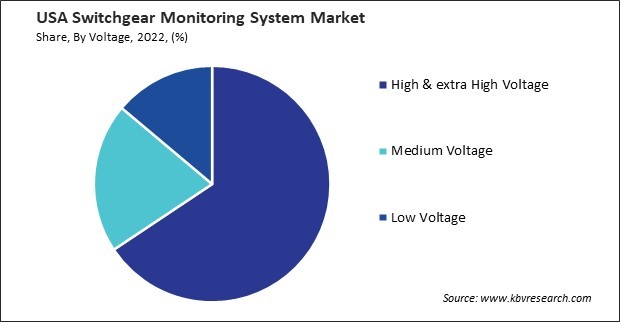

By Voltage

By Services

By Type

By End User

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.