The USA Dental Alloys Market size is expected to reach $25.1 Million by 2030, rising at a market growth of 5.7% CAGR during the forecast period. In the year 2022, the market attained a volume of 16,218.2 thousand litres, experiencing a growth of 4.1% (2019-2022).

The Dental Alloys Market in the United States has witnessed significant growth in recent years, driven by changing consumer preferences and a growing demand for convenient and high-quality coffee products. The convenience factor of coffee concentrate is another driving force behind its industry growth. Busy lifestyles and an increasing demand for on-the-go options have led consumers to seek quick and convenient coffee solutions. Coffee concentrate fits this need perfectly, allowing individuals to enjoy a quality coffee experience without the time-consuming process of brewing.

One of the key drivers of the dental alloys market in the U.S. is the growing prevalence of dental disorders and the rising demand for restorative and cosmetic dentistry. As the aging population increases, so does the need for dental treatments, including prosthetics and implants that heavily rely on high-quality alloys. The COVID-19 pandemic has prompted a renewed focus on infection control measures in healthcare settings, including dental practices in the U.S. The use of biocompatible materials like dental alloys aligns with the heightened awareness of infection control, ensuring that dental restorations are not only effective but also safe for patients.

In the U.S., technological advancements and innovations in dental alloy manufacturing have significantly influenced industry growth. Dental professionals and laboratories increasingly adopt advanced alloys with superior mechanical properties and aesthetic appeal. Additionally, the emphasis on digital dentistry and CAD/CAM technologies has further propelled the demand for precision-engineered alloys.

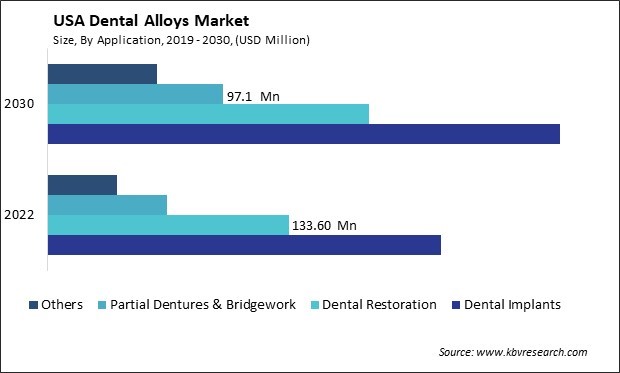

The demand for dental implants in the United States has experienced a notable surge, reflecting a paradigm shift in the dental care landscape. Dental alloys, pivotal in fabricating these implants, have become increasingly sought after in the U.S. dental industry. Advancements in dental technology have also played a crucial role in fostering the demand for dental implants and alloys. Innovations in material science and manufacturing processes have led to the development of high-performance dental alloys that enhance the overall efficacy of implants.

One of the primary drivers of this heightened demand is the growing awareness among the U.S. population about the benefits of dental implants. As individuals seek more durable and natural-looking solutions for missing teeth, dental implants have emerged as a preferred choice. Moreover, the aging population in the United States has contributed significantly to the rise in demand for dental implants. As individuals age, they are more prone to tooth loss, creating a substantial industry for implant-based restorative solutions. Dental alloys, with their ability to withstand the rigors of oral function while mimicking the appearance of natural teeth, have become integral to the success and acceptance of these implants among older demographics.

According to the United States Census Bureau, the older population reached 55.8 million or 16.8% of the population of the United States in 2020. Over the course of a century, the older population expanded by 50.9 million, surging from 4.9 million (constituting 4.7% of the total U.S. population) in 1920 to 55.8 million (16.8%) in 2020. This remarkable increase reflects a growth rate of approximately 1,000%, nearly five times higher than that observed in the overall population, which saw a growth rate of about 200%. As the older population continues to grow, the demand for dental alloys and related products is likely to witness a significant upswing, presenting opportunities and challenges for stakeholders in the U.S. dental alloys market.Top of Form

