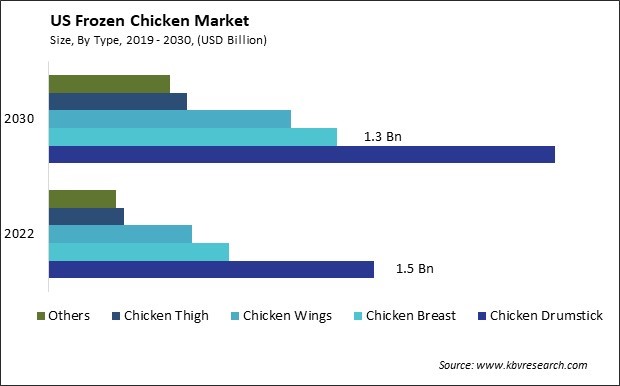

The US Frozen Chicken Market size is expected to reach $6 Billion by 2030, rising at a market growth of 6.3% CAGR during the forecast period. In the year 2022, the market attained a volume of 307.5 Kilo Tonnes, experiencing a growth of 5.2% (2019-2022).

The frozen chicken market in the United States is a significant sector within the broader poultry industry. Frozen chicken products play a crucial role in the American diet, offering convenience, affordability, and versatility to consumers, food service establishments, and retailers. One of the key drivers of the frozen chicken market is its convenience factor. Frozen chicken products allow U.S. consumers to have a readily available source of protein that can be stored for extended periods without spoiling. Additionally, frozen chicken products offer flexibility in meal planning, as they can be easily incorporated into various recipes and dishes.

In addition to catering to consumer demand, the frozen chicken market also serves the needs of the food service industry. According to the U.S. Census Bureau, in 2023, the U.S. food service industry reached $709.9 billion. Restaurants, cafeterias, fast-food chains, and other establishments rely on frozen chicken products to streamline operations, reduce food waste, and maintain consistency in their menu offerings. The convenience, affordability, and versatility of frozen chicken make it an indispensable ingredient in the food service sector.

However, COVID-19 has significantly impacted the frozen chicken market in the United States. The pandemic led to disruptions in the food supply chain, causing shortages and price fluctuations. Additionally, consumer behavior shifted as people stocked up on essentials and cooked more meals at home due to restaurant closures and social distancing measures. Furthermore, food safety and hygiene concerns prompted consumers to prioritize packaged and frozen foods over fresh alternatives. As a result, sales of frozen chicken surged during the pandemic as consumers turned to these products as a safe and convenient option for feeding themselves and their families.

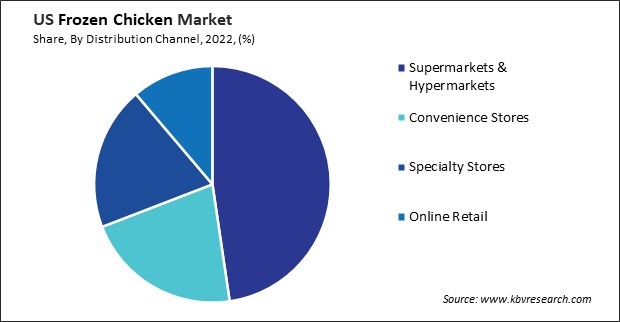

In recent years, the frozen chicken market in the United States has witnessed a significant surge in supermarkets and hypermarkets offering these products. One of the primary drivers behind the proliferation of supermarkets and hypermarkets in the frozen chicken market is the convenience they offer Americans. With hectic lifestyles becoming increasingly common, many individuals prefer the convenience of purchasing frozen chicken during their routine grocery shopping trips.

Supermarkets and hypermarkets, with their expansive product offerings and one-stop shopping experience, have become go-to destinations for consumers looking to stock up on frozen chicken and other household essentials. According to the U.S. Department of Agriculture, in 2020, the collective worth of retail food service sales reached $483 billion, with supermarkets dominating the industry by contributing 70% of total sales. The convenience store sector also played a significant role, accounting for another 14% of the overall sales. Supermarkets and hypermarkets leverage their buying power and economies of scale to negotiate competitive pricing with suppliers, making frozen chicken products more affordable for U.S. consumers.

