US Food Preservatives Market Size, Share & Industry Trends Analysis Report By Function (Anti-microbial, Anti-oxidant, and Others), By Type (Natural and Synthetic), By Application, Growth Forecast, 2023 - 2030

Published Date : 15-Feb-2024 | Pages: 114 | Formats: PDF |

COVID-19 Impact on the US Food Preservatives Market

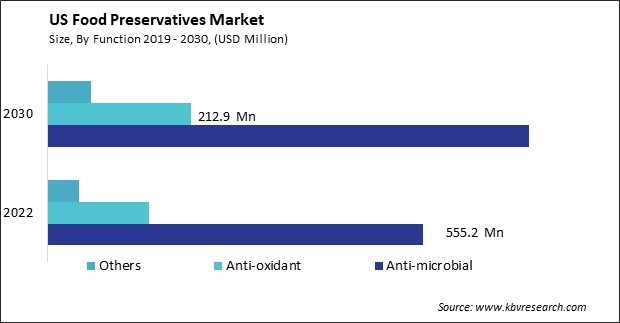

The USA Food Preservatives Market size is expected to reach $990.7 million by 2030, rising at a market growth of 3.6% CAGR during the forecast period. In the year 2022, the market attained a volume of 47,621.8 Kilo Tonnes units, experiencing a growth of 2.8% (2019-2022).

In the US, sorbates, benzoates, and other chemicals that serve as antimicrobial preservatives are included in the substances that are listed as generally recognized as safe (GRAS). Given the industry's growth, the beverages segment in the US food preservatives market is expected to increase rapidly throughout the projected period.

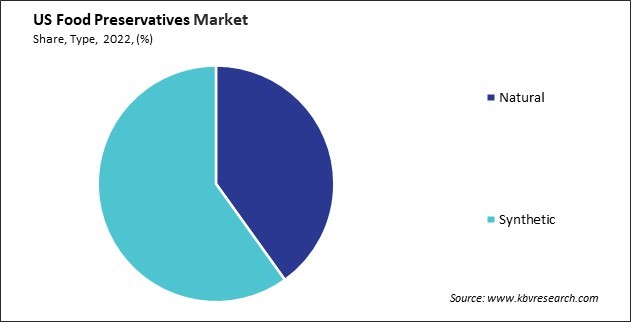

Demand for natural preservatives is increasing due to consumers' growing health consciousness and regulatory bodies' acceptance of them during processing. The rise in popularity of clean-label food products and customers' increasing preference for convenient food are the reasons behind this trend.

Antimicrobial preservatives, followed by antioxidants, dominate the market. Sorbates, benzoates, and other chemicals act as antimicrobial preservatives, and the demand for natural preservatives is increasing as a result of consumers' growing health consciousness and regulatory bodies' acceptance of them during processing. This trend results from consumers' increasing preference for easy meals and the growing popularity of clean-label food goods. The expanding food industries are a significant factor propelling the demand for food preservatives. The food and beverage manufacturing industry in the United States employed 1.7 million people in 2021, or little more than 1.1 percent of all nonfarm jobs in the country, according to the US Department of Agriculture.

The food and beverage industry's exports are rising significantly, with the United States being the primary destination. Meat and fish goods, dairy products, and drinks, including alcohol and soft drinks, are the main exported products.

Based on value-added, sales, and employment, the meat processing industrial group is the largest in the food and beverage manufacturing sector, according to the US Department of Agriculture. The slaughter, processing, and rendering of animals and fowl are all included in meat processing. With 26.2 percent of revenues in 2021, it is the largest industry group in the food and beverage manufacturing sector. By sales, dairy (12.8 percent), other foods (12.4 percent), and beverages (11.3 percent) are another significant sector.

The increasing urbanization of populations has led to smaller living spaces and a rise in single-person households. In such environments, consumers often opt for quick and easy meals that don't require extensive cooking or preparation. The demand for convenience foods, including ready-to-eat meals and snacks, continues to drive the need for effective preservatives to maintain the quality and safety of these products over an extended period of shelf life. The food preservatives market is expanding in the US as more people engage in outdoor recreational activities, including camping, hiking, and trekking. Due to technological advancements in the food sector, convenience food comprises ready meals in chilled, frozen, portion-controlled, shelf-stable, microwaveable, and prepared-mixes formats, all necessitating preservatives.

Market Trends

Shift towards natural preservatives

Consumer preferences are growing in the US, and there is a growing demand for cleaner, healthier, and more transparent food products. The United States is removing artificial preservatives from its diets due to increasing incidents of allergic reactions caused by consuming food products with artificial preservatives. Companies across the food industry recognize the importance of adapting to consumer preferences for natural preservatives to preserve a competitive advantage and remain relevant.

