The US Flock Adhesives Market size is expected to reach $498 Million by 2030, rising at a market growth of 4.4% CAGR during the forecast period. In the year 2022, the market attained a volume of 106.16 Kilo Tonnes, experiencing a growth of 3.6% (2019-2022).

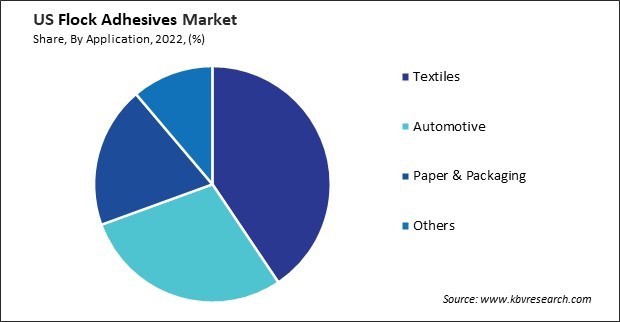

The United States' flock adhesives market has witnessed steady growth. One of the key drivers contributing to the growth of the flock adhesives market in the United States is the growing automotive industry. Flock adhesives are extensively used in automotive interiors for applications such as headliners, door panels, and dashboard trim, as they offer superior bonding strength and durability.

According to Select USA, international automakers produced 5 million vehicles in the United States in 2020. In 2020, the United States exported 1.4 million new light vehicles and 108,754 medium and heavy trucks (worth a combined value of over $52 billion) to more than 200 industries around the world, with additional exports of automotive parts valued at $66.7 billion. With the increasing demand for luxury and customized vehicles, the demand for flock adhesives is expected to further escalate in the coming years.

Additionally, the packaging industry contributes to the demand for flock adhesives in the United States. Flock adhesives find applications in packaging materials such as boxes, containers, and display cases. They enhance packaging surfaces' aesthetics and tactile qualities, creating a distinctive branding and marketing appeal. As packaging plays a crucial role in product presentation and consumer engagement, the adoption of flock adhesives continues to increase among packaging manufacturers in the U.S. seeking differentiation and brand recognition.

However, the flock adhesives market in the United States faced challenges due to the COVID-19 pandemic. Moreover, the economic slowdown and uncertainty caused by the pandemic impacted consumer spending and industrial activities, leading to a temporary decline in demand for flock adhesives across various end-use industries. The growing emphasis on product innovation and sustainability will likely drive the demand for eco-friendly flock adhesives in the coming years. Additionally, the increasing adoption of flocking technology in emerging applications such as 3D printing and medical textiles is expected to create new opportunities for industry players.

The textile and apparel industry in the United States has witnessed notable expansion. One significant aspect driving this expansion is the industry's increasing demand for flock adhesives. One key driver of the growth of flock adhesives in the U.S. textile and apparel industry is the continuous innovation and development of adhesive technologies. Manufacturers constantly strive to formulate adhesives that offer superior bonding strength, flexibility, and resistance to various environmental conditions.

According to Select USA, as of September 2020, the U.S. textile and apparel industry is prominent in manufacturing. With an export value reaching $23 billion in 2019, the United States is one of the leading global industries. The domestic garment industry in the U.S. was valued at $311 billion in the same year, underscoring its substantial influence. These advancements enable textile and apparel producers to create high-quality products that meet the evolving demands of consumers.

Furthermore, the expansion of the e-commerce sector has provided significant opportunities for the textile and apparel industry, further boosting the demand for flock adhesives. Flock adhesives enable them to achieve these objectives by facilitating the production of high-quality, customizable textile and apparel items that meet online shoppers' expectations.

According to the Census Bureau of the Department of Commerce, U.S. retail e-commerce sales for the third quarter of 2023 were $284.1 billion, up 2.3% from the second quarter of 2023. Total retail sales for the third quarter of 2023 were estimated at $1,825.3 billion. With the rise of online retail platforms, manufacturers in the U.S. are under pressure to deliver visually appealing, durable, and cost-effective products.

Moreover, the textile and apparel industry's emphasis on sustainability and eco-friendliness has propelled the adoption of flock adhesives derived from renewable sources. Manufacturers increasingly invest in bio-based and environmentally friendly adhesive formulations to reduce their carbon footprint and meet regulatory requirements. Therefore, the increasing demand for flock adhesives in the U.S. textile and apparel industry is driven by continuous innovation, e-commerce expansion, and a growing emphasis on sustainability.

