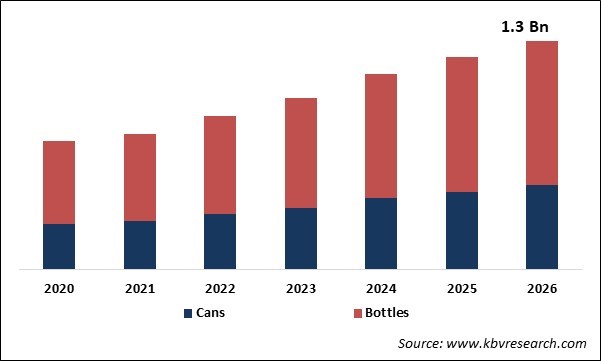

The Global Tonic Water Market size is expected to reach $1.3 billion by 2026, rising at a market growth of 10.2% CAGR during the forecast period. Tonic water can be considered as a tonic soft drink in which quinine is dissolved. Initially, Tonic water was utilized as a medication against malaria but now it has fundamentally lower quinine content and is consumed for its different unpleasant flavor. It is regularly utilized in alcoholic drinks, especially in gin and tonic.

Rising consumer drink inclinations to 'Gin and Tonic' across the world is the leading driving element for the market. Additionally, expanding the utilization of tonic water to serve vodka and to make different kinds of mainstream cocktails is also offering new scope for the business. Expanding the utilization of alcoholic drinks, for example, gin, vodka, and different kinds of cocktails is the leading driving component for the market. Also, tonic water contains a decent measure of quinine, which decrease the odds of malaria and other leg related medical problems. These medicinal properties are anticipated to boost market development over the forecast period.

Tonic water is one of the extensively consumed soft drinks with spirits across the globe. Numerous beverages have a solid base of tonic water, which gives a bitter edge to cocktails. Gin and Tonic have become one of the popular blends consumed by drinkers around the world and is commonly known as 'G and T' mainly in nations including the UK, Ireland, Australia, New Zealand, the U.S., and Canada. By and large, the greater part of the recipes contains a 1:1 to 1:3 tonic water to gin ratio. These trends are anticipated to remain conducive factors for the industry over the forecast period.

Due to the outbreak of the COVID-19 pandemic, there has been an extensive effect on the tonic water industry. The on-trade segment has particularly been affected since bars, cafés, pubs, breweries have been closed because of the lock-down and client visits are totally confined. Similarly, the effect was more uncertain felt on the off-trade sales channel since consumer’s stock-piled beverages in the initial phases of the lockdown. Nonetheless, the lockdown has created extraordinary opportunities for e-commerce channels because of social distancing.

| Report Attribute | Details |

|---|---|

| Market size value in 2019 | USD 780.9 Million |

| Market size forecast in 2026 | USD 1.3 Billion |

| Base Year | 2019 |

| Historical Period | 2016 to 2018 |

| Forecast Period | 2020 to 2026 |

| Revenue Growth Rate | CAGR of 10.2% from 2020 to 2026 |

| Number of Pages | 156 |

| Number of Tables | 330 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Flavor, Distribution Channel, Packaging Form, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Free Valuable Insights: Global Tonic Water Market to reach a market size of $1.3 Billion by 2026

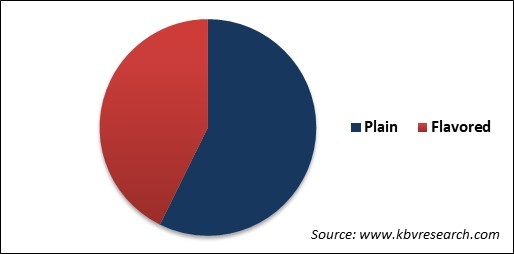

Based on Flavor, the market is segmented into Plain and Flavored. Based on Distribution Channel, the market is segmented into Off-trade, On-trade and Online Retail. Based on Packaging Form, the market is segmented into Cans and Bottles. Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Keurig Dr Pepper, Inc. (Dr Pepper Snapple Group), The Coca Cola Company, Monster Beverage Corporation (Hansen Beverage), Fever-Tree Drinks PLC, Asahi Group Holdings Ltd., PepsiCo, Inc. (Soda Stream International Ltd.), Q-Tonic, LLC, Zevia, LLC, Fentimans Ltd. and Britvic PLC.

Market Segmentation:

By Flavor

By Distribution Channel

By Packaging Form

By Geography

Companies Profiled

The tonic water market size is projected to reach USD 1.3 billion by 2026.

The major factors that are anticipated to drive the tonic water industry include customer preference for premium drinks and rise in the consumption of gin.

The Europe represented a major revenue share in the worldwide tonic water market.

Keurig Dr Pepper, Inc. (Dr Pepper Snapple Group), The Coca Cola Company, Monster Beverage Corporation (Hansen Beverage), Fever-Tree Drinks PLC, Asahi Group Holdings Ltd., PepsiCo, Inc. (Soda Stream International Ltd.), Q-Tonic, LLC, Zevia, LLC, Fentimans Ltd. and Britvic PLC.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.