For instance, McCormick's commitment to sustainability and transparency has driven the company towards natural preservatives in the U.S. McCormick has been at the forefront of using rosemary extract as a natural preservative in some of its spice blends. The antioxidant properties of rosemary make it an effective preservative for US consumers, allowing McCormick to maintain product quality while responding to consumer preferences for recognizable and natural ingredients.

New players like Kemin Industries, Inc. and Galactic SA are launching new goods made with natural ingredients like vinegar and rosemary extracts and cutting-edge technology to compete. For example, Conagen, Inc. introduced 'p-Coumaric Acid' (PCA) in August 2021 as a new clean-label, natural preservative made by fermentation. The expanding demand for natural preservatives will result in overall increase in the growth of the market.

Increasing application of food preservatives in meat and meat products

As the demand for processed and convenience meat products rises, preservatives play a pivotal role in ensuring microbial safety, extending shelf life, and maintaining product quality during distribution and storage. Meat is highly susceptible to microbial contamination, including bacteria, molds, and yeasts.

Manufacturers such as Corbion N.V. play a significant role in the United States food industry and are involved in various aspects of food production, including meat processing. They use vinegar and jasmine extract as antioxidants and citrus powder to prevent moisture migration of the product.

The demand for ready meal products has increased in the food preservatives market in the US. Online retailing of these products is one of the reasons for the growth in sales of these products. Weekly supermarket shopping has doubled in the industry since the lockdown caused by the COVID-19 pandemic, and consumers are adopting online retailing in an irreversible trend. Thus, the abovementioned factors drive the expansion of the US food preservatives market.

Competition Analysis

The US food preservatives market is prominently shaped by industry leaders, with Koninklijke DSM NV, DuPont de Nemours Inc., BASF SE, and Corbion N.V. standing out as major players. These companies wield considerable influence in the sector, contributing significantly to the development and supply of food preservatives in the United States.

The leading companies, such as Kerry Group, are global companies interested in natural and clean-label solutions. Kerry Group collaborates with food manufacturers to provide customized solutions. This involves working closely with clients in the US to develop and implement natural preservative solutions tailored to specific product lines.

Cargill plays a significant role in the US food and beverage industry, providing manufacturers with various ingredients and solutions. The company has a broad range of food ingredients and solutions. This may include offerings related to food preservation, such as antioxidants, antimicrobials, and other preservatives. These ingredients help extend the shelf life of food products.

Nestle SA, Hello Fresh Group, Kraft Heinz, and ConAgra Brands Company are a few of the major players operating in the industry. To raise the number of sales in the ready meals industry, the companies are broadening their product offers. Conagra Brands unveiled a wide range of new summer goods with modern flavors to satisfy cravings and resolve mealtime dilemmas. Trendy ingredients are used in the items which are prepared conveniently.

Smithfield Foods strategically incorporated food preservatives into its product lines in the United States. By doing so, the company aimed to extend the shelf life of its offerings, providing consumers with a broader array of choices while reducing food waste. Smithfield Foods likely utilized advanced preservation technologies to maintain the freshness and safety of its products, contributing to consumer confidence in the brand. Through its commitment to food safety and quality, Smithfield Foods addressed the need for longer shelf life in meat products and contributed to the broader trends shaping the US food preservatives market in 2022.

List of Key Companies Profiled

- Archer Daniels Midland Company

- Cargill, Incorporated

- Kerry Group PLC

- Akzo Nobel N.V.

- Kemin Industries, Inc.

- Univar Solutions, Inc.

- Koninklijke DSM N.V.