In addition to convenience and competitive pricing, supermarkets and hypermarkets have also been proactive in catering to evolving consumer preferences and dietary trends. As consumers increasingly prioritize health and wellness, many retailers have expanded their offerings to include a diverse range of frozen chicken products, such as organic, antibiotic-free, and minimally processed options. Hence, the proliferation of supermarkets and hypermarkets in the frozen chicken market in the U.S. is driven by convenience, competitive pricing, and an adaptation to evolving consumer preferences for healthier options.

The frozen chicken market in the United States has witnessed a significant surge in consumption over the past few years. One of the primary drivers behind the rising consumption of frozen chicken in the U.S. is the convenience it offers to consumers. With busy schedules becoming increasingly common among American households, many U.S. consumers seek convenient meal solutions that require minimal preparation time. Frozen chicken products fit this requirement perfectly, as they can be stored for extended periods without compromising taste or quality, allowing Americans quick and easy access to protein-rich meals.

Moreover, the versatility of chicken products contributes to their popularity in the U.S. According to the U.S. Department of Agriculture, in 2021, 68.1 pounds of chicken per person were available for human consumption in the United States. The availability of chicken began its upward climb in the 1940s, overtaking pork availability in 1996 and surpassing beef in 2010 to become the most available for U.S. consumption. Since 1980, U.S. chicken availability per person has more than doubled. This versatility appeals to consumers seeking convenient yet customizable meal solutions that adapt easily to different recipes and culinary traditions.

Furthermore, freezing and packaging technology advancements have improved the quality and taste of frozen chicken products, making them more comparable to fresh poultry. Quick-freezing methods help preserve chicken's natural flavors and nutrients, ensuring a high-quality product that meets consumer expectations. Thus, the surge in consumption of frozen chicken in the United States is attributed to its convenience, versatility, and improved quality through technological advancements in freezing and packaging.

The frozen chicken market in the United States is a dynamic and competitive industry characterized by numerous players catering to the diverse demands of consumers, retailers, and food service establishments. One prominent player in the U.S. frozen chicken market is Tyson Foods, Inc. As one of the largest food companies globally, Tyson Foods has a significant presence in the frozen chicken segment, offering a wide range of products tailored to different consumer preferences. The company's extensive distribution network and brand recognition enable it to reach consumers across various retail channels, including grocery stores, supermarkets, and club stores. Additionally, Tyson Foods supplies frozen chicken products to food service providers, including restaurants, schools, and healthcare facilities.

Sanderson Farms is renowned for its high-quality frozen chicken products, catering primarily to the retail and food service segments. The company's vertically integrated operations, from breeding and hatching to processing and distribution, ensure product quality and traceability throughout the supply chain. Sanderson Farms' focus on operational efficiency and cost management enables it to remain competitive in the industry while meeting the evolving needs of customers and consumers.

Another key player in the U.S. frozen chicken market is Perdue Farms. With a strong focus on quality and innovation, Perdue Farms has built a reputation for producing premium frozen chicken products that appeal to discerning consumers. The company's product portfolio includes diverse offerings, such as individually quick-frozen (IQF) chicken breasts, wings, and nuggets, catering to different cooking preferences and meal occasions. Perdue Farms leverages its vertically integrated supply chain and commitment to animal welfare and sustainability to differentiate its products in the frozen chicken market.

In addition to these major players, several regional and niche companies contribute to the diversity of the U.S. frozen chicken market. These companies often specialize in specific product categories or cater to niche industry segments, such as organic or antibiotic-free frozen chicken. Brands like Bell & Evans and Coleman Natural Foods have carved out a niche by offering premium frozen chicken products sourced from responsibly raised poultry.

Private label brands also play a significant role in the U.S. frozen chicken market, with retailers leveraging their strong distribution networks and consumer trust to offer competitively priced alternatives to branded products. Companies like Costco Wholesale Corporation and Walmart Inc. have extensive private label frozen chicken offerings, providing consumers various options at various prices. With ongoing innovation and a focus on quality and sustainability, these companies strive to maintain their competitive edge and capture industry opportunities in this dynamic landscape.

By Type

By Distribution Channel

By Product

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.