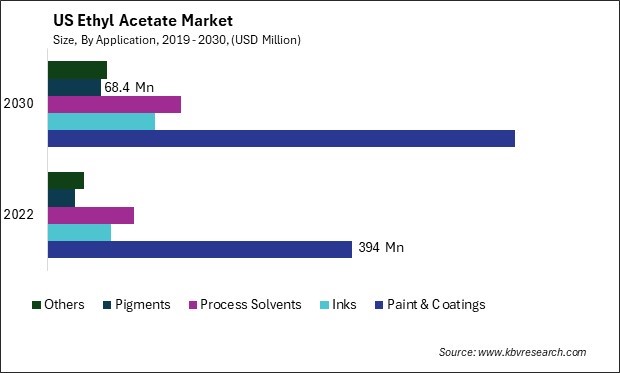

The United States (US) Ethyl Acetate Market size is expected to reach $1.1 Billion by 2030, rising at a market growth of 6% CAGR during the forecast period. In the year 2022, the market attained a volume of 511.8 Kilo Tonnes, experiencing a growth of 5.3% (2019-2022).

The ethyl acetate market in the United States has grown significantly, driven by diverse applications across various industries. One of the primary drivers of the ethyl acetate market in the U.S. is the robust growth of the paints and coatings industry. With increasing construction activities and infrastructure development projects across the country, the demand for paints and coatings has steadily risen, fueling the demand for ethyl acetate.

Moreover, the adhesive industry constitutes another significant industry for ethyl acetate in the U.S. Adhesives formulated with ethyl acetate exhibit strong bonding properties and are widely used in packaging, automotive, and construction industries. Furthermore, the pharmaceutical sector represents a growing industry for ethyl acetate, primarily driven by its application as a solvent in drug formulations. The increasing focus on healthcare and the development of new pharmaceutical products have bolstered the demand for ethyl acetate in the U.S.

The COVID-19 pandemic significantly impacted the ethyl acetate market in the U.S. As governments imposed strict lockdown measures and businesses scaled back operations to curb the spread of the virus, the demand for ethyl acetate experienced a temporary downturn. Disruptions in supply chains, reduced industrial activity, and fluctuating consumer demand resulted in a slowdown in the consumption of ethyl acetate across various end-use industries. However, the industry gradually rebounded as economic activities resumed and industries adapted to the new normal. The pharmaceutical sector, in particular, witnessed increased demand for ethyl acetate due to the production of essential medications and vaccines to combat the pandemic.

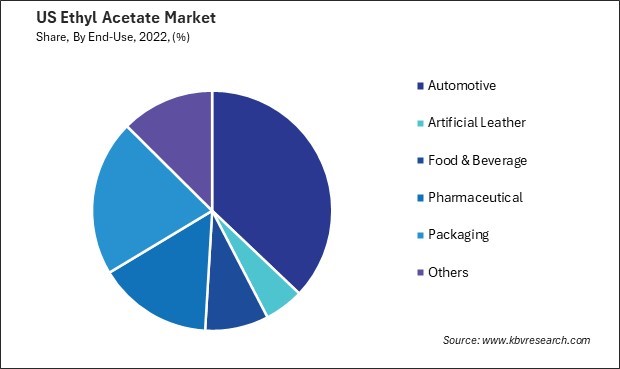

The automotive industry plays a significant role in driving demand for ethyl acetate in the United States. One key factor contributing to the expansion of the automotive industry's use of ethyl acetate is its effectiveness as a solvent in coatings. Automotive coatings are essential for protecting vehicles from corrosion, abrasion, and environmental factors. Ethyl acetate's ability to dissolve various resins and polymers while offering fast drying times makes it a preferred choice for automotive paint formulations. Additionally, its low volatility and toxicity align with the automotive industry's efforts to reduce emissions and enhance worker safety.

According to Select US, in 2020, the automotive industry in the United States saw a significant expansion, with international automakers manufacturing 5 million vehicles within the country. This growth was paralleled by a substantial influx of foreign direct investment, amounting to $143.3 billion in 2019. Similarly, the ethyl acetate market in the U.S. experienced a surge in expansion, reflecting the trend of increased investment and development within the automotive sector.

Furthermore, the automotive industry's emphasis on sustainability has fueled the demand for eco-friendly solvents like ethyl acetate. As regulatory pressures increase to reduce volatile organic compound (VOC) emissions and promote environmentally friendly manufacturing practices, manufacturers in the U.S. are seeking alternatives to traditional solvent-based formulations. Ethyl acetate, with its relatively low VOC content and biodegradability, presents a viable solution for meeting these sustainability goals without compromising performance.

Moreover, ethyl acetate has extensive applications in adhesives and sealants used in automotive assembly processes. These materials are crucial for bonding and sealing various components of vehicles, ensuring structural integrity and preventing leaks. Hence, ethyl acetate's effectiveness as a solvent in coatings, its eco-friendliness, and its applications in adhesives and sealants make it a pivotal component driving the demand within the automotive industry in the United States.

The ethyl acetate market in the United States is witnessing a surge in demand due to the increasing popularity of artificial leather products. One of the primary drivers of the growing demand for artificial leather in the U.S. is the shifting consumer preference toward sustainable and cruelty-free alternatives to traditional leather products. As awareness about animal welfare and environmental sustainability continues to increase, more Americans are opting for synthetic leather, which is often made from ethyl acetate-based materials.

Another factor driving the demand for artificial leather is the growing concern over the environmental impact of traditional leather production. The leather industry is known for its significant water and land usage and the release of pollutants into the environment from tanning processes. By choosing artificial leather made from ethyl acetate-based materials, U.S. consumers reduces their carbon footprint and minimize environmental harm associated with leather production.

Furthermore, the versatility of ethyl acetate as a solvent in producing synthetic materials contributes to its growing prominence in the industry. Ethyl acetate is widely used in the manufacturing process of artificial leather due to its ability to dissolve various polymers and create flexible, durable materials with desirable properties. Therefore, the surge in demand for ethyl acetate in the United States is driven by the growing preference for sustainable and cruelty-free alternatives like artificial leather.

The ethyl acetate market in the United States is a dynamic sector driven by various factors such as industrial applications, consumer demand, regulatory policies, and technological advancements. One of the major players in the U.S. ethyl acetate market is Eastman Chemical Company. Founded in 1920 and headquartered in Kingsport, Tennessee, Eastman Chemical Company is a global specialty chemical company that produces a wide range of products, including ethyl acetate. Eastman's ethyl acetate is used in numerous applications, such as coatings, adhesives, pharmaceuticals, and fragrances. The company's commitment to sustainability and innovation drives its leadership in the industry, continually offering high-quality products and solutions to meet customer needs.

Huntsman Corporation is also a significant player in the U.S. ethyl acetate market. Headquartered in The Woodlands, Texas, Huntsman Corporation is a global manufacturer and marketer of specialty chemicals. Huntsman produces ethyl acetate for various applications such as coatings, printing inks, and pharmaceuticals. The company's strong distribution network and customer-centric approach have established it as a reliable supplier in the ethyl acetate market.

Another key player in the U.S. ethyl acetate market is Celanese Corporation. Based in Irving, Texas, Celanese is a leading producer of specialty chemicals and materials, including ethyl acetate. Celanese's ethyl acetate finds applications in coatings, pharmaceuticals, and industrial solvents. The company's focus on research and development ensures that its products remain at the forefront of technology, meeting evolving industry demands while adhering to stringent quality and safety standards.

Furthermore, OXEA Corporation, a subsidiary of Oman Oil Company, is a significant player in the U.S. ethyl acetate market. OXEA is a leading manufacturer of oxo intermediates and derivatives, including ethyl acetate, which is utilized in coatings, printing inks, and pharmaceuticals. The company's focus on sustainable practices and product innovation underscores its commitment to environmental responsibility and customer satisfaction.

Additionally, INEOS Group Holdings S.A., a multinational chemicals company headquartered in London, United Kingdom, has a notable presence in the U.S. ethyl acetate market. INEOS produces ethyl acetate at its manufacturing facilities in the U.S. and supplies it to diverse industries, including coatings, adhesives, and personal care products. The company's global reach and extensive product portfolio contribute to its competitiveness in the ethyl acetate market. These companies play a vital role in meeting the diverse needs of customers across various sectors, driving the industry forward with their expertise and commitment to excellence.

By Distribution Channel

By Application

By End Use

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.