- Tate & Lyle PLC

- BASF SE

- Celanese Corporation

US Food Preservatives Market Report Segmentation

By Function

- Anti-microbial

- Anti-oxidant

- Others

By Type

- Natural

- Edible Oil

- Rosemary Extracts

- Natamycin

- Vinegar

- Others

- Synthetic

- Sorbates

- Benzoates

- Propionates

- Others

By Application

- Meat & Poultry Product

- Bakery Products

- Dairy Product

- Beverages

- Snacks

- Others

1.1 Market Definition

1.2 Objectives

1.3 Market Scope

1.4 Segmentation

1.4.1 USA Food Preservatives Market, by Function

1.4.2 USA Food Preservatives Market, by Type

1.4.3 USA Food Preservatives Market, by Application

1.5 Methodology for the research

Chapter 2. Market Overview

2.1 Introduction

2.1.1 Overview

2.1.1.1 Market Composition and Scenario

2.2 Key Factors Impacting the Market

2.2.1 Market Drivers

2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

3.1 KBV Cardinal Matrix

3.2 Recent Industry Wide Strategic Developments

3.2.1 Partnerships, Collaborations and Agreements

3.2.2 Product Launches and Product Expansions

3.2.3 Acquisition and Mergers

3.2.4 Geographical Expansion

3.3 Market Share Analysis, 2022

3.4 Top Winning Strategies

3.4.1 Key Leading Strategies: Percentage Distribution (2019-2023)

3.4.2 Key Strategic Move: (Product Launches and Product Expansions : 2019, Oct – 2023, Sep) Leading Players

3.5 Porter’s Five Forces Analysis

Chapter 4. US Food Preservatives Market

4.1 US Food Preservatives Market by Function

4.2 US Food Preservatives Market by Type

4.2.1 US Food Preservatives Market by Natural Type

4.3 US Food Preservatives Market by Synthetic Type

4.4 US Food Preservatives Market by Application

Chapter 5. Company Profiles – Global Leaders

5.1 Archer Daniels Midland Company

5.1.1 Company Overview

5.1.2 Financial Analysis

5.1.3 Segmental and Regional Analysis

5.1.4 Research & Development Expense

5.1.5 SWOT Analysis

5.2 Cargill, Incorporated

5.2.1 Company Overview

5.2.2 Recent strategies and developments:

5.2.2.1 Partnerships, Collaborations, and Agreements:

5.3 Kerry Group PLC

5.3.1 Company Overview

5.3.2 Financial Analysis

5.3.3 Segmental and Regional Analysis

5.3.4 Research & Development Expenses

5.3.5 Recent strategies and developments:

5.3.5.1 Acquisition and Mergers:

5.3.5.2 Geographical Expansions:

5.3.6 SWOT Analysis

5.4 Akzo Nobel N.V.

5.4.1 Company Overview

5.4.2 Financial Analysis

5.4.3 Segmental and Regional Analysis

5.4.4 Recent strategies and developments:

5.4.4.1 Partnerships, Collaborations, and Agreements:

5.4.4.2 Product Launches and Product Expansions:

5.4.4.3 Geographical Expansions:

5.4.5 SWOT Analysis

5.5 Kemin Industries, Inc.

5.5.1 Company Overview

5.5.2 Recent strategies and developments:

5.5.2.1 Partnerships, Collaborations, and Agreements:

5.5.2.2 Product Launches and Product Expansions:

5.5.2.3 Acquisition and Mergers:

5.5.2.4 Geographical Expansions:

5.5.3 SWOT Analysis

5.6 Univar Solutions, Inc.

5.6.1 Company Overview

5.6.2 Financial Analysis

5.6.3 Segmental Analysis

5.6.4 SWOT Analysis

5.7 Koninklijke DSM N.V.

5.7.1 Company Overview

5.7.2 Financial Analysis

5.7.3 Segmental and Regional Analysis

5.7.4 Research & Development Expense

5.7.5 Recent strategies and developments:

5.7.5.1 Product Launches and Product Expansions:

5.7.5.2 Acquisition and Mergers:

5.7.6 SWOT Analysis

5.8 Tate & Lyle PLC

5.8.1 Company Overview

5.8.2 Financial Analysis

5.8.3 Segmental & Regional Analysis

5.8.4 Research & Development Expense

5.8.5 SWOT Analysis

5.9 BASF SE

5.9.1 Company Overview

5.9.2 Financial Analysis

5.9.3 Segmental and Regional Analysis

5.9.4 Research & Development Expense

5.9.5 Recent strategies and developments:

5.9.5.1 Product Launches and Product Expansions:

5.9.5.2 Geographical Expansions:

5.9.6 SWOT Analysis

5.10. Celanese Corporation

5.10.1 Company Overview

5.10.2 Financial Analysis

5.10.3 Segmental and Regional Analysis

5.10.4 Research & Development Expenses

5.10.5 SWOT Analysis

TABLE 2 US Food Preservatives Market, 2023 - 2030, USD Million

TABLE 3 US Food Preservatives Market, 2019 - 2022, KILO TONNES

TABLE 4 US Food Preservatives Market, 2023 - 2030, KILO TONNES

TABLE 5 Partnerships, Collaborations and Agreements– Food Preservatives Market

TABLE 6 Product Launches And Product Expansions– Food Preservatives Market

TABLE 7 Acquisition and Mergers– Food Preservatives Market

TABLE 8 Geographical Expansion– Food Preservatives Market

TABLE 9 US Food Preservatives Market by Function, 2019 - 2022, USD Million

TABLE 10 US Food Preservatives Market by Function, 2023 - 2030, USD Million

TABLE 11 US Food Preservatives Market by Function, 2019 - 2022, KILO TONNES

TABLE 12 US Food Preservatives Market by Function, 2023 - 2030, KILO TONNES

TABLE 13 US Food Preservatives Market by Type, 2019 - 2022, USD Million

TABLE 14 US Food Preservatives Market by Type, 2023 - 2030, USD Million

TABLE 15 US Food Preservatives Market by Type, 2019 - 2022, KILO TONNES

TABLE 16 US Food Preservatives Market by Type, 2023 - 2030, KILO TONNES

TABLE 17 US Food Preservatives Market by Natural Type, 2019 - 2022, USD Million

TABLE 18 US Food Preservatives Market by Natural Type, 2023 - 2030, USD Million

TABLE 19 US Food Preservatives Market by Natural Type, 2019 - 2022, KILO TONNES

TABLE 20 US Food Preservatives Market by Natural Type, 2023 - 2030, KILO TONNES

TABLE 21 US Food Preservatives Market by Synthetic Type, 2019 - 2022, USD Million

TABLE 22 US Food Preservatives Market by Synthetic Type, 2023 - 2030, USD Million

TABLE 23 US Food Preservatives Market by Synthetic Type, 2019 - 2022, KILO TONNES

TABLE 24 US Food Preservatives Market by Synthetic Type, 2023 - 2030, KILO TONNES

TABLE 25 US Food Preservatives Market by Application, 2019 - 2022, USD Million

TABLE 26 US Food Preservatives Market by Application, 2023 - 2030, USD Million

TABLE 27 US Food Preservatives Market by Application, 2019 - 2022, KILO TONNES

TABLE 28 US Food Preservatives Market by Application, 2023 - 2030, KILO TONNES

TABLE 30 Key Information – Cargill, Incorporated

TABLE 31 Key Information – Kerry Group PLC

TABLE 32 Key information – Akzo Nobel N.V.

TABLE 33 Key Information – Kemin Industries, Inc.

TABLE 34 Key Information – Univar Solutions, Inc.

TABLE 35 Key Information – Koninklijke DSM N.V.

TABLE 36 Key Information – Tate & Lyle PLC

TABLE 37 Key Information – BASF SE

TABLE 38 Key Information – Celanese Corporation

List of Figures

FIG 1 Methodology for the research

FIG 2 US Food Preservatives Market, 2019 - 2030, USD million

FIG 3 Key Factors Impacting the Food Preservatives Market

FIG 4 KBV Cardinal Matrix

FIG 5 Market Share Analysis, 2022

FIG 6 Key Leading Strategies: Percentage Distribution (2019-2023)

FIG 7 Key Strategic Move: (Product Launches and Product Expansions : 2019, Oct – 2023, Sep) Leading Players

FIG 8 Porter’s Five Forces Analysis - Food Preservatives Market

FIG 9 US Food Preservatives Market share by Function, 2022

FIG 10 US Food Preservatives Market share by Function, 2030

FIG 11 US Food Preservatives Market by Function, 2019 - 2030, USD million

FIG 12 US Food Preservatives Market share by Type, 2022

FIG 13 US Food Preservatives Market share by Type, 2030

FIG 14 US Food Preservatives Market by Type, 2019 - 2030, USD Million

FIG 15 US Food Preservatives Market share by Synthetic Type, 2022

FIG 16 US Food Preservatives Market share by Synthetic Type, 2030

FIG 17 US Food Preservatives Market by Synthetic Type, 2019 - 2030, USD milion

FIG 18 US Food Preservatives Market share by Application, 2022

FIG 19 US Food Preservatives Market share by Application, 2030

FIG 20 US Food Preservatives Market by Application, 2019 - 2030, USD million

FIG 23 Recent strategies and developments: Kerry Group, Plc.

FIG 24 Swot Analysis: KERRY GROUP PLC

FIG 25 Recent strategies and developments: Akzo Nobel N.V.

FIG 26 SWOT Analysis: Akzo Nobel N.V.

FIG 27 Recent strategies and developments: Kemin Industries, Inc.

FIG 28 Swot Analysis: Kemin Industries, Inc.

FIG 29 Swot Analysis: Univar Solutions, Inc.

FIG 30 Recent strategies and developments: Koninklijke DSM N.V.

FIG 31 SWOT Analysis: Koninklijke DSM N.V

FIG 32 Swot Analysis: Tate & Lyle PLC

FIG 33 Recent strategies and developments: BASF SE

FIG 34 SWOT Analysis: BASF SE

FIG 35 SWOT Analysis: Celanese Corporation