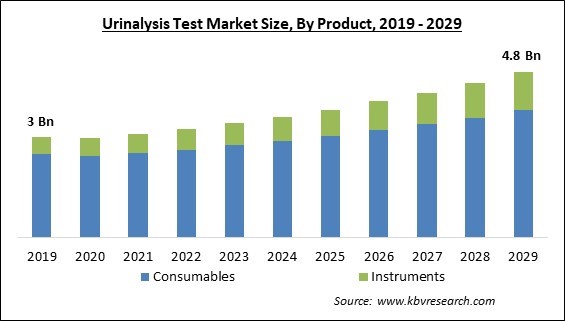

The Global Urinalysis Test Market size is expected to reach $4.8 billion by 2029, rising at a market growth of 6.3% CAGR during the forecast period.

The chemical, physical, and microscopic elements of urine are examined during urinalysis, also known as a pee test. Several tests are used in urine analysis to look for any irregularities that might point to a disease or infection. It is used to identify and treat a variety of diseases and conditions, including kidney disease, diabetes, and urogenital infections. Urinalysis involves analyzing the urine's composition, color, and consistency. In order to identify and quantify the many compounds that are present in urine entails a series of procedures using a single urine sample. The urinalysis test uses a variety of supplies, including reagents, urine analyzers, disposables, dipsticks, and disposables.

An opportunity for the market for urinalysis tests is created by growth and advancements in the medical device sector for the production of urinalysis products such as urine analyzers and pregnancy test products. Moreover, the urinalysis test market is expected to grow due to the increased availability of advanced healthcare infrastructure, growing unmet healthcare needs, the rising prevalence of chronic ailments such as diabetes, and a growing need for urine analyzers, control, and strip solutions. In addition, the increase in the number of diabetics is driving up the need for urine tests and expanding the market.

Also, the demand for better healthcare services is growing, and the government is making sizeable investments to upgrade the infrastructure for healthcare, which is contributing to the enormous growth of the healthcare sector in emerging economies. Due to consumers' increasing preference for online buying over conventional purchasing methods, e-commerce (or electronic commerce) has emerged as a crucial tool for small and large enterprises globally, which helps the market expand even further.

The lockdown's impact on urological procedures and the consequent drop in demand for urine analysis restrain market expansion during the COVID-19. However, due to increased urological problems, the industry is already rebounding from the pandemic and is expected to continue growing. When nations loosened their travel restrictions, testing numbers for urinalysis are reported to be on the rise again. Market expansion is predicted to be fueled by the increased significance of urinalysis in detecting post-COVID-19 disorders, including acute kidney & tubular injuries, thus providing market growth in the post-pandemic period after the decline in the initial phase.

Urinalysis is frequently used as a point-of-care diagnostic test. The need for point-of-care testing is anticipated to increase due to the rising prevalence of chronic diseases and the requirement for prompt diagnosis and treatment. Usage of urinalysis as a diagnostic tool in ERs, PCPs, and nursing homes, particularly as healthcare systems around the world continue to move towards decentralized and patient-centered care models. These reasons are increasing the demand for point-of-care testing, and the rising cases of Urinary tract infections are anticipated to expand the urinalysis market's growth.

Diabetes is a long-term metabolic condition characterized by high blood glucose (or blood sugar) levels, which seriously harms the heart, blood vessels, eyes, kidneys, and nerves over time. The most prevalent type of diabetes is type 2, which often affects adults, and develops when the body stops producing enough insulin or creates insulin resistance. Type 2 diabetes has been much more common in nations of all income levels over the past three decades. According to WHO, the bulk of the 422 million people with diabetes globally reside in low- and middle-income nations, and diabetes is directly responsible for 1.5 million fatalities annually.

Many developing nations have a shortage of skilled laboratory workers who can efficiently and accurately carry out urine tests. In addition, the poor quality of healthcare services in many developing nations can further impede the expansion of the market for urine tests. Because of this, the shortage of lab personnel and standards might impede the development of innovative urine testing techniques and prevent their wide acceptance in clinical settings. These factors also restrict its ability to enhance patient care and results, which is projected to restrain the expansion of the urinalysis market.

Based on product, the urinalysis test market is segmented into instruments and consumables. The consumables segment dominated the urinalysis test market with maximum revenue share in 2022. This is due to increased demand for sophisticated urinary consumables, which is attributable to the fact that they are simple to use, convenient to handle, and can be kept for extended periods without losing quality. Also, technological advancements raise the accuracy and convenience of urine testing, which is expected to propel the segment's expansion during the projected period.