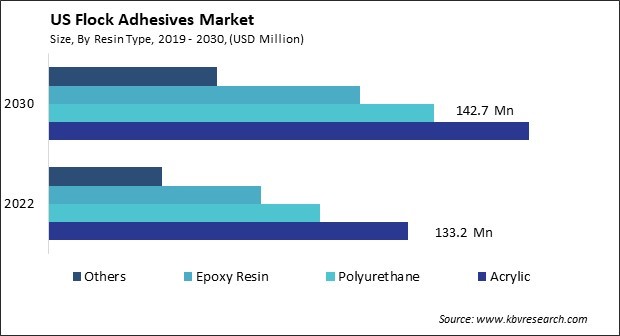

The flock adhesives market in the U.S. is experiencing a notable surge in demand for acrylic-based flock adhesives, driven by several key factors that underline their superior performance and versatility across various applications. One significant driver of the rising demand for acrylic-based flock adhesives is their ability to adhere to diverse surfaces effectively. Furthermore, acrylic-based flock adhesives resist harsh environmental conditions such as temperature fluctuations, moisture, and chemicals.

Another key factor driving the demand for acrylic-based flock adhesives is their ease of application and processing. These adhesives are applied using various methods, including spraying, brushing, or roller coating, providing manufacturers with flexibility in production processes. Additionally, acrylic-based formulations typically have faster curing times than other adhesive types, allowing for quicker production turnaround and increased efficiency in manufacturing operations.

Moreover, the growing emphasis on sustainability and environmental friendliness is prompting a shift towards acrylic-based flock adhesives, known for their low volatile organic compound (VOC) emissions and minimal environmental impact. Hence, the surge in demand for acrylic-based flock adhesives in the U.S. is driven by their superior adhesion, resistance to environmental conditions, ease of application, and sustainability benefits.

The flock adhesives market in the United States is a segment of the adhesive industry that caters to various sectors. One prominent player in the U.S. flock adhesives market is Henkel Corporation. Henkel offers a wide range of adhesive solutions, including flock adhesives, under its brand names like LOCTITE and TECHNOMELT. The company's flock adhesives are renowned for their high performance, durability, and versatility, making them suitable for various industry applications. Henkel's extensive research and development efforts ensure that its flock adhesive products meet customers' evolving demands and adhere to stringent quality standards.

Another key player in the U.S. flock adhesives market is H.B. Fuller Company. H.B. Fuller provides innovative adhesive solutions to diverse industries worldwide, including flock adhesives designed to effectively bond flock fibers to substrates. The company's commitment to sustainability and technological advancement drives its development of eco-friendly flock adhesive formulations that deliver superior bonding performance while minimizing environmental impact. H.B. Fuller's global presence and customer-centric approach make it a preferred choice for flock adhesive solutions in the U.S.

3M Company is also a significant contributor to the flock adhesives market in the United States. 3M's adhesive technologies are renowned for their reliability, durability, and superior bonding properties. The company offers a comprehensive range of flock adhesive products tailored to meet the specific requirements of different applications and industries. With a focus on innovation and customer satisfaction, 3M continues to develop cutting-edge flock adhesive solutions that enhance product performance and efficiency for its U.S. customers.

Bostik, Inc. is also a notable player in the U.S. flock adhesives market, known for its high-quality adhesive products and solutions. Bostik's flock adhesives are engineered to deliver strong, durable bonds between flock fibers and substrates, ensuring excellent adhesion and long-lasting performance. The company's relentless pursuit of excellence in adhesive technology drives its development of innovative flock adhesive formulations that address customers' evolving needs across various industries in the United States.

Furthermore, Dow, Inc. is a leading supplier of flock adhesives in the U.S., offering a diverse portfolio of adhesive solutions designed to meet the unique requirements of different applications and industries. Dow's flock adhesives are recognized for superior bonding strength, flexibility, and durability, making them ideal for bonding flock fibers to a wide range of substrates. These companies leverage their expertise in adhesive technology and commitment to innovation to develop high-performance flock adhesive solutions that cater to the diverse needs of industries such as automotive, textiles, packaging, and construction.

By Resin Type

By Application

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.