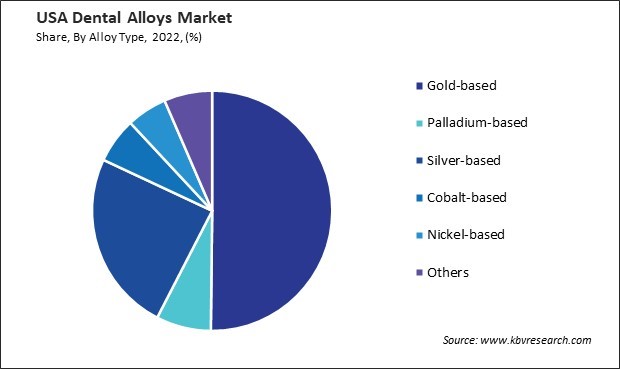

In the United States, the dental alloys market has witnessed a notable surge in the utilization of nickel-based alloys, marking a significant trend in the dental industry. One key driver behind the growing popularity of nickel-based alloys in the U.S. dental alloys market is their ability to withstand the harsh oral environment while offering durability and longevity. The U.S. dental industry’s inclination towards digital dentistry has played a role in the adoption of nickel-based alloys.

Moreover, the biocompatibility of nickel-based alloys has been a crucial factor in their widespread adoption. The alloys' compatibility with oral tissues minimizes the risk of adverse reactions in American patients, further solidifying their place in the dental materials industry. As patient awareness of dental health and aesthetics continues to rise in the U.S., the demand for dental restorations that not only offer durability but also ensure a comfortable and biocompatible fit has led to the prominence of nickel-based alloys.

The U.S. dental industry's emphasis on providing high-quality and aesthetically pleasing dental solutions has also contributed to the increased use of nickel-based alloys. Dental practitioners are increasingly recognizing the alloys' versatility in achieving both functional and cosmetic goals, meeting the evolving expectations of patients. Hence, the surge in nickel-based alloy utilization in the U.S. dental alloys market is driven by their durability for digital dentistry meeting the rising demand for high-quality dental solutions in the evolving American dental landscape.

The dental alloys market in the United States is a dynamic and competitive sector with several key players contributing to its growth and development. One of the leading players in the dental alloys market is Dentsply Sirona. Dentsply Sirona is a global leader in dental technology and solutions, offering dental professionals a comprehensive range of products. The company's dental alloys are known for their durability, biocompatibility, and aesthetic appeal. Dentsply Sirona's commitment to innovation and research has positioned it as a key player in the dental industry, providing cutting-edge solutions to meet the evolving needs of dental practitioners.

Another major player in the U.S. dental alloys market is Ivoclar Vivadent. The company is a renowned dental materials and equipment manufacturer, known for its focus on quality and innovation. The company's dental alloys are widely used in restorative dentistry, offering excellent mechanical properties and compatibility with various dental procedures. The company's commitment to research and development ensures that its dental alloys meet the highest standards of performance and biocompatibility.

GC America is also a significant player in the U.S. dental alloys market. The company is recognized for its comprehensive range of dental products, including high-quality alloys used in prosthodontics and restorative dentistry. GC America's dental alloys are designed to provide optimal strength and aesthetics, meeting the demands of modern dental practices. The company's emphasis on research and education further establishes its position as a trusted partner for dental professionals.

Zimmer Biomet is a global leader in musculoskeletal healthcare, including dental solutions. The company's dental alloys are widely used in implantology and restorative dentistry, offering reliable and clinically proven materials. Zimmer Biomet's focus on innovation and clinical research contributes to the continuous improvement of its dental alloy offerings, ensuring they align with the latest advancements in dental care.

Additionally, Kerr Corporation is a notable player in the U.S. dental alloys market. Kerr is recognized for its diverse dental product portfolio, including alloys catering to various restorative and prosthetic applications. The company's commitment to providing solutions that enhance patient outcomes and streamline dental procedures has earned it a strong presence in the dental community. These companies are crucial in providing high-quality dental alloys widely used in various dental applications, including crowns, bridges, and dentures.

By Application

By Alloy Type

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.