On the basis of application, the urinalysis test market is divided into disease screening and pregnancy & fertility. The pregnancy & fertility segment procured a substantial revenue share in the urinalysis test market in 2022. This is because urine tests for pregnancy are one of the most accurate and convenient ways to find out about a pregnancy after the patient has missed their period. About a day after the first missed period, the test can typically find this hormone in the user’s urine and determine if they are pregnant.

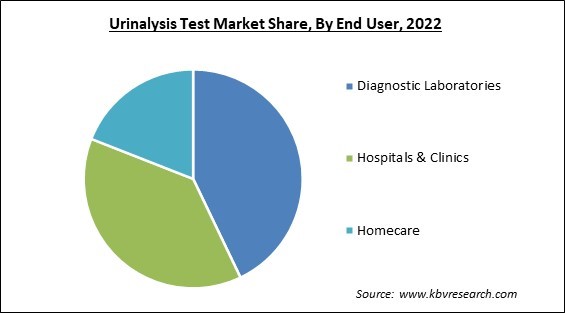

By end user, the urinalysis test market is classified into hospitals & clinics, diagnostic laboratories and home care. The diagnostic laboratories segment witnessed the largest revenue share in the urinalysis test market in 2022. This is owing to the prevalence of age-related illnesses such as diabetes, liver disease, and renal disease is expected to rise dramatically as the senior population rises. In addition, one of the primary factors propelling the segment's growth is the increasing prevalence of urinary tract infections (UTIs) in developing nations.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 3 Billion |

| Market size forecast in 2029 | USD 4.8 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 6.3% from 2023 to 2029 |

| Number of Pages | 197 |

| Number of Table | 333 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the urinalysis test market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region registered the highest revenue share in the urinalysis test market in 2022. The market is expanding due to improvements in the region's urinalysis product manufacturing technology. In North America, diabetes is a common chronic illness linked to aberrant urine composition. The need for urinalysis tests in this area is being driven by the fact that urinalysis is a good diagnostic tool for spotting early indicators of kidney impairment brought on by diabetes.

Free Valuable Insights: Global Urinalysis Test Market size to reach USD 4.8 Billion by 2029

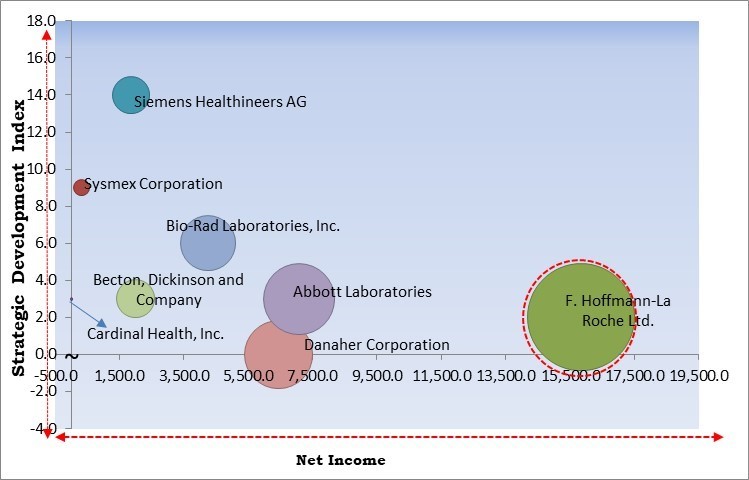

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; F. Hoffmann-La Roche Ltd. is the forerunner in the Urinalysis Test Market. Companies such as Siemens Healthineers AG, Bio-Rad Laboratories, Inc., and Abbott Laboratories are some of the key innovators in Urinalysis Test Market.

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Cardinal Health, Inc., Siemens Healthineers AG (Siemens AG), ACON Laboratories, Inc., Sysmex Corporation, Bio-Rad Laboratories, Inc., Arkray, Inc., Abbott Laboratories, Danaher Corporation, F. Hoffmann-La Roche Ltd., and Becton, Dickinson and Company.

By Product

By Application

By End User

By Geography

The Market size is projected to reach USD 4.8 billion by 2029.

Rising cases of urinary tract infections and usage of point-of-care testing are driving the Market in coming years, however, Improper standardization in testing and dearth of skilled workforce restraints the growth of the Market.

Cardinal Health, Inc., Siemens Healthineers AG (Siemens AG), ACON Laboratories, Inc., Sysmex Corporation, Bio-Rad Laboratories, Inc., Arkray, Inc., Abbott Laboratories, Danaher Corporation, F. Hoffmann-La Roche Ltd., and Becton, Dickinson and Company.

The Disease Screening segment acquired maximum revenue share in the Global Urinalysis Test Market by Application in 2022 thereby, achieving a market value of $3.5 billion by 2029.

The Hospitals & Clinics segment has shown a high growth rate of 6.7% during (2023 - 2029).

The North America market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $1.